Dogecoin Holds Steady Around $0.12 Today — What’s Next for DOGE’s Price Movement?

Jakarta, Pintu News – Dogecoin (DOGE) price is currently struggling to break through important resistance levels. After a prolonged period of consolidation, DOGE remains within a descending channel pattern on the higher time frames – a structure that generally hints at further downside potential, unless it is convincingly broken.

Despite several attempts, the price has not managed to return above the midpoint of the channel, indicating that the selling pressure is still dominant. As the price movement continues to weaken, the possibility of a deeper correction towards the lower support levels increases.

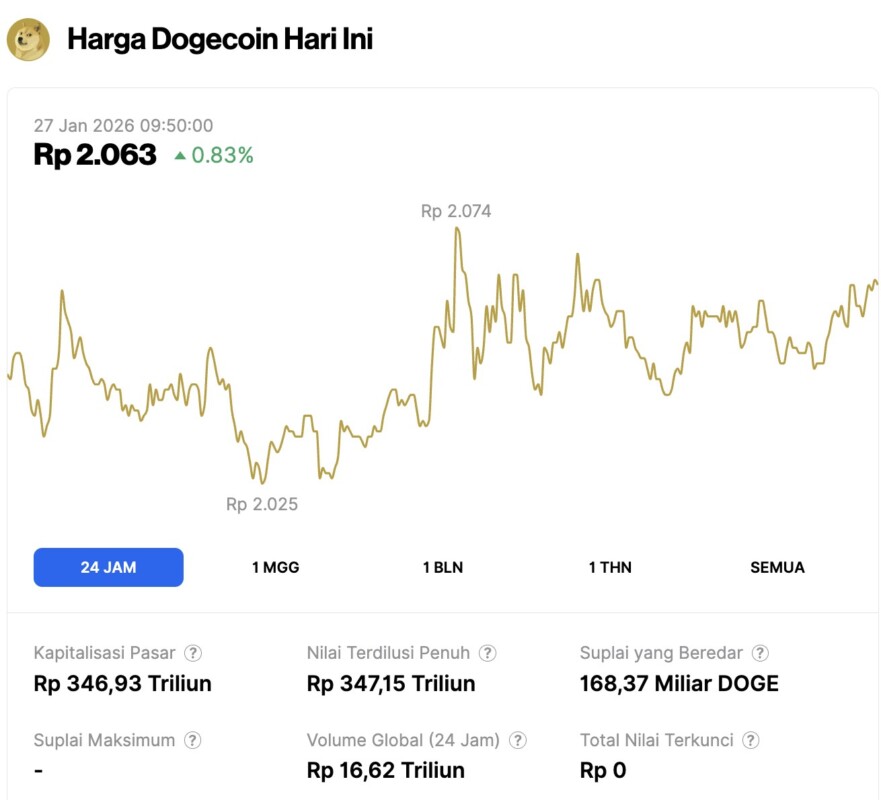

Dogecoin price rises 0.83% in 24 hours

On January 27, 2026, Dogecoin saw a modest gain of 0.83% over the past 24 hours, trading at $0.1228, which is approximately IDR 2,063. During this period, DOGE fluctuated within a range of IDR 2,025 to IDR 2,074.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 346.93 trillion, with a 24-hour trading volume of approximately IDR 16.62 trillion.

Read also: Ethereum Climbs Above $2,900 as Whales Step In to Accumulate ETHH!

Key Technical Points of Dogecoin Price:

- The descending channel is still maintained: Price continues to form a pattern of lower tops and lower bottoms.

- Failed to break the midpoint of the channel: Price rejection in this area further confirms the dominance of bearish sentiment.

- $0.09 is the main downside target: The support area at the bottom of the channel has not been touched.

From a technical structure standpoint, Dogecoin is still firmly trapped in a descending channel pattern on higher time frames. This pattern reflects a continuing bearish trend, characterized by a series of progressively lower peaks and bottoms.

Importantly, the price has not shown any significant deviation from this pattern, reinforcing the view that downside risks remain high.

Channels like this usually act as trend continuation patterns. Until the price is able to reclaim the upper boundary of the channel or decisively break the midpoint of the channel, any rallies are likely to be corrective in nature, not trend reversals.

Weak Reception Below Channel Midpoint

Currently, Dogecoin is consolidating near the lowest value area and around the midpoint of the descending channel. This area acts more as a zone of pressure (compression) than as support. Repeated attempts to break higher continue to fail, where the price has not been able to record a convincing candle close above the midpoint of the channel.

The inability to reclaim this resistance level is an important signal of weakness. Under bullish recovery conditions, prices usually immediately manage to take control of key levels in the middle of the range.

In the case of DOGE, the continued rejection shows that the buyers don’t have enough strength to start a sustained upside movement.

Value Low Area Turns into Resistance

Adding to the bearish sentiment is the shifting role of the value area low which now serves as resistance, rather than support. This shift indicates that the price is currently trading below its fair value – a condition that is often a sign of further declines.

When the market fails to reclaim valuable areas, it is common for prices to seek liquidity at lower levels. For Dogecoin, this means that the ongoing consolidation is most likely just a pause before the decline continues, not a basis for a trend reversal.

Support at $0.09 Level Begins to Be in the Spotlight

With the downward momentum continuing to build, attention is now focused on the support area at the lower boundary of the descending channel, around $0.09. This level is the bottom of the channel structure and has not been touched in the current phase of price movement.

Untested support areas like this often become natural magnets for prices, especially when aligned with a broader bearish structure.

Read also: Bitcoin Price Recovers to $88,000 Today: What’s Next for BTC?

A move towards $0.09 could also reflect a “capitulation” action, where weak market participants are forced out due to selling pressure. Such moves are generally sharp and triggered by emotional sentiment, especially if overall market sentiment has deteriorated.

Risk of Capitulation Increases if Weakness Continues

The longer Dogecoin stays below the resistance area, the greater the risk of capitulation. Typically, capitulation occurs after a long period of consolidation near resistance, followed by a sharp decline as demand dries up. The current structure-compression below the channel midpoint and value area low-fits this pattern.

However, capitulation does not necessarily signal the end of a downtrend. While it could trigger a short-term bounce, the broader structure still needs to improve before a sustainable recovery can take place.

Forecast of Future Price Movements

Dogecoin is technically still in a vulnerable position as long as the price remains below the midpoint of the descending channel and the lowest value area. If this weakness continues, it is likely that the price will continue to move down towards the $0.09 support area.

To invalidate this bearish scenario, buyers need to be able to push the price back through the midpoint of the channel with large volumes and strong market acceptance.

Until that happens, any rally is likely to face selling pressure, and downside risks remain the dominant theme in DOGE’s short-term outlook.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. Dogecoin price continues to struggle below key resistance levels. Accessed on January 27, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.