7 21Shares’ Outlook for XRP Price in 2026

Jakarta, Pintu News – Ripple (XRP) is one of the popular cryptocurrencies that is now being affected by the launch of Exchange Traded Funds (ETFs) and the development of the tokenization ecosystem. According to projections from asset manager 21Shares, the XRP price has a number of different scenarios for 2026, ranging from optimistic to more conservative, reflecting the combined impact of ETF capital flows, institutional acceptance, and global market conditions.

1. Price Projections by 21Shares

21Shares projects the price of XRP at the end of 2026 in three main scenarios: a base case of around US$2.45 (±$41,150), a bull case of around US$2.69 (±$45,215), and a bear case of around US$1.60 (±$26,877). This bull case scenario relies on sustained demand from institutional investors and inflows from spot XRP ETFs. The bear case scenario may occur if adoption weakens or demand for XRP-related products is not strong.

Read More: 5 Key Gold Price Predictions for 2026-2030 in the Context of Global Asset Markets

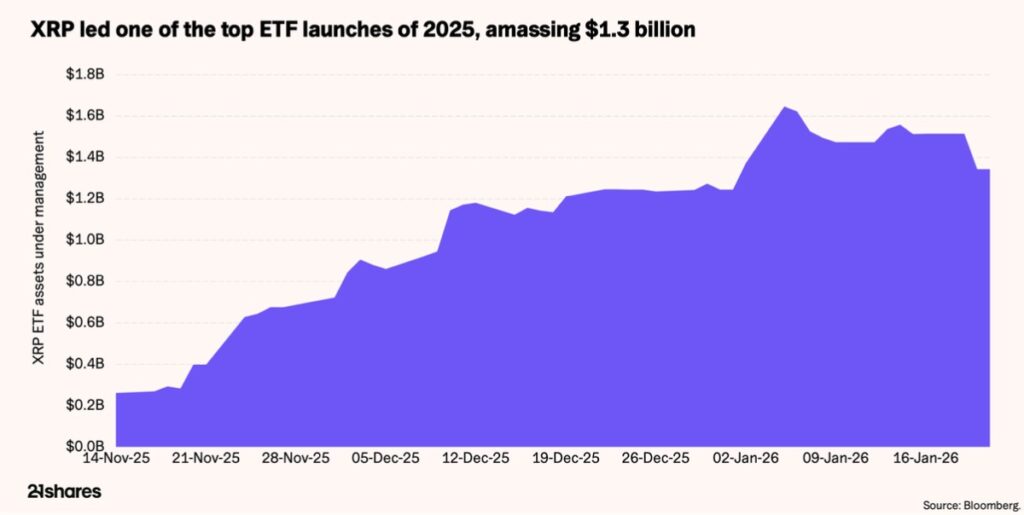

2. Key Influencers: XRP ETF

The launch of the spot XRP ETF in the United States is considered an important catalyst in the changing demand structure of this asset. The ETF was able to attract substantial capital with positive net flows during the initial period after the launch, signaling institutional investor interest. 21Shares notes that these capital flows are structural in nature, not just based on short-term speculation.

3. Impact of Regulatory Settlement

One of the main factors for the change in XRP’s outlook was the settlement of a lengthy legal case with the Securities and Exchange Commission (SEC) in the US in August 2025.

The settlement removed the legal uncertainty that previously limited institutional participation in the XRP market. With the regulatory landscape clear, traditional investors’ access to XRP has become more open through listed products such as ETFs.

4. XRP Ledger Ecosystem Adoption

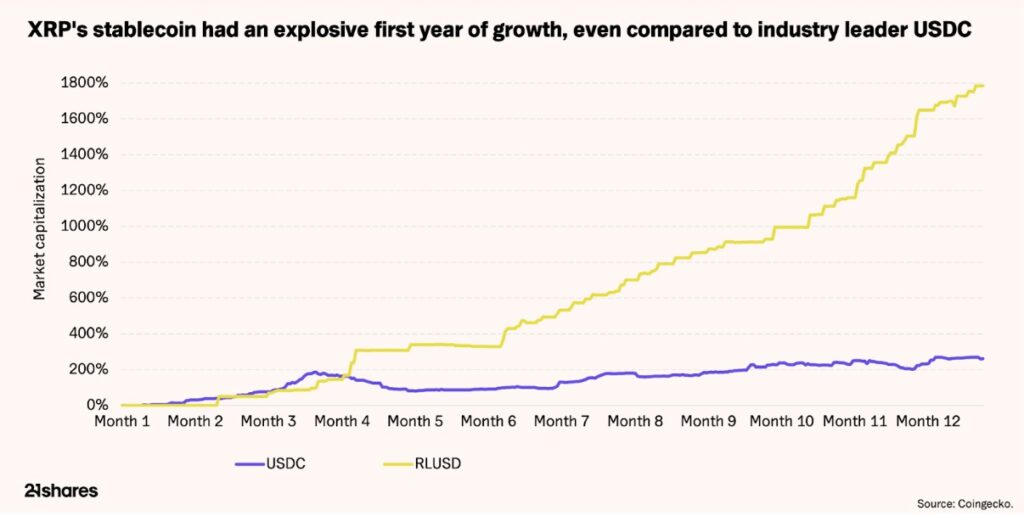

In addition to ETF activity, the adoption of the XRP Ledger (XRPL) for tokenization of real assets and stablecoins was also cited as a long-term value driver. The RLUSD stablecoin linked to XRPL experienced significant capitalization growth, indicating the potential for wider use in the decentralized finance (DeFi) sector. XRPL’s role as a cross-border settlement network provides utility value beyond mere price speculation.

5. Competitive Risks and Pressures

While the bull case projections are attractive, risks remain if ETF demand weakens or if adoption of RLUSD and other token utilities stagnates. A slowdown in institutional investor demand or a capital shift to other crypto assets could also pressure XRP prices towards a bear scenario. Competition from other networks that are also growing in tokenization and DeFi are also risk factors that investors need to consider.

6. Base Case as Midpoint

The base case scenario of around US$2.45 reflects a balance between continued ETF demand and stable network usage. In this scenario, XRP continues to show moderate growth without major spikes. Medium-term investors who focus on institutional trends and technology adoption may see this scenario as a realistic projection for 2026.

7. Lessons for Beginner Crypto Investors

It is important to understand that price projections are not a guarantee, but a tool to plan investment strategies in the volatile cryptocurrency ecosystem. ETFs and regulatory developments can present new opportunities, but they also come with market risks that must be properly managed. Young and novice investors should consider a combination of fundamental analysis, market sentiment and capital risk before making an investment decision.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– Camila Grigera Naón/BeInCrypto. 21Shares Makes XRP Price Prediction for 2026. Accessed January 29, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.