7 Important Facts about Bitcoin Dominance in Early 2026

Jakarta, Pintu News – Bitcoin (BTC) – the largest cryptocurrency by market capitalization – maintained its market dominance in early 2026, reflecting a stronger market structure after a period of intense volatility in 2025. This dominance is important to understand as it provides context to the overall crypto market dynamics and how investor capital is allocated between Bitcoin and other altcoins.

1. Bitcoin’s Dominance Remains Steady

Bitcoin dominance remained at a high level in early 2026, indicating that BTC still dominates most of the crypto market capitalization. This stable dominance is achieved despite the altcoin market having projects that are experiencing fundamental growth. The strong dominance level indicates investors’ preference for the most established and liquid crypto assets.

Also Read: 7 Important Facts: Impact of Whale Sale on XRP Price

2. Stronger Market Structure

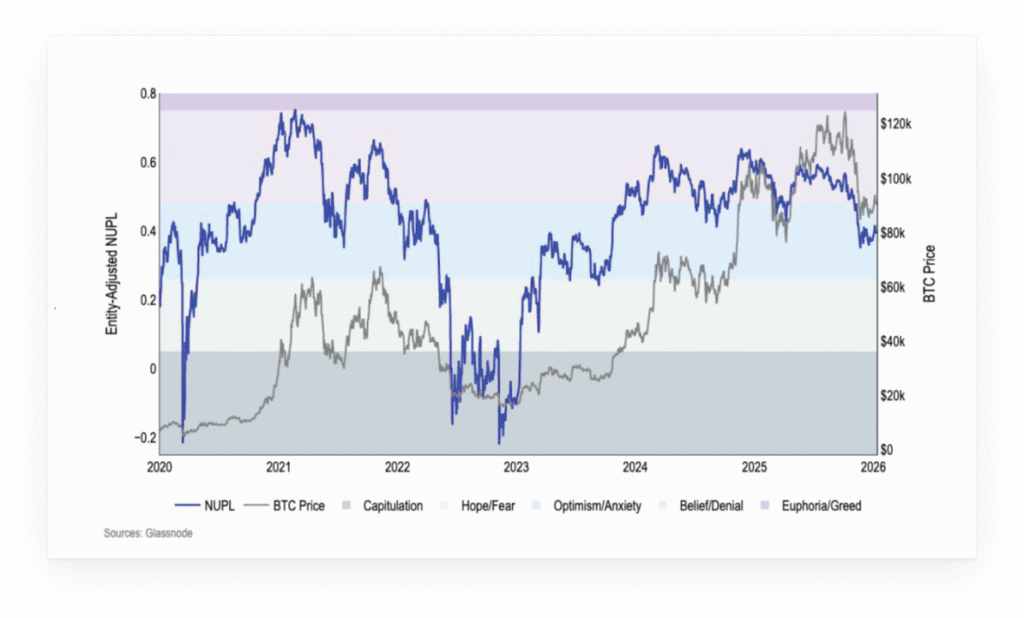

The crypto market enters 2026 with a structure that is considered stronger than the previous period. The stability of Bitcoin’s dominance reflects a decrease in extreme bearish pressure and market adjustment following the major deleveraging in Q4 2025. The healthier market structure makes room for more regular and less volatile price movements in late 2025.

3. Institutional Interest in Bitcoin

Institutional demand for Bitcoin through products such as spot ETFs continues to put a buffer weight on Bitcoin’s market dominance. The flow of capital into Bitcoin ETFs and related products is indicative of major investors’ confidence in BTC’s role as a core asset in portfolios. This preference tends to reinforce Bitcoin’s dominance relative to smaller or less liquid altcoins.

4. Altcoins Do Not Shift Dominance Significantly

Although some altcoins are showing strong on-chain performance and transaction growth, the majority are still unable to outperform BTC’s contribution to the overall market capitalization. Bitcoin’s high dominance suggests that capital is still concentrating on the most secure asset in the crypto ecosystem. This is consistent with market behavior in consolidation periods or after major corrective phases.

5. Market becomes more selective

The 2026 crypto market shows higher selectivity on assets other than Bitcoin, with capital concentrated on projects that have real utility or strong institutional backing. Investors appear to be allocating capital based on network usage fundamentals, rather than simply speculative sentiment. Bitcoin’s steady dominance reflects a market phase where risk and liquidity are the main focus rather than broad-based speculation.

6. Dominance Doesn’t Always Hinder Altcoins

Despite the high dominance of BTC, several large altcoins continue to attract capital outside of Bitcoin’s dominance, especially those that show strong usage fundamentals. Bitcoin’s stable dominance does not mean altcoins are not moving, but their allocation to market capital is still smaller than BTC. This reflects more selectively distributed capital flow dynamics rather than absolute dominance.

7. Implications for Crypto Investors

For crypto investors especially beginners, Bitcoin’s strong dominance in early 2026 suggests that BTC is still the leading asset in a structurally healthier market.

Investors need to assess this dominance along with other metrics such as trading volume, on-chain data, and capital flow maps to understand when capital rotation to altcoins might occur. Bitcoin’s high dominance often signals periods of broad market consolidation, where asset selection based on fundamentals becomes key.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– Bitcoin.com News. Bitcoin Dominance Holds as Crypto Enters 2026 With Stronger Structure. Accessed January 30, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.