Jerome Powell’s Speech Set to Shape Crypto Market Direction Ahead of Fed Meeting

Jakarta, Pintu News – Global financial markets are awaiting Federal Reserve Chairman Jerome Powell’s speech scheduled to take place today, coinciding with the Fed’s first meeting in 2026. The main focus of investors is on the interest rate decision and future monetary policy signals. Although the market expects no change in interest rates, the direction of the central bank’s communication remains crucial for risk assets. For crypto and cryptocurrency markets, this speech has the potential to influence short-term sentiment.

Market Expectations Ahead of Fed Meeting

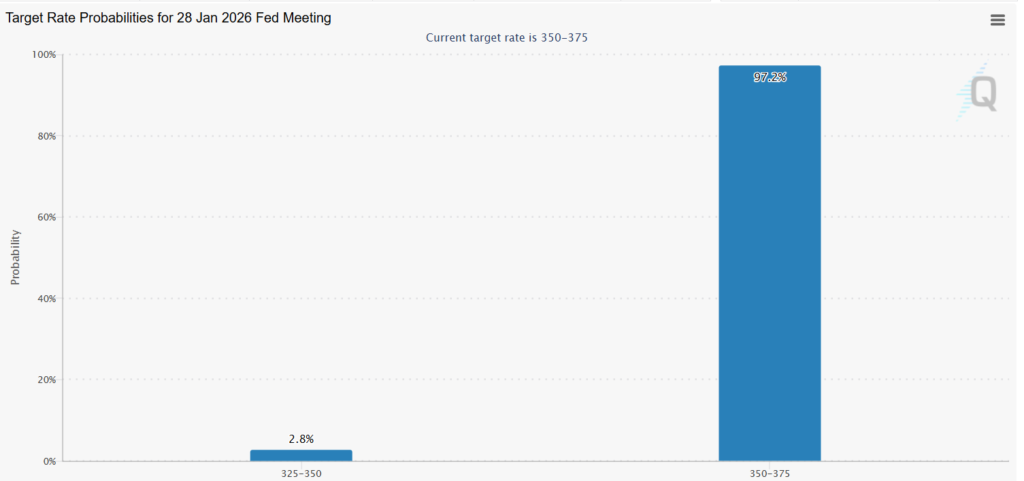

This Federal Open Market Committee (FOMC) meeting is expected to maintain the benchmark interest rate. Based on CME FedWatch data, the probability of interest rates remaining in the range of 3.5 to 3.75 percent reaches around 97 percent. The level has been maintained since the end of last year after the Fed made three consecutive interest rate cuts. Inflation conditions that are still above the target are the main reason for the central bank’s cautious attitude.

On the other hand, labor market indicators have also not shown significant improvement. Some policymakers favor monetary easing to lower borrowing costs. However, another group believes that inflationary pressures are not yet fully under control. This divergence of views has led the Fed to choose a wait-and-see approach to the latest economic data.

Also read: XRP Locked at $2 Level for 14 Months, Crypto Analysts Hint at Big Breakout?

Jerome Powell’s Stance and Monetary Policy Direction

Jerome Powell is not expected to deliver a statement that surprises the market. He is predicted to reiterate that monetary policy will depend heavily on incoming economic data. The Fed tends to maintain a conservative approach despite pressure from market and political dynamics. In this context, the signal of an interest rate cut in the near future is considered small.

Nevertheless, Powell’s press conference at 2.30pm local time is a key moment for investors. Every nuance of language used will be analyzed in depth to read the next policy direction. The market currently expects one to two rate cuts this year, possibly in June and December. Powell’s statement has the potential to reinforce or delay these expectations.

Additional Political and Uncertainty Factors

In addition to economic issues, political pressure is also the background of the Fed meeting this time. The United States Department of Justice is reportedly investigating the Federal Reserve building renovation project. This issue surfaced in the midst of President Donald Trump’s announcement regarding Jerome Powell’s replacement candidate. The situation has the potential to affect the way the Fed communicates to the public.

Also read: Gold and Silver Collapse by $1.7 Trillion, an Early Signal that Bitcoin is Ready to Rise?

Although the Fed is institutionally independent, political dynamics often influence market perception. Investors will look closely at whether Powell alludes to institutional stability and monetary policy independence. This clarity of stance is important to maintain market confidence. Lingering political uncertainty can magnify volatility in risky assets.

Impact of FOMC Meeting on Crypto Market

The cryptocurrency market is showing a moderate response ahead of the FOMC meeting. In the past 24 hours, the crypto market capitalization recorded an increase of about 1 percent. Bitcoin (BTC) stayed around USD 87,000 or around Rp1.45 billion, showing relative stability. Meanwhile, Ethereum (ETH) is moving around USD 2,900 or equivalent to IDR 48.47 million.

Ripple (XRP) is also attracting the attention of institutional investors even though it is still struggling to break the USD 2 level or around Rp33,426. The Fed’s dovish stance usually supports risky assets like crypto. Conversely, a statement that is too tight can suppress market sentiment. Therefore, the meeting results and Powell’s speech are important catalysts in the short term.

To conclude, the Fed meeting and Jerome Powell’s speech are crucial moments for global financial markets. Although the interest rate decision is expected to remain unchanged, the direction of the central bank’s communication will determine risk sentiment. For the crypto market, monetary policy stability could open up room for further gains. However, investors still need to pay close attention to economic data signals and the accompanying political dynamics.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Jerome Powell Speech Today: What to Expect From Fed Meeting for Crypto Market?. Accessed January 28, 2026

- Featured Image: CNBC

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.