Ripple (XRP) Trading Volume Surges Ahead of Critical Market Tests

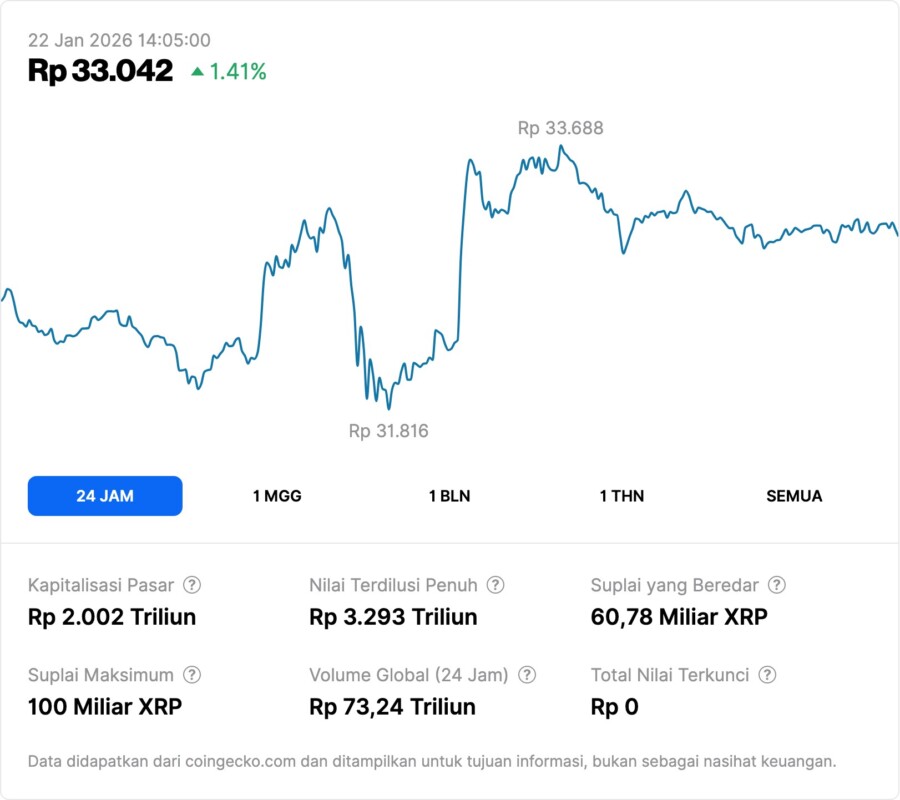

Jakarta, Pintu News – In the past 24 hours, Ripple (XRP) has seen a significant increase in trading volume, reaching $3.27 billion. This comes as Ripple (XRP) faces a pivotal market test. According to data from CoinMarketCap, there was a 10% increase in Ripple (XRP) trading volume during the period. Currently, Ripple (XRP) is under pressure, with the weekly price drop reaching 11.21%.

Price Drops and Their Impact

Ripple (XRP) has experienced seven consecutive days of declines since January 5. At one point, the price of Ripple (XRP) had dropped to $1.85 during Monday’s market crash. Currently, Ripple (XRP) is trying to recover its position, reaching a price of $1.92 in intraday trading before declining again.

This drop comes amid a generally red crypto market, with total liquidations in the last 24 hours reaching $861.9 million. Of this, long positions accounted for $753.45 million. This suggests strong selling pressure in the market, which could affect the price stability of Ripple (XRP) going forward.

Also Read: 3 Bitcoin Scenarios of 2026: Failure to Survive at $100K Could Trigger a Major Crash

Psychological Test at $2 Level

According to analysis from Glassnode, the $2 level is an important psychological zone for Ripple (XRP) holders. Since the beginning of 2025, every time Ripple (XRP) tried to break the $2 level, there were realized losses of between $0.5 billion to $1.2 billion per week. This shows how critical that price level is to the market.

Glassnode also noted that the current market structure shows similarities to the market conditions in February 2022. Ripple (XRP) holders who were active in the past week to month are in a profit position, yet many of those who bought in the past six to twelve months have yet to break even. This could increase selling pressure if prices continue to decline.

Outlook and Investor Strategy

Investors who have held Ripple (XRP) over the long term are likely to use the price rise to exit the market rather than increase their exposure. This indicates a lack of confidence in the long-term potential of Ripple (XRP) at current price levels. This strategy could be an important indicator for new investors considering entering the Ripple (XRP) market.

On the other hand, new investors need to be mindful of these market dynamics and may need to wait for price stabilization before making investment decisions. Understanding long-term trends and market reactions to psychological price levels can provide valuable insights in navigating this volatile market.

Conclusion

With market conditions constantly changing, a deep understanding of market dynamics and investor reactions to price changes is key. Ripple (XRP) is currently at an important crossroads, and its next move could very well determine its future direction in the crypto ecosystem.

Also Read: 3 Reasons 2026 Is No Longer About Cycles, This Is What Actually Drives Crypto Prices

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. $3,270,000,000 XRP Hit in 24 Hours as Price Faces Crucial Market Test. Accessed on January 22, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.