7 Facts on Gold & S&P 500 Price Predictions amid USD 88K Bitcoin Rally

Jakarta, Pintu News – Gold prices (XAU/USD) and the S&P 500 main equity index are registering attractive momentum in early 2026 after Bitcoin (BTC) prices stabilized around USD 88,000, which helped fuel global risk-on sentiment in the market. The combination of a rebound in risk assets and safe-haven demand reveals complex cross-asset class dynamics. From technical predictions to macro factors, the following is a summary of important relevant aspects for investors.

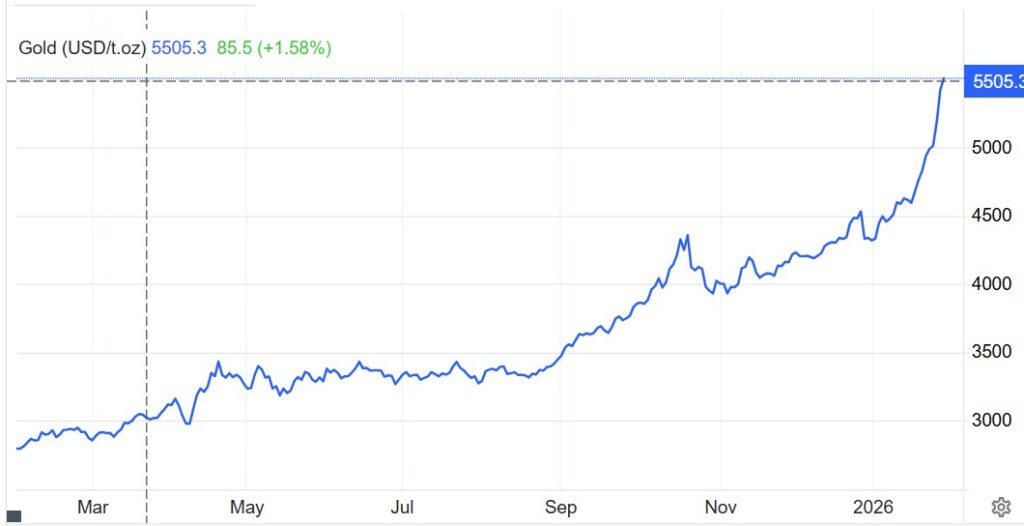

1. Gold Rally Continues with Bullish Trend

Gold continues to record new highs, with prices reaching over USD 5,500 per ounce before showing a minor correction from its psychological level. Capital flows into the precious metal are driven by geopolitical conditions and global macro uncertainties that favor safe-haven demand. Technical forecasts for gold suggest a chance of surging to USD 5,700-6,000 per ounce if the bullish trend continues in the coming weeks.

Also Read: 7 Important Facts: Impact of Whale Sale on XRP Price

2. S&P 500 Sets Record and Potential