HIP-3 Fuels Hyperliquid Surge — Can HYPE Price Hit $50 in February 2026?

Jakarta, Pintu News – Liquidity rotation seems to have started for other altcoins, while top-tier altcoins are consolidating in narrow ranges. After experiencing downward consolidation for several weeks, the price of Hyperliquid (HYPE) triggered a large spike.

This raised great confidence among market participants, as trading volumes also jumped by more than 100%. Along with Axie Infinity rising by more than 35%, HYPE prices are expected to continue to climb higher if the bulls manage to break through important barriers.

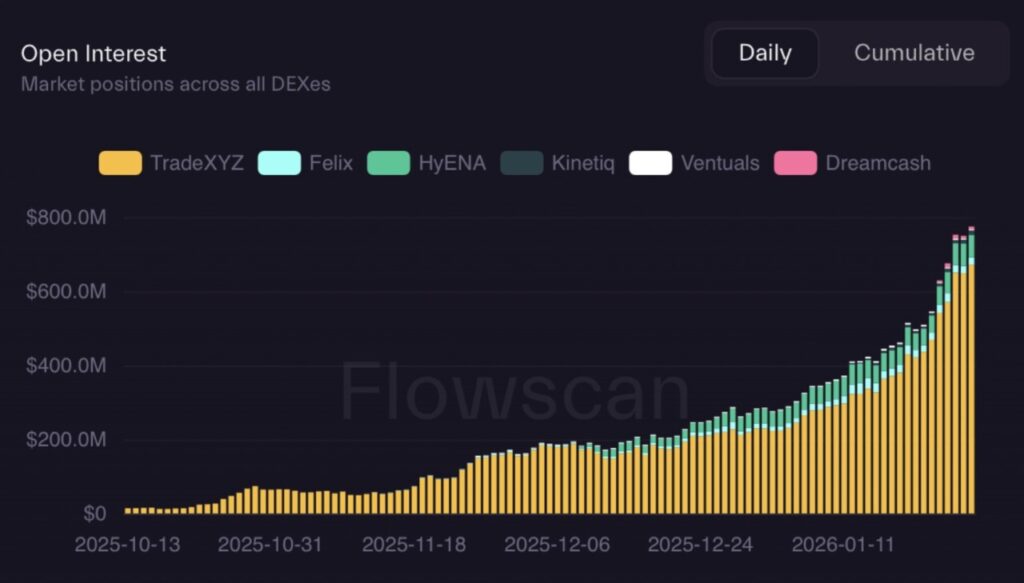

Hyperliquid HIP-3 Open Interest Hits Record High (ATH)

The popular layer-1 blockchain, Hyperliquid, experienced a significant spike in volume since the previous trading day, mainly due to increased trading activity through “Builder-Deployed Perpetuals.”

Read also: VanEck Launches First Spot Avalanche ETF in the US: Time for AVAX to Rise?

The trading level jumped dramatically to a record high (ATH) of $790 million. In a post, Hyperliquid cited the rapid adoption of HIP-3 as one of the main factors behind this surge.

HIP-3, or Hyperliquid Improvement Proposal, which came into effect last October, allows developers to launch perpetual futures contracts for any asset that has a price feed.

This increase suggests that the rally was driven more by aggressive positioning in the perpetual market than accumulation in the spot market. This suggests that many new positions were entered, while the growth of HIP-3 confirms that there was specific demand for the platform, rather than just general market data.

HYPE Price Analysis – Can Buyers Sustain Current Momentum?

On the daily chart (Jan 27), Hyperliquid (HYPE) showed early signs of trend stabilization after a long correction phase. Price action bounced sharply from the lower demand zone around $21, supported by increased volume and the appearance of stronger bullish candles.

This recovery brings HYPE back near the intermediate resistance zone that was previously the breakdown area. This structure indicates that buyers are trying to take control, although confirmation is needed through a break and price acceptance above the immediate supply zone as well as a continuation of solid momentum.

In the daily time frame, HYPE is trying to make a structural recovery after bouncing off the $21-$22 demand zone. The price has moved towards the $27-$28 supply area, but the Supertrend indicator is still showing bearish signals, which means that the main trend has not completely reversed.

Meanwhile, the DMI indicator printed a bullish crossover, with the +DI surpassing the -DI, signaling an improving directional momentum. This combination suggests the potential start of a trend transition, but confirmation in the form of a Supertrend reversal and price acceptance above resistance is required.

Read also: Pepe Coin (PEPE) 2026 Price Prediction: Is It the Right Time to Invest?

Will Hyperliquid Price Reach $50 in February?

Technically, HYPE needs some additional confirmation to support a potential upside towards $50. Currently, the price remains below important resistance zones around $28 and $34-$36, while the Supertrend remains bearish, indicating that the main trend has not changed.

Although the bullish crossover on the DMI supports the short-term momentum, a continuation of the upside requires price acceptance above those zones and a sustained increase in volume.

Unless the price structure improves significantly, the $50 target in February still seems too ambitious, with consolidation or a gradual rise more realistic.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinCentral. HyperLiquid HIP-3 Open Interest Reaches $793 Million All-Time High. Accessed on January 28, 2026

- CoinGape. HYPE Token Jumps 24% as HyperLiquid HIP-3 Sees Record $793M Open Interest. Accessed on January 28, 2026

- Coinpedia. HyperLiquid Momentum Builds as HIP-3 Open Interest Hits $790M, Can HYPE Price Test $50 in February. Accessed on January 28, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.