7 Facts About DOGE and Potential Side Moves to Summer 2026

Jakarta, Pintu News – Dogecoin (DOGE) has exhibited relatively stagnant price behavior in recent months, moving in a narrow range after an early 2026 rally without a strong catalyst driving a breakout. Recent analysis suggests that DOGE’s short-term momentum is weak and could remain sideways until the summer of 2026 without new significant price dynamics.

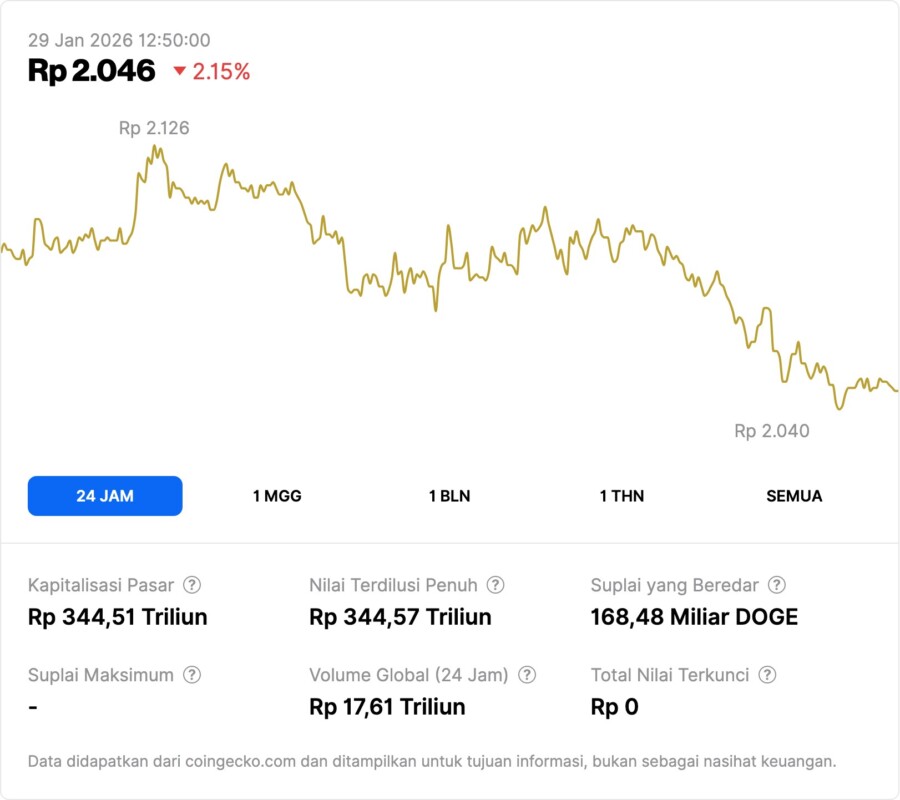

1. Recent DOGE Price Consolidation

The price of DOGE has been moving in a range between US$0.1172 to US$0.1566 since December 2025, despite a short-term rebound. The recent intraday high reached around US$0.1275, but failed to break the key resistance level. This movement reflects the market’s weaker consolidation trend and lack of strong catalysts to trigger a significant uptrend.

Read More: 5 Key Gold Price Predictions for 2026-2030 in the Context of Global Asset Markets

2. The Role of Broader Crypto Market Sentiment

According to market observers, DOGE’s movements are influenced by the general crypto market sentiment, which is still not showing a strong trending direction. Meme coins like DOGE tend to follow broader market trends due to their highly speculative nature. Without any fundamental catalysts or major relevant news, DOGE is likely to continue consolidating within its current price range.

3. Key Technical Level Support

DOGE ‘s main support is currently around US$0.12, which provides a bit of stability in the short term. If this support holds, prices could continue to range above this level with no clear trend direction. However, if this support breaks, selling pressure could increase and trigger further declines in the short term.

4. Technical Resistance and Targets

Resistance around US$0.132 is also limiting DOGE’s upside movement, having failed to break this level significantly. A break above this technical level is still required to change the market bias to a more bullish one. Without a clear technical breakthrough, prices are likely to move sideways within a narrow range until a new catalyst emerges.

5. Potential Summer Volatility

According to some DOGE community analysts, without strong catalysts such as new adoptions or institutional support, the DOGE price could continue to stagnate or even experience seasonal declines in June, August, and September 2026. Summer is often a period of decreased liquidity in the crypto market, which could weaken the price momentum of meme coins. Breakout opportunities remain, but only if there are external factors that drive buying interest significantly.

6. Risk Context for Beginner Investors

The sideways movement with no clear direction suggests that the risks for short-term investors remain high, especially if the capital used for speculation is not carefully managed. New investors need to understand that DOGE as a meme coin asset is highly sensitive to market sentiment and lacks strong fundamental backing. A disciplined entry and exit strategy as well as an understanding of short-term market risk is required before taking a significant position in DOGE.

7. Volatility Opportunities & Limits

Despite consolidation, small price movements could still occur on DOGE due to market reactions to global news or broader crypto dynamics. High volatility is still possible in the short term, but not enough to trigger a sustained trend breakout without a major catalyst. Longer-term investors may see the consolidation period as a time for gradual accumulation, but it is still important to view it in the context of broader market risks.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– U.Today. No Catalyst, No Breakout? DOGE Could Drift Sideways into Summer 2026. Accessed January 29, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.