7 Facts of the XRP “Golden Ticket” Debate and Implications for Crypto Investors

Jakarta, Pintu News – Recent discussions in the XRP Ledger (XRPL) community have brought up the term “golden ticket”, but according to some observers, this concept is more than just a narrative or legislative issue. The theory relates to the potential fundamental utility of the XRPL network that could drive wider adoption, rather than simply a policy or speculative catalyst. A true understanding of this idea is important for crypto investors assessing the long-term value of XRP amid market dynamics and developments in blockchain technology.

1. Origin of the term “Golden Ticket” in the XRPL Community

The term “golden ticket” emerged in XRPL community discussions, initially attributed to the possible impact of legislation such as the CLARITY Act in the US. Some argue that structural market rules could be an entry point for XRP into the larger institutional ecosystem. However, other views emphasize that the technical utility of the network is more relevant than such external factors.

Read More: 5 Key Gold Price Predictions for 2026-2030 in the Context of Global Asset Markets

2. Focus on On-Chain Utility, Not Narrative

According to XRPL community commentators, the real value of the “golden ticket” is in the functionality of the network itself: how XRP can be used in transaction operations and liquidity within the decentralized ledger. One of the main ideas is that Ripple Payments can take liquidity directly from the on-chain decentralized exchange (DEX) in XRPL. In addition, Ripple Prime is referred to as a mechanism for the settlement of institutional flows on the same ledger, which is more substantial than just narrative hype.

3. Liquidity Sourcing from On-Chain DEX XRP Ledger

The ability to access liquidity directly from XRPL’s on-chain DEX is considered a critical element in markedly increasing XRP’s utility. If payment and settlement platforms can utilize this liquidity without regulatory barriers, then the utility of the network will increase. This could potentially attract wider usage by large market participants and financial institutions.

4. Ripple Prime’s Role in Transaction Settlement

In addition to liquidity sources, Ripple Prime was cited as a pathway that could strengthen XRP’s use case for institutional clients. According to some community members, this kind of solution could be a practical point of differentiation for XRPL over other blockchains in the context of more traditional financial settlements. This approach emphasizes utilizing ledger technology for infrastructure functions, rather than simply price speculation.

5. Technical Barriers and Regulatory Compliance

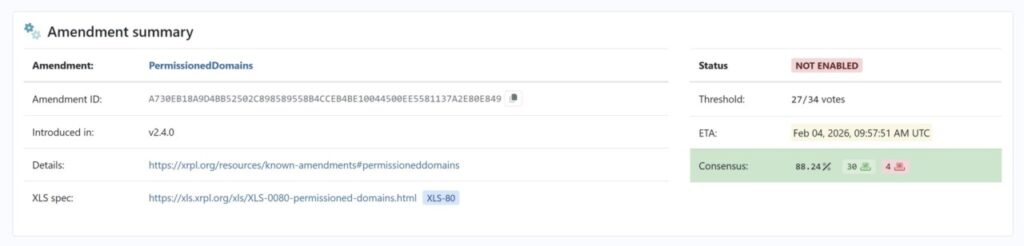

The discussion also covered issues such as Permissioned Domains and permissioned DEXs, which are considered part of the solution to enable the participation of regulated entities without compromising on regulation. Obstacles to regulated liquidity in on-chain DEXs were still cited as a major factor to overcome. These technical solutions are important to bridge the world of institutions and open blockchain systems without compromising on compliance.

6. Not Just a Policy Catalyst

While policies such as the CLARITY Act were once viewed by some as market-opening factors for XRP, community discussions suggest that technical utility and network adoption are far more important in the long run. Investors who focus on network fundamentals tend to prioritize technical factors that can increase the real usage of XRP. This view enriches the understanding that increased value or adoption is not solely dependent on external factors alone.

7. Implications for Crypto Investors

The debate on the “golden ticket” highlights the difference between market narratives and real technical utility in the crypto ecosystem. Young and novice investors considering exposure to XRP need to understand that a coin’s long-term value is often determined by the network’s ability to provide practical utility and liquidity. Fundamental analysis related to on-chain functionality, as well as technical advancements as discussed above, can help assess XRP’s prospects more objectively.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– NewsBTC. XRP’s ‘Golden Ticket’ Might Not Be What You Think, Expert Says. Accessed January 29, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.