Bitcoin Rebounds to $88,000 — What Could Be Next for BTC?

Jakarta, Pintu News – Bitcoin (BTC) had another dip, falling below $88,000 on January 26, 2026. Yes, on the daily chart a death cross signal is emerging, which is when the 50-day moving average drops past the 200-day moving average.

However, this signal usually comes too late. A bigger factor is the pressure from macroeconomic conditions that erode risk appetite at a particularly unfavorable time. As a result, Bitcoin price will likely struggle to rise in the near future.

Then, how will the Bitcoin price move today?

Bitcoin Price Rises 1.36% in 24 hours

As of January 27, 2026, Bitcoin was trading at $88,537, equivalent to IDR 1,492,754,233—marking a 1.36% increase over the past 24 hours. During this timeframe, BTC dipped to a low of IDR 1,465,469,162 before climbing to its highest level of the day.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 29,589 trillion, while its 24-hour trading volume has risen by 3.5% to reach IDR 791.19 trillion.

Read also: 4 Important Crypto Events of the Week: Can the Market Recover?

Bitcoin Price Plummeting Again?

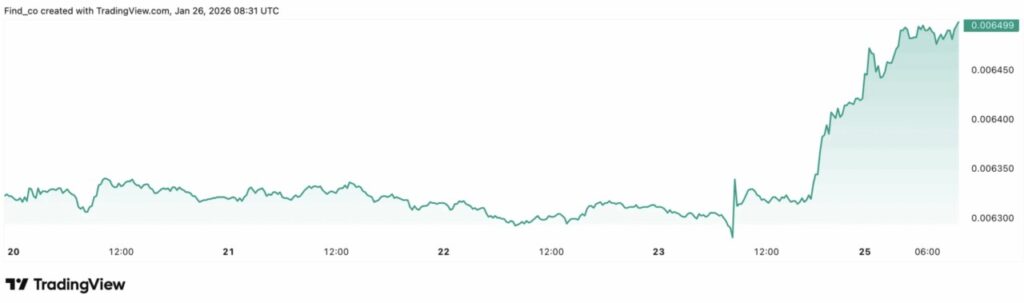

Bitcoin price fell back below $88,000 and briefly dipped to the mid-$86,000 range in the latest wave of liquidations on January 26, 2026 yesterday. This drop was notable because it forced highly leveraged long positions to be dissolved immediately. The rest were settled by liquidation, as shown by data from Coinglass, where more than $670 million of leveraged positions were wiped out.

Indeed, the daily chart (1/26) displays a death cross signal, which is when the 50-day moving average drops below the 200-day average. However, this signal usually appears too late. On a closer look, Bitcoin’s price has bounced back a bit after holding in the $87,000 area, but the overall structure is still fragile.

As can be seen, the major cryptocurrency is still stuck below the $96,000 resistance zone, which since December continues to be a barrier whenever the price tries to rise. Every time the price touches that area, sellers re-enter the market, making it a strong supply area.

However, the downward pressure started to slow down at the support zone of $85,000 to $86,000. Buyers have already appeared in this area several times, and trading volumes tend to stabilize, not increase, as prices fall. This suggests the selling pressure is starting to ease, although the buyers haven’t really taken control yet.

As long as Bitcoin remains below the $92,000 zone, the market is likely to remain in a vulnerable phase and move in a limited range. However, for the bearish signal to be canceled and the upside momentum to reopen, the price needs to stay consistently above the area.

The main factor pressuring the market today is macroeconomic conditions that are eroding risk appetite at a very unfavorable time. At the same time, fund flows into ETFs are also no longer a crutch. Spot Bitcoin ETFs in the US recorded one of the weakest weeks in almost a year, with net outflows of around $1.33 billion. When that demand disappears, the price has to find its own bottom.

If inflows do not increase, BTC’s next price drop target could be below $85,000.

Yen also plays a role in BTC price movement

In addition, macroeconomic developments seem to be influencing the current direction of Bitcoin’s movement. In particular, the Japanese Yen (JPY) jumped sharply after reports emerged of an “interest rate check” by the US-which markets often take as an early sign of potential intervention.

A strong Yen negatively impacts carry trade activity as it increases funding pressure and forces investors into deleveraging. As traders rush to close exposure to the Yen, they tend to sell the most liquid risk assets first.

In this case, Bitcoin is one of the top choices for sale.

Moreover, the Bank of Japan (BoJ) did not ease the pressure either. The BoJ kept interest rates at 0.75%, but remained hawkish as bond yields spiked and political risks increased ahead of Japan’s election in February.

Meanwhile, capital is flowing into old safe assets: gold just broke $5,000 for the first time, showing that the current market fears are not just discourse. If this trend continues, Bitcoin price will most likely find it difficult to withstand further downside potential.

However, crypto analyst Michaël van de Poppe expressed an optimistic view that Bitcoin price may soon recover from the latest drop.

Read also: Amid Huge Whale Accumulation, Trump-Backed WLFI Switches from WBTC to ETH

“There was a bit of a liquidity sweep below the low, took out all the long liquidity and then bounced strongly to the upside. If commodity prices start to stagnate, I can see BTC going above $90K this week,” he said.

Interest Rate Cut Unlikely to Happen This Month

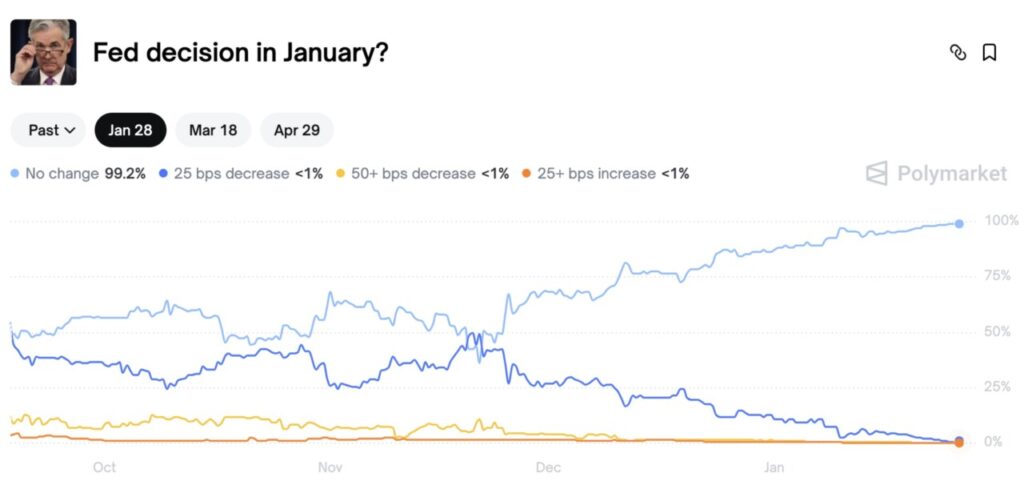

On the other hand, the market has now largely set expectations regarding the Federal Reserve’s decision this January.

Data from Polymarket shows that the probability of the Fed keeping rates on hold now exceeds 99%, signaling a very strong market expectation that there will be no policy change.

Expectations for a rate hike or cut have shrunk considerably and are now almost completely ruled out.

This change reflects the growing belief that the Fed wants more time to evaluate inflation and employment data before taking its next policy move.

Recent economic data releases have not been weak enough to force an early rate cut, while financial conditions have generally started to loosen, reducing the urgency for the Fed to act quickly.

As such, the “no change” decision in January was essentially priced in by the market. Therefore, Bitcoin’s price movements will likely be influenced more by the tone of Jerome Powell’s speech than the interest rate decision itself.

If Powell is neutral or dovish, this could push bond yields and the US dollar down, increase interest in riskier assets, and make room for BTC to test resistance in the $92,000 range.

Conversely, if Powell’s tone tends to be hawkish, then yields and the dollar could strengthen again, putting pressure on BTC until it returns to the support zone around $80,000 as seen in the chart.

However, like van de Poppe, analyst Ted Pillows also predicts that Bitcoin price could potentially rise towards $93,000 in the near future.

“BTC now has 2 CME gaps to the upside. The first is at $89,350 and the second is at $93,000. Since October 2025, 100% of Bitcoin gaps on CME have closed within two weeks, so stay tuned,” he said.

So, What’s Next for BTC Price?

In the short term, the main focus of the market is on price stabilization. If Bitcoin fails to reclaim the important resistance level it has broken and the outflow from ETFs continues, the chart will likely pull the price to the next major demand zone.

On the 4-hour chart (Jan 26), Bitcoin price is seen weakening in the $88,000 area, after slipping below the 0.236 Fibonacci level of $88,800. In addition, BTC is forming arounded distribution pattern, which is a bearish signal.

Buying volumes also remained weak, with the Chaikin Money Flow (CMF) indicator remaining in the negative zone and holder sentiment remaining well below the surface.

This makes BTC vulnerable to a retest to the $85,994 region if buyers fail to quickly push the price back above $90,000. On the contrary, if there is a recovery and the price manages to break $91,967, then this bearish structure will be deemed invalid. In that scenario, BTC could potentially jump to $95,383.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Bitcoin (BTC) Price Collapses Below $88K Following Drop Below Key EMA: Rebound Remains Unlikely. Accessed on January 27, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.