Ethereum Slips to $2,900 as Whales Scoop Up $1.3 Billion in ETH Amid ERC-8004 Buzz

Jakarta, Pintu News – Ethereum (ETH) is attracting attention again following the launch of ERC-8004, a new standard focused on artificial intelligence (AI), which aims to give autonomous agents identity, reputation, and validation on the blockchain.

At first glance, this looks like an innovation that should boost market sentiment. After the announcement, the price of Ethereum had risen by almost 2.5% on January 28. However, the market reaction showed differently. Although large holders started coming in and the price started to stabilize, the overall sentiment remained sluggish.

Currently, the main tension shaping Ethereum’s next direction is the gap between structural progress and market confidence.

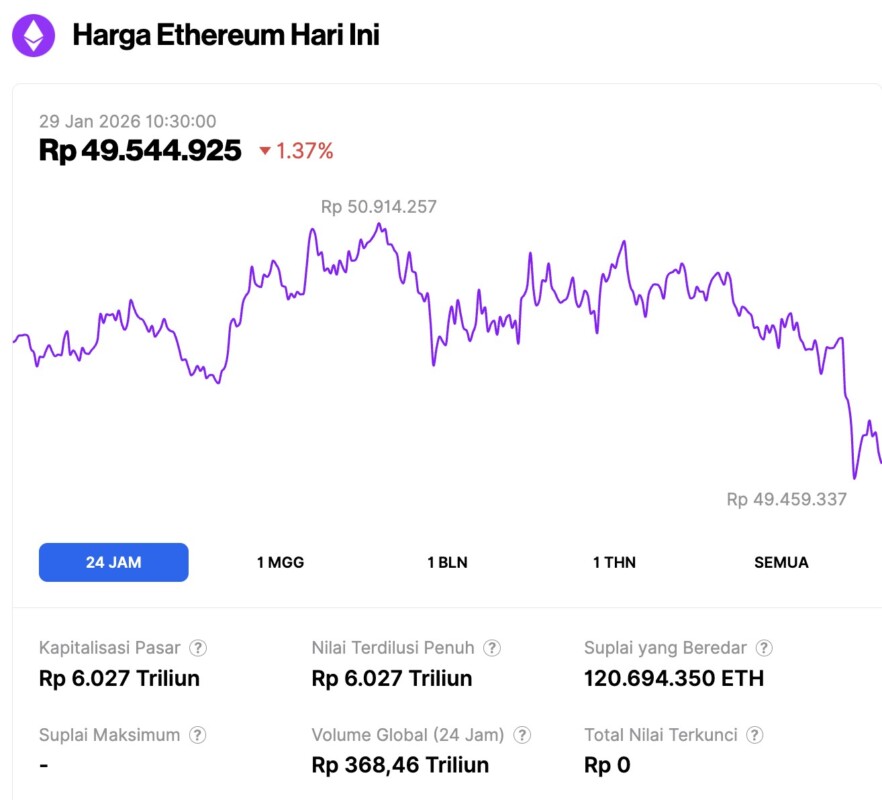

Ethereum Price Drops 1.37% in 24 Hours

On January 29, 2026, Ethereum was trading at approximately $2,945, or around IDR 49,544,925 — marking a 1.37% decline over the past 24 hours. During that period, ETH dipped to a low of IDR 49,459,337 and reached a high of IDR 50,914,257.

At the time of writing, Ethereum’s market capitalization is estimated at IDR 6,027 trillion, while its daily trading volume has dropped by 16% over the last 24 hours to IDR 368.46 trillion.

Read also: Bitcoin Holds Near $88,000 as Traders Set Their Sights on $93,500 Liquidation Zone

ERC-8004 Price Impact: Why Ethereum’s AI Boost May Not Have Driven a Price Rally

ERC-8004 is designed to support decentralized AI agents by providing transferable on-chain identity, reputation history, and validation. In simple terms, this standard allows machines to trust each other and transact without the need for a centralized platform. This is an important step for Ethereum’s long-term role in AI coordination.

However, sentiment data shows that the market is not responding as it did during Ethereum’s previous big run-up.

