NEAR Protocol Price Surges After Grayscale Files for NEAR ETF

Jakarta, Pintu News – Grayscale Investments has filed an S-1 form with the US Securities and Exchange Commission (SEC) to convert Grayscale Near Trust into a spot ETF. As a result, the price of NEAR Protocol (NEAR) rose by more than 3% despite the general crypto market decline on January 21, 2026.

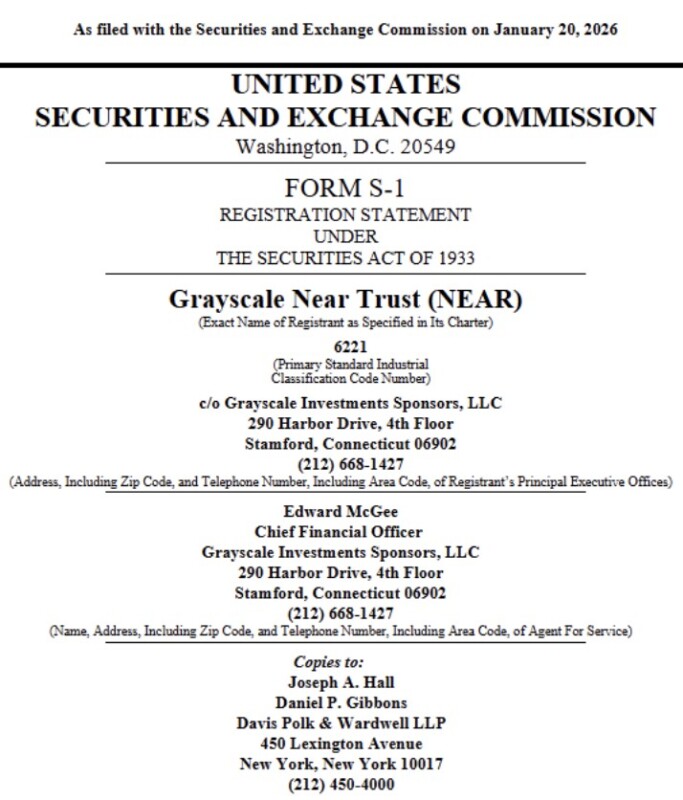

Grayscale Files NEAR ETF Application with US SEC

Based on a Form S-1 document filed with the US Securities and Exchange Commission (SEC) on January 20, Grayscale plans to convert the Near Trust into an ETF. In addition, the company also intends to rename the trust as the Grayscale Near Trust ETF.

Read also: Ethereum Price Rises Again to $3,000 Today: Whale Buys $360 Million ETH!

If the registration is approved, shares of this ETF currently traded on the OTCQB market under the ticker GSNR will be moved to the NYSE Arca exchange. Fees and other details will be announced in subsequent filings with the SEC.

Grayscale also includes a clause regarding possible staking. If the conditions for staking are met, “the Organizer anticipates that the Trust will enter into a written agreement with the custodian for the staking of the Trust’s NEARs to one or more verified third party staking providers.”

CSC Delaware Trust Company was appointed as trustee, The Bank of New York Mellon acted as transfer agent and administrator, while Continental Stock Transfer & Trust Company was the co-transfer agent for this trust.

In addition, Coinbase Inc will serve as the prime broker, and Coinbase Custody Trust Company LLC the custodian. This Grayscale NEAR Trust ETF will follow the NEAR Protocol spot price based on the CoinDesk NEAR CCIXber Reference Rate.

In response to this filing, Bloomberg’s ETF analyst James Seyffart said that “Crypto ETP product filings continue to come across the SEC’s desk.” Previously, Grayscale has also registered trusts for the BNB ETF and Hyperliquid ETF in Delaware.

NEAR Protocol Price Rises More than 3%

On January 21, 2026, the price of NEAR Protocol had jumped 3%, reducing losses amid the crypto market crash. At that time, the NEAR price was trading at $1.54, with a 24-hour low and high (1/21) of $1.50 and $1.60, respectively.

Read also: SUI Crypto Price: Could It Skyrocket to $10 as the Market Enters an Expansion Phase?

In addition, trading volume increased by 22%, signaling increased interest from traders. However, NEAR’s price is still below its 50-day and 200-day moving averages.

Data from CoinGlass shows buying activity in the derivatives market in recent hours. Total open interest (OI) for NEAR Protocol futures contracts rose nearly 2% to $229 million in the last 4 hours. Futures OI on the Binance, OKX, and Bybit platforms each saw an increase of more than 2%.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Grayscale Files S-1 for NEAR ETF, NEAR Protocol Price Rebounds. Accessed on January 22, 2026

- Coingape. Grayscale Files S-1 for NEAR ETF, NEAR Protocol Price Rebounds. Accessed on January 22, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.