Ethereum Slips to $2,900 as Market Eyes Potential 50% Upside

Jakarta, Pintu News – Ethereum (ETH) price briefly climbed back above the psychological $3,000 level, showing a modest but meaningful recovery after several days of downward pressure.

While this recovery is still in its early stages, on-chain activity and technical structure indicate that the recent decline is likely more of an accumulation moment than a trend reversal. So, how will Ethereum price move today?

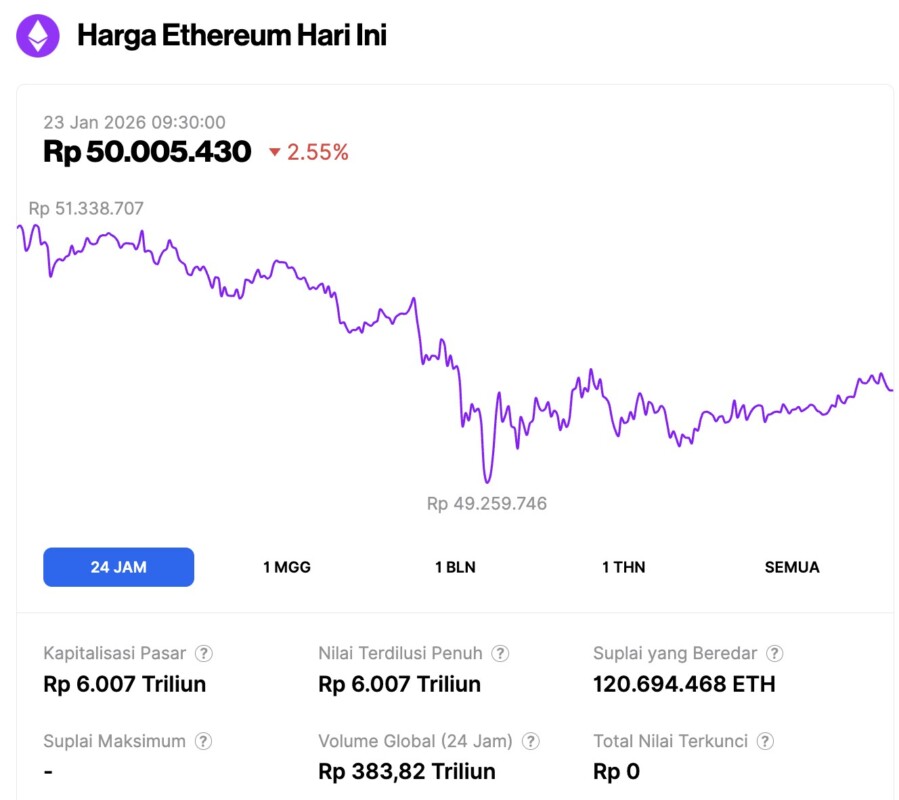

Ethereum Price Drops 2.55% in 24 Hours

As of January 23, 2026, Ethereum was trading at approximately $2,957, or around IDR 50,005,430, marking a 2.55% drop over the past 24 hours. During the same period, ETH hit a low of IDR 49,259,746 and climbed to a high of IDR 51,338,707.

At the time of writing, Ethereum’s market capitalization is estimated at IDR 6,007 trillion, while its 24-hour trading volume has declined by 39%, settling at around IDR 383.82 trillion.

Read also: XRP Retail Sentiment Shifts from Greed to Extreme Fear – A Bullish Sign?

Crypto whales step in as smart money buys in on falling prices

On-chain data clearly illustrates the strategic maneuvering behind the scenes. Notably, a large OTC address whale bought 10,000 ETH worth nearly $29 million during the market downturn, despite generally weak market conditions.

In a separate transaction, another institutional entity borrowed $70 million USDT from Aave and used it to buy 24,555 ETH worth approximately $75.5 million – demonstrating a high conviction in buying on price drops.

These fund flows indicate that the big players are not waiting for confirmation from price movements. Instead, they seem to be preparing positions early ahead of possible structural shifts in the market.

At the same time, the Ethereum OG wallet (an early adopter of Ethereum) deposited 14,183 ETH worth approximately $42 million into Coinbase. While deposits to exchanges are often interpreted as selling pressure, this move seems to reflect selective profit-taking rather than wholesale distribution – especially when compared to the scale of accumulation that continues elsewhere.

Read also: SKR Crypto Explodes 200%: Smart Money Accumulation vs Airdrop Selling Pressure!

Overall, the data suggests the market is being divided between long-term holders securing profits and institutions aggressively increasing their exposure at current price levels.

Ethereum’s price structure hints at 50% upside potential

Ethereum’s price chart structure still suggests a bullish outlook in the medium term. On the daily chart, ETH price remains in a macro bullish pattern, forming a series of cyclically rounded bottoms that have historically often been the start of large rallies.

The current price structure suggests that the recent drop to the $2700-$2800 range is likely a higher low in a broader accumulation phase.

If the general market sentiment is in favor of the bulls, the Ethereum price has the potential to increase by 40-50%, which could bring ETH to the $4200-$4800 zone in the near future. As long as ETH price stays above $2700, the overall bullish structure is maintained.

However, if the price breaks below this level, this pattern will be considered invalidated and the risk of a drop to the $2400 area opens up again.

Overall, Ethereum’s price reversal towards $3000, coupled with whale accumulation and a bullish structural basis, suggests that the market is preparing itself for a potential breakout, with the possibility of a 50% increase now becoming more real.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Ethereum Price Reclaims $3000 as Whale Activity Intensifies: Is a 50% Rally Next? Accessed on January 23, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.