When the Pectra upgrade went live on the mainnet in May 2025, positive sentiment towards Ethereum immediately spiked. On launch day, the positive sentiment score stood at 259. Within three days, that score rose to 610-a jump of about 135%.

This increase in sentiment preceded an Ethereum price rally that lasted for several months until August, when prices peaked after the sentiment score hit an annual record of 749.

The current situation is very different. During the launch of ERC-8004, Ethereum’s positive sentiment score was only around 18-the lowest number in the past year. Compared to the baseline of 259 at the launch of Pectra, current sentiment is down by more than 90%.

This difference is due to the nature of the upgrade. Pectra is a protocol-level upgrade that deals directly with scalability, efficiency, and fundamental aspects of the network, directly impacting users and transaction fees. In contrast, ERC-8004 is more like a standard at the application layer. While structurally important, the benefits are still at an early stage and not yet apparent to most market participants.

In short, ERC-8004 is important to the future of Ethereum. However, sentiment data suggests that the market is not appreciating that potential future at the moment.

Whales Start Accumulating as RSI Bounces – But “Smart Money” Is Still Wary

Although the market sentiment towards Ethereum is still weak, the on-chain behavior shows a different positioning pattern.

Technically, Ethereum recently showed a hidden bullish divergence between December 18 and January 25. During this period, the price formed a higher low, while the RSI (Relative Strength Index) printed a lower low.

The RSI measures market momentum. This pattern usually signals that the selling pressure is starting to ease, although it doesn’t mean that the bearish trend has completely reversed. The rebound that followed confirmed the stabilization of the price and even managed to avoid the bear flag breakdown pattern.

Now, Ethereum needs to print a daily close above $3,160 to confirm the invalidation of the bearish pattern.

Read also: Altcoins Potentially Strengthen Ahead of Monthly Close – Will Altseason Happen Soon?

Along with that stabilization and the hope of the bearish trend being reversed, the big holders started to move. Ethereum whales increased their holdings from 104.18 million ETH to 104.61 million ETH after the ERC-8004 announcement. That translates to an addition of about 430,000 ETH, or the equivalent of approximately $1.3 billion at the average price-signaling massive accumulation.

This is not speculative action from retail investors reacting emotionally to news. It is a slow and deliberate deployment of capital.

However, there is one indicator that is holding back the short-term bullish interpretation. The Smart Money Index, which tracks capital participation with precise historical timing, is still below its signal line.

In previous cycles, significant Ethereum rallies only occurred after the index broke through an upward signal line. The index’s last clean signal preceded a rally of about 13%. Until now, this confirmation has not appeared.

Combined, the message is clear: whales are accumulating on weakness, possibly with a long-term view. Smart money is yet to catch up with the momentum, in line with the still low market sentiment. This is more of a positioning strategy, not a short-term speculation. As such, the price impact of ERC-8004 will likely remain limited for now.

Double Bottom Signals Ethereum $4,000 Price Target?

It’s only once market sentiment and positioning are understood that the larger price structure becomes clear.

Ethereum has recently managed to avoid a breakdown and is now starting to form a double bottom pattern (W structure) on the daily chart. This pattern suggests that there is incoming demand at similar low price levels, creating the potential for a broader recovery if resistance levels can be broken.

This structure forms a clear ladder of price levels:

- The first resistance zone is around $3,160.

- Above it, there is the crucial neckline of the double bottom pattern, which is in the range of $3,390-$3,400. This level is very important. A sustained breakout above it would technically activate the pattern-not just signal it.

If the neckline is broken with confirmation, the pattern opens up conditional upside targets around $3,790 and $4,170. Further extension towards $4,410 requires not only price strength, but also a marked improvement in sentiment and smart money participation.

However, without confirmation of the neckline breakout, this pattern remains a potential energy that has yet to become a real trigger.

On the downside, if the price drops below $2,930, the strength of the bullish argument starts to weaken. If $2,780 breaks below, the double bottom structure is considered invalidated, and opens up the potential for Ethereum prices to fall further.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Whales Add $1.3 Billion on ERC-8004 Hype – But One Metric Still Blocks a Rally. Accessed on January 29, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.