7 Facts Gold Price Strengthens Towards USD 5,600 per Ounce & Bitcoin Falls

Jakarta, Pintu News – Global markets earlier today showed opposing dynamics between gold and Bitcoin (BTC), with the precious metal continuing to show price strength while Bitcoin experienced selling pressure. This morning’s market reports highlight how price movements in these two asset classes reflect different risk sentiments among global investors.

1. Gold Strengthens Near USD 5,600 per Ounce

World spot gold prices rose significantly to near USD 5,600 per ounce, sparking buying interest in global commodity markets. The rise extends a bullish trend that has been running for several sessions, supported by safe-haven demand amid financial market uncertainty. This stage of the rally puts gold at price levels not seen before, reinforcing the precious metal’s position as a hedging instrument.

Also Read: 7 Important Facts: Impact of Whale Sale on XRP Price

2. Bitcoin Experiences Selling Pressure

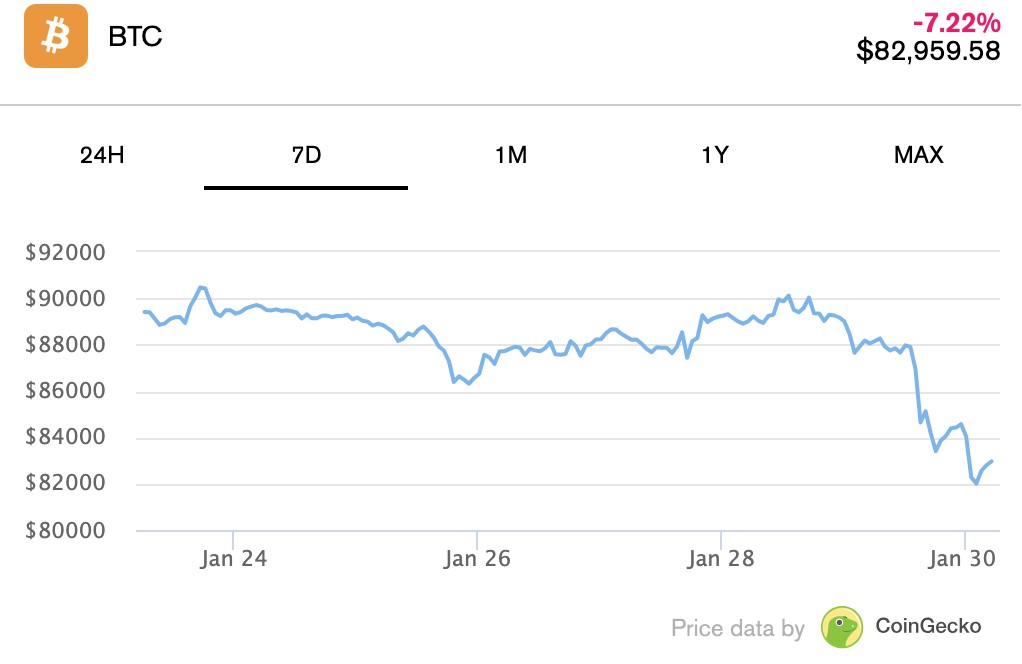

While gold rallied, Bitcoin price experienced a sharp decline at market open, reflecting the short-term negative correlation between safe-haven and risk assets.

BTC dropped from important resistance levels and failed to sustain prices above USD 88,000, switching to a short-term bearish trend. Bitcoin’s volatility increased due to selling pressure in the derivatives market and a general decline in risk sentiment.

3. Risk Sentiment Declines

The decline in prices of riskier assets such as technology stocks and cryptocurrencies reflects a decline in risk appetite among global investors. This morning’s market data shows that investors tend to withdraw capital from volatile assets towards assets that offer stability such as gold. This puts additional pressure on Bitcoin and other altcoins.

4. Capital Flows to Safe Haven Assets

Demand for gold is driven by macro factors such as disappointing economic data and long-term inflation concerns. Safe-haven assets like gold often attract capital when inflation expectations rise or when traditional financial markets come under pressure. Institutional investors are also said to be expanding gold exposure in their hedge portfolios.

5. Crypto Market Volatility Increases

With Bitcoin down significantly, crypto market volatility was noted to increase, especially in the futures and derivatives markets. The liquidation of long positions in Bitcoin accelerated the short sell-off, deepening the short-term price pressure. This volatility often occurs when crypto markets interact with traditional market dynamics simultaneously.

6. Technical Indicators Show BTC Selling Pressure

Short-term technical indicators are displaying bearish signals for Bitcoin, including a decline in the relative strength index (RSI) level. The next BTC support level is evaluated by the market in the range of USD 80,000-USD 82,000, with the risk of a continued decline if the selling pressure continues. This scenario suggests that Bitcoin still needs a positive catalyst to stop the current corrective trend.

7. Implications for Investors

For investors, this highlights the importance of understanding risk assets and safe-haven assets together. Capital shifting from risky assets like Bitcoin to gold is often a reflection of macro risk sentiment, rather than changes in long-term price fundamentals. Novice investors need to be aware that high volatility can occur in both asset classes in periods of global market uncertainty.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– U.Today News. Morning Minute: Gold Soars Toward $5,600; Bitcoin Falls. Accessed January 30, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.