Ethereum Climbs Above $2,900 as Whales Step In to Accumulate ETH

Jakarta, Pintu News – Crypto whales are pulling Ethereum (ETH) in opposite directions by the end of January 2026. On-chain data shows that large holders are actively rotating their capital, while others are taking advantage of the price drop to accumulate ETH, signaling an increasingly strong tug-of-war between distribution actions and long-term placement strategies.

This divergence comes amid continued market pressure weighing on the second-largest cryptocurrency, which has dropped more than 10% in the past week. So, how will Ethereum’s price move today?

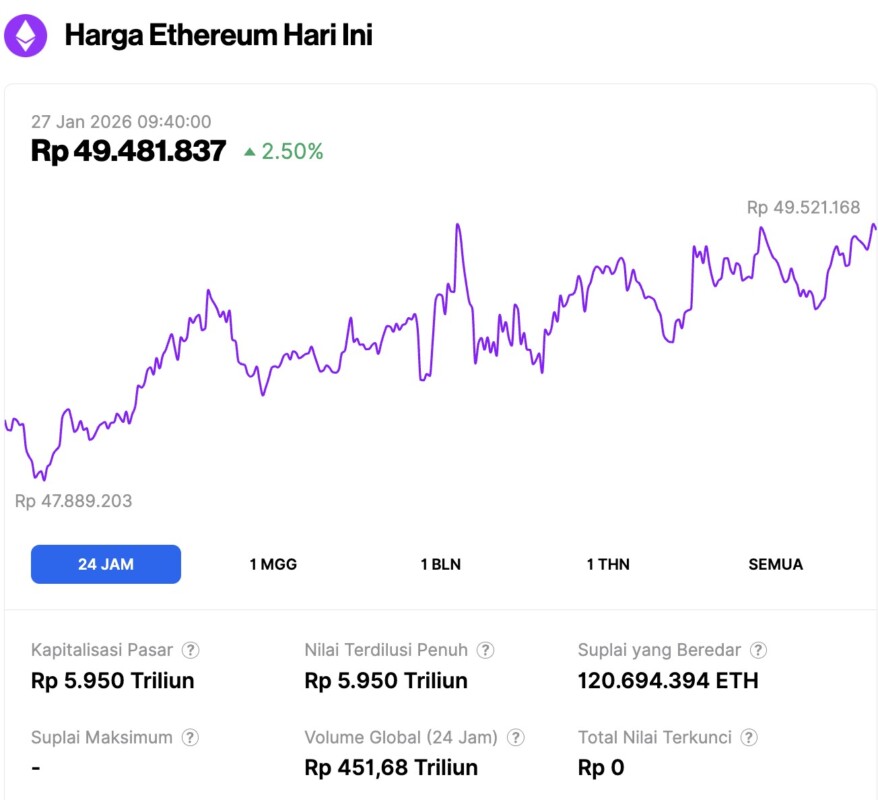

Ethereum Price Rises 2.50% in 24 Hours

As of January 27, 2026, Ethereum was trading at approximately $2,937, or around IDR 49,481,837—marking a 2.50% increase over the past 24 hours. During this timeframe, ETH dipped to a low of IDR 47,889,203 and reached a high of IDR 49,521,168.

At the time of writing, Ethereum’s market capitalization is estimated at IDR 5,950 trillion, while its daily trading volume has climbed 4% to IDR 451.68 trillion over the last 24 hours.

Read also: Bitcoin Price Recovers to $88,000 Today: What’s Next for BTC?

What Are Ethereum Whales Doing Amid January Market Pressure?

With the recent price drop, Ethereum has erased all of its early gains in 2026. The second-largest crypto is down almost 5% since the beginning of the year, and continues to struggle to break the $3,000 level.

Amidst this, the behavior of Ethereum whales looks increasingly divided. On the accumulation side, Lookonchain reported that whale OTC address 0xFB7 bought 20,000 ETH worth $56.13 million. In the past five days, the same whale has accumulated a total of 70,013 ETH, worth about $203.6 million. This accumulation trend is nothing new.

Previously, Ethereum whales added more than 350,000 ETH in just one day last week. In addition, data from CryptoQuant showed that ETH reserves on exchanges continued to decline. This indicates a reduced supply for sale and reinforces the view that large holders are moving their ETH from exchanges to long-term storage.

But at the same time, there was also capital rotation by large holders. The DeFi project backed by former President Trump, World Liberty Financial, shifted its exposure from Bitcoin (BTC) to Ethereum by exchanging 93.77 WBTC worth $8.08 million into 2,868 ETH. Another address whale, 0xeA00, sold 120 BTC worth $10.68 million and switched it to 3,623 ETH.

Nevertheless, not all whale activity indicates a bullish sentiment. An early Ethereum whale wallet, 0xb5Ab, sent 50,000 ETH worth $145.25 million to the Gemini exchange after nine years of inactivity.

“This address withdrew 135,000 ETH ($12.17 million) from the Bitfinex exchange nine years ago, when the ETH price was around $90. The current price has increased 32 times compared to that time. After transferring 50,000 ETH today, this address still holds 85,000 ETH ($244 million),” the EmberCN analyst added.

Large transfers to exchanges often raise concerns of selling pressure, as it could signal that long-term holders are preparing to take profits, balance portfolios, or reallocate their capital.

Read also: 4 Important Crypto Events of the Week: Can the Market Recover?

Lookonchain also highlighted the selling activity of address 0x3c9E, nicknamed “whale buy expensive, sell cheap.” In the last three days, this wallet sold 5,500 ETH worth approximately $16.02 million at an average price of $2,912.

Interestingly, the same address bought 2,000 ETH five days earlier at a higher price, around $2,984.

Ethereum Network Activity Shows Solid Underlying Strength

Amidst mixed whale behavior and sluggish price performance, Ethereum’s network fundamentals are showing bullish signals.

CryptoOnchain notes that the seven-day simple moving average (SMA) for Ethereum active addresses has reached an all-time record high of 718,000 addresses.

“Most importantly, the chart shows a clear Bullish Divergence between price movement and network activity. While the price of Ethereum (ETH) is still in a consolidation phase, the number of active participants has jumped sharply,” the report reads.

CryptoOnchain emphasized that this spike shows that, despite ongoing market volatility, the activity and core utility of the Ethereum network remains strong. The analysis also added that this kind of divergence in the past has often been an early signal of upward price movement.

“Whether driven by Layer-2 adoption, a resurgence of DeFi activity, or renewed interest from retail investors, the data suggests that the Ethereum network is on a tear. The market may soon begin to adjust the price of ETH to reflect this record-breaking fundamental growth,” the analyst added.

On the technical front, analysts also pointed to several signals suggesting that Ethereum is ready to move up.

The combination of a record-breaking number of active users, steadily shrinking reserves of ETH on exchanges, as well as positive technical signals, strengthens the bullish argument for Ethereum. However, general trends in the crypto market and global macroeconomic conditions remain important factors that could affect the timing of such a major move.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Whales Split as Accumulation and Selling Clash in January. Accessed on January 27, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.