3 Altcoins Crypto Whales Are Targeting in February 2026 – Here’s Why They Stand Out

Jakarta, Pintu News – Crypto whales have started taking positions for the next market phase ahead of February 2026. On-chain data shows that large holders are accumulating certain altcoins in anticipation of a possible trend change.

Here is an analysis of three altcoins that stand out as being bought by whales, and each has a strong price increase narrative for the next few months, citing a BeInCrypto report.

Aster (ASTER)

Aster (ASTER) has emerged as one of the leading tokens as accumulation by crypto whales increases.

Read also: Altcoins Potentially Strengthen Ahead of Monthly Close – Will Altseason Happen Soon?

In the past month, wallet addresses holding more than $1 million in ASTER added around 15 million tokens. These continued purchases indicate growing confidence from large holders, despite the general market conditions remaining volatile.

Despite strong accumulation, ASTER prices have been on a downward trend since mid-November 2025 and were trading around $0.65 on January 27. This downward trend reflects weak short-term sentiment.

However, if the support from the whales continues, ASTER could potentially recover towards $0.71 in the next few weeks and could even target $1.00 if the market moves in a very bullish direction.

However, this bullish outlook is highly dependent on external factors. Changes in whale behavior or overall market weakness could suppress price movements. In such a scenario, ASTER may drop towards $0.57 or lower, which would invalidate the optimistic predictions and extend the correction phase.

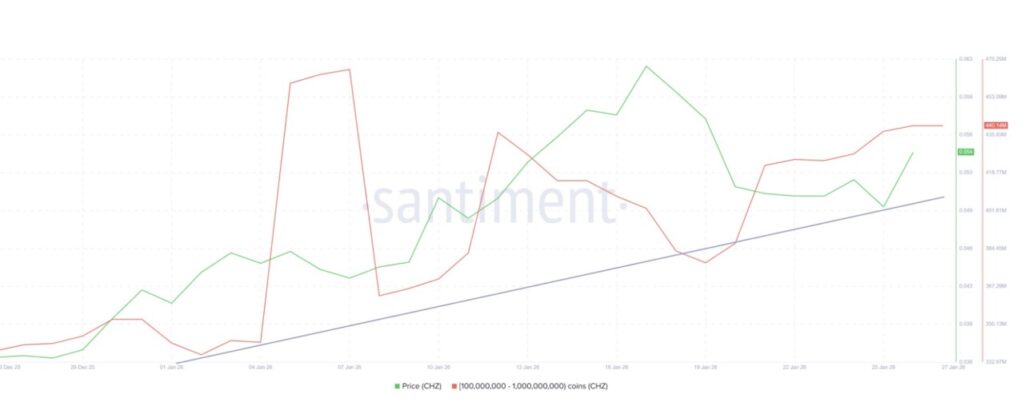

Chiliz (CHZ)

Chiliz (CHZ) has been one of the tokens in demand by whales in the past month. Address wallets holding between 100 million and 1 billion CHZ accumulated more than 100 million tokens, worth about $5 million. This activity reflects the growing confidence of large holders, even though the general market is still volatile.

Over the same period, the price of CHZ rose by about 30% and is now trading around $0.054. This rise is in line with continued accumulation by whales, which often signals trend continuation.

If the buying continues, CHZ could potentially target $0.066 in the medium term and could even rise towards $0.080.

However, profit-taking remains a major risk. Large holders may decide to secure profits, which will increase selling pressure. If that happens, the CHZ price could correct back to the support level at $0.045 or even $0.041, which would derail the bullish outlook and slow down the recovery.

Read also: Hip-3 Hyperliquid Sets a New Record, Can HYPE Price Break $50 in February 2026?

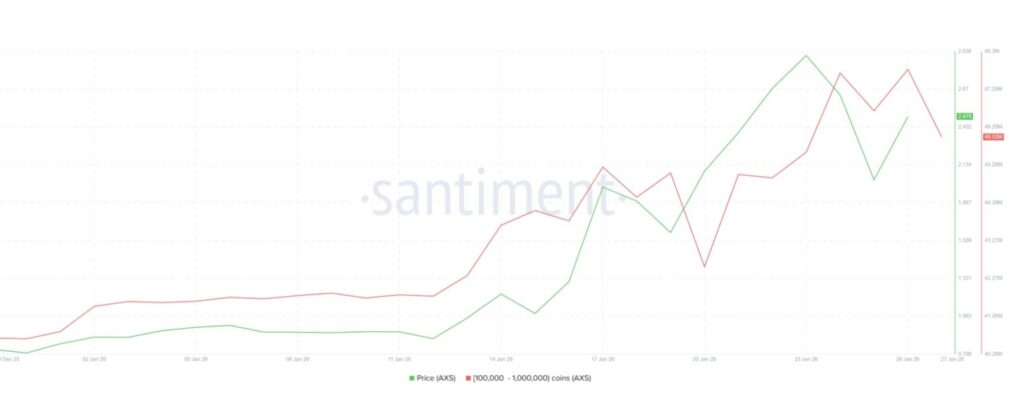

Axie Infinity (AXS)

Axie Infinity (AXS) is also one of the altcoins being hunted by whales, with a very strong price performance. On January 27, AXS was trading at around $2.55 after experiencing a surge of around 213% since the beginning of the month.

This sharp rise reflects renewed investor interest and improved market sentiment, making AXS one of the best performing altcoins in the recent market rally.

Whale activity plays an important role in maintaining this uptrend. Addresses holding between 100,000 and 1 million AXS have accumulated more than 6 million tokens worth about $15 million over the past month.

If accumulation continues, AXS has the potential to rise towards $3.00 in the short term and even $4.00 in the long term.

However, this bullish outlook also comes with considerable risks. If whales start taking profits, momentum could quickly change direction. Heavy selling from major holders could push the price of AXS down below $2.00.

If that happens, the decline could continue to $1.30 or lower, invalidating previous positive projections.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins Crypto Whales Are Buying For February 2026. Accessed on January 30, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.