Antam Gold Price Today January 22, 2026: Slight Fall, Monthly Rise, and Impact on Crypto

Jakarta, Pintu News – Antam’s gold price today is again a concern amid global market dynamics, fluctuations in the rupiah exchange rate, as well as increased investor interest in hedge assets and crypto. Data as of January 22, 2026 shows a daily correction, but on a monthly basis, gold prices are still in an upward trend. This article summarizes the development of Antam gold prices based on global spot data and its implications for cryptocurrencies in an informative and neutral manner.

1. Antam Gold Price Today Slightly Decreased Daily

Antam’s gold price today was recorded at around IDR 2.79 million per gram after experiencing a decline compared to the previous day. This correction is in line with the weakening of world spot gold prices which were recorded at around USD 4,781.60 per troy ounce. Assuming an exchange rate of 1 USD = IDR 16,971, the global gold price is equivalent to around IDR 81.1 million per ounce or around IDR 2.61 million per gram.

This daily decline is limited and still within the range of reasonable volatility. Historically, gold’s daily fluctuations are often influenced by US dollar movements, interest rate expectations, as well as global market sentiment. Therefore, the short-term correction does not necessarily change the main trend of gold prices.

Also Read: 3 Bitcoin Scenarios of 2026: Failure to Survive at $100K Could Trigger a Major Crash

2. January 2026 Monthly Trend Still Strong

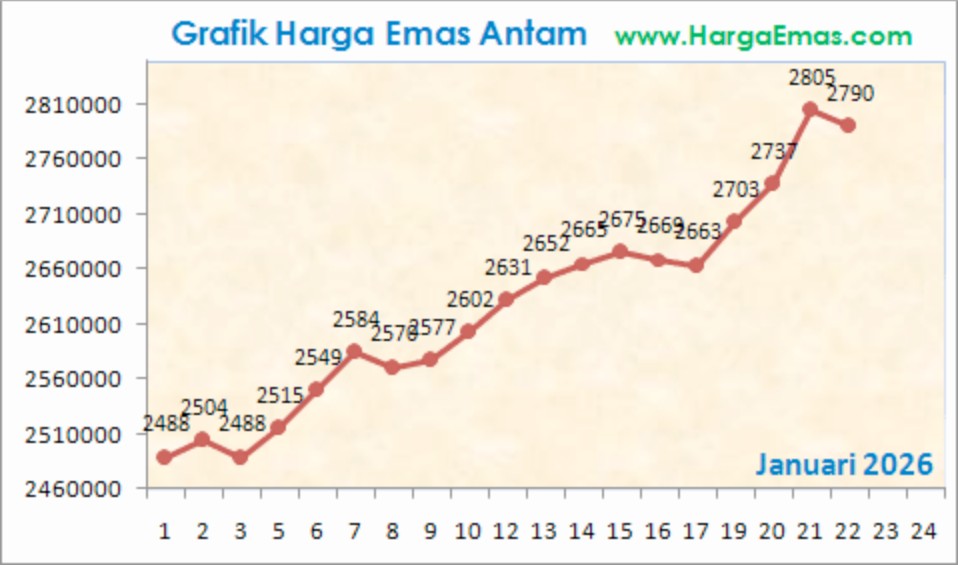

Despite the daily correction, the Antam gold price chart throughout January 2026 shows an upward trend on a monthly basis. Prices were recorded moving from the range of IDR 2.48 million per gram at the beginning of the month to touch a level above IDR 2.80 million per gram. This increase reflects the increasing demand for gold as a hedging asset.

This positive monthly trend is also in line with the ongoing global uncertainty. Under these conditions, gold is often seen as a defensive asset, similar to the narrative often attached to Bitcoin (BTC) as “digital gold” in the cryptocurrency ecosystem.

3. The Role of the Rupiah Exchange Rate in Gold Price Movements

In addition to the world gold price, the rupiah exchange rate has a significant role in shaping Antam’s gold price. Data shows that the USD/IDR exchange rate is in the range of IDR16,920-Rp16,971, which is relatively weak compared to the previous period. The weakening rupiah tends to hold back the decline in domestic gold prices despite the correction in global prices.

This explains why the decline in Antam gold prices was not as deep as the decline in world spot gold prices. For domestic investors, understanding the interaction between global prices and exchange rates is important to read gold movements more comprehensively.

4. Comparison of Physical Gold and Crypto as an Asset of Value

Physical gold and crypto are often compared as alternative stores of value in the medium to long term. Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Pepe Coin (PEPE) are characterized by much higher volatility than gold. However, both are affected by macroeconomic sentiment and global liquidity.

In this context, the price movement of Antam gold can be an indicator of general risk sentiment. When gold rallies steadily, the market tends to be in a defensive phase, which often has an impact on the flow of funds in the cryptocurrency market.

5. Implications of Gold Price Data for Crypto Investors

For crypto and cryptocurrency market participants, today’s Antam gold price data is relevant as a macro reference. Gold is often used as a benchmark to assess whether the market is risk-off or risk-on. Monthly gold price increases may indicate global investor caution.

However, it is important to note that the correlation between gold and crypto is not always consistent. Therefore, gold prices should be used as supplementary data, not the sole basis of analysis in making digital asset investment decisions.

6. Gold Price Key Data Summary January 22, 2026

In summary, the world spot gold price is in the range of USD 4,781.60 per ounce or around IDR 81.1 million per ounce. The domestic Antam gold price was recorded at around IDR 2.79 million per gram after a daily correction. On a monthly basis, the trend of gold prices still shows a solid increase.

This data illustrates that the gold market is still relatively strong despite short-term fluctuations, which is relevant to read alongside the development of the crypto market, which is also affected by similar global factors.

7. Conclusion: Gold Stabilizes, Crypto Remains Dynamic

Today’s Antam gold price shows reasonable dynamics in the context of a volatile global market. The daily correction does not erase the monthly upward trend that is still maintained. In the modern investment landscape, gold and cryptocurrencies are two asset classes that are often analyzed side by side.

A data-driven approach and cross-asset understanding is key for investors. By reading gold and crypto movements together, market analysis can be done in a more balanced and contextualized manner.

Also Read: 3 Reasons 2026 Is No Longer About Cycles, This Is What Actually Drives Crypto Prices

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- HargaEmas.com. Antam Gold Price Today January 22, 2026. Accessed January 22, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.