Solana Price Prediction: Could SOL Decline Amid Weak ETF Interest and Sluggish Retail Demand?

Jakarta, Pintu News – Solana (SOL) rose 4% on Monday (26/1), after falling 6% on Sunday. However, it remains under pressure overall due to a 14% decline last week. The decline is in line with the declining interest from institutional and retail investors, which is reflected in the declining fund inflows and open interest.

Moreover, the liquidation of over $60 million worth of long positions in the last 24 hours suggests a clearing of bullish positions. In terms of technical analysis, the focus is now on the December low of $117 and the psychological support level of $100, as selling pressure increases.

Institutional and Retail Demand for Solana Starts to Decline

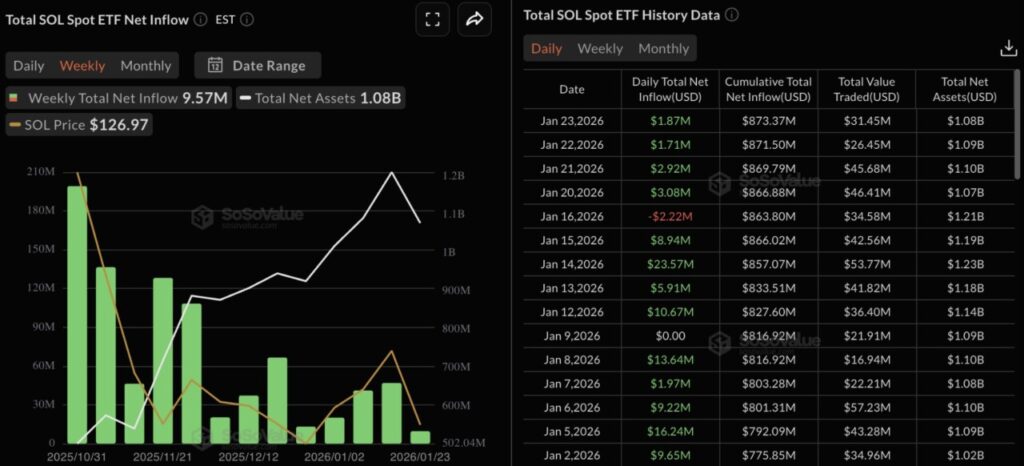

The spot-based Solana ETF in the United States recorded the lowest weekly inflow of $9.57 million, down drastically from $46.88 million in the previous week. This decline in inflows indicates diminishing interest from institutional investors, influenced by risk-averse market sentiment.

Read also: XRP Price Prediction: $1.80 Support Still Sturdy as Volume Explodes to 184%!

This is most likely triggered by continued geopolitical tensions and tariff threats from the United States. Additionally, the strengthening of the Japanese Yen due to speculation of its central bank’s intervention to stop the currency’s depreciation could also rattle the overall crypto market.

In the derivatives market, demand was also weak. The liquidation of long positions worth over $60 million in the past 24 hours far exceeded the liquidation of shorts by $2.14 million, which reinforced the selling sentiment. Open Interest (OI) for SOL futures contracts fell 1% to $7.41 billion, reflecting a decline in the value of active contracts.

This happened as bullish positions were cleared and new bearish positions were formed, reinforced by a negative funding rate of -0.0036%.

Technical Review: Will Solana’s Recovery Avoid a Drop to $100?

Solana showed a quick recovery on Monday with a 4% gain during the Asian trading session and near the $125 level. However, SOL prices are still well below the declining 50, 100, and 200-day exponential moving averages (EMAs), which confirms the bearish trend is still dominant.

Read also: 4 Important Crypto Events of the Week: Can the Market Recover?

The 50-day EMA at $135 is likely to be the upper limit for an early recovery, while the 100-day EMA at $144 is the next barrier.

The MACD (Moving Average Convergence Divergence) indicator shows a histogram that is still negative, but is starting to narrow, signaling a weakening of downward pressure. However, both the MACD line and the signal line are still below zero, which keeps the general market bias weak.

The Relative Strength Index (RSI) stands at 38, reflecting weak momentum although it has not yet entered oversold territory.

Nevertheless, downside risks remain if SOL falls below the December 18 low of $117, which could pave the way towards Pivot Point S1 at $112, and further to the deeper psychological support zone of $100.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FXStreet. Solana price forecast: SOL flags downside risk as ETF retail demand eases. Accessed on January 27, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.