7 Gold Price Predictions for February 2026: Rise, Scenarios & Risk Factors!

Jakarta, Pintu News – Gold price predictions for next month, February 2026, show a moderate to significant upward trend according to various market models and prediction algorithms based on historical data from CoinCodex, reflecting the demand for safe haven assets under current global conditions.

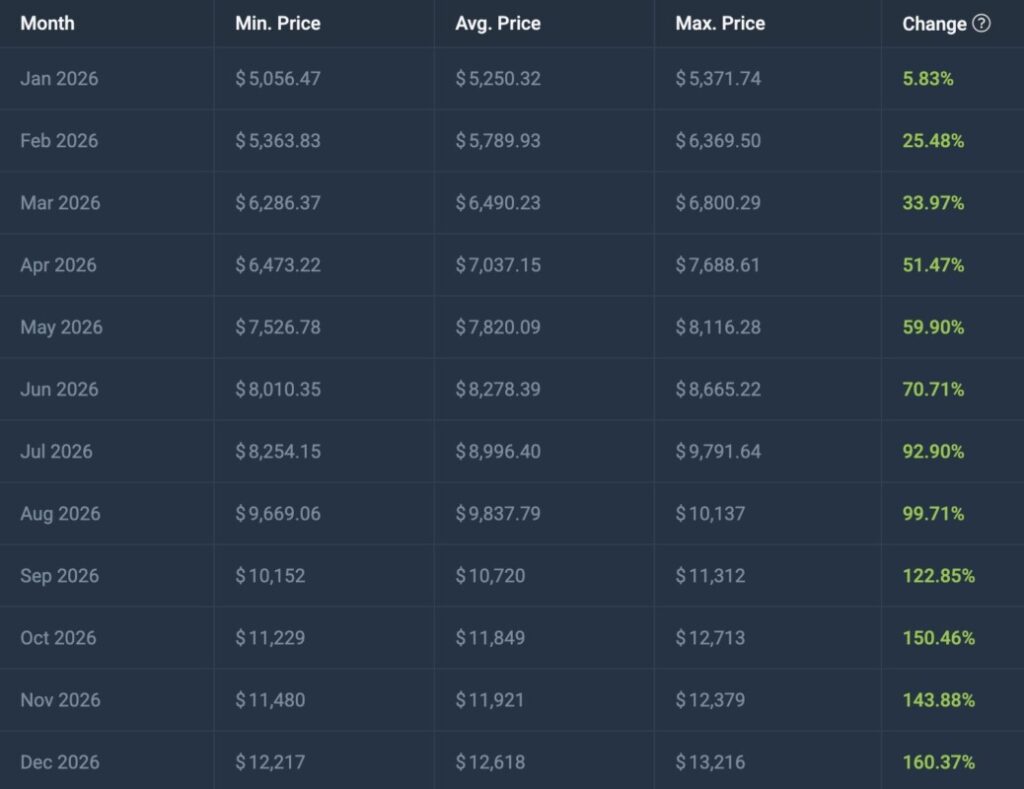

1. Average Price Projection February 2026

According to forecasts from CoinCodex, the price of gold per ounce is expected to be around US$4,653-US$4,783 in February 2026. This movement reflects a higher prediction than the January average, indicating an upward trend in gold prices.

For the context of value in Indonesia, if the price reaches US$4,700 per ounce, the equivalent would be around IDR2.50 million per gram (1 ounce ≈ 31.1035 grams and exchange rate of US$1 = IDR16,815). This conversion is important for local investors calculating potential investment or hedging costs in the domestic market.

Also Read: 5 Key Facts on Silver vs Gold Supply Gap and Its Impact on Crypto & Commodity Assets

2. Monthly Upward Trend

CoinCodex projects that gold will gradually rise throughout February, peaking at a higher price than at the beginning of the month. This trend is consistent with gold’s historical pattern of often strengthening when global markets face economic uncertainty.

Demand for gold often increases when investors seek to hedge against the volatility of capital markets and other risky assets such as cryptocurrencies or stocks, especially when bullish momentum is still strong.

3. Reasons for Bullish Side Predictions

The CoinCodex model bases its predictions on the historical movement of the gold price which shows stronger upward momentum than downward in certain cyclical periods. This indicates a chance of the price staying above important technical support levels.

Global gold demand is also influenced by central bank reserves, jewelry demand, ETF investments, and reactions to global monetary policy. The macro situation is a factor driving the increase in gold prices next month.

4. Potential Highs at the End of the Month

In the prediction chart, gold values are expected to reach higher in mid-to-late February 2026, compared to the beginning of the month, indicating continued bullish momentum. If this pattern materializes, prices could break the upper range of the average projection.

Such a rise usually occurs when risk sentiment improves and investors turn to assets with better perceived value protection. Such demand can keep gold prices in a high range throughout the month.

5. Potentially Weakening Risk Factors

Next month’s price outlook remains vulnerable to global volatility and changes in the Federal Reserve’s interest rate policy. A potential short-term price correction could emerge if capital markets stabilize and demand for risky assets increases.

In addition, easing geopolitical factors or stronger-than-expected economic indicators could dampen the “safe haven” sentiment that used to drive gold prices. Price predictions are still no guarantee of a definite direction in the short term.

6. Comparison of Various Prediction Models

Besides CoinCodex, other models show a wider range of predictions, with some bull scenarios being much higher in the long term. Meanwhile, short-term predictions such as for February could remain moderate.

The variation in predictions shows that although the likelihood of an uptrend next month is relatively strong, investors still need to pay attention to the risk range. The difference in fundamental assumptions between models is the reason for this variation.

7. Implications for Investors

For investors in physical gold or ETFs, the projected rise in gold prices next month could be a signal to reassess their asset allocation. For crypto and stock investors, rising gold prices often reflect broader market uncertainty.

However, any investment decision should consider short-term risks and global economic fundamentals. Diversification remains important to manage overall portfolio risk.

How to Trade XAUUSD and its Alternatives in Crypto

As an alternative in the age of digital assets, exposure to gold can now also be gained through tokenized gold such as Tether Gold (XAUT). XAUT is a physical gold-backed crypto asset, where each token represents ownership of professionally stored gold.

Through Pintu, users can purchase and store XAUT for a more flexible amount without the need to manage physical gold. This approach provides easy access to gold with blockchain transparency, while combining the safe haven characteristics of gold and the efficiency of the crypto ecosystem.

Read More: Altcoin Price Spikes: A Seasonal Phenomenon Not to be Missed!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coincodex. Gold Price Forecast & Predictions for 2026, 2027-2030. Accessed January 28, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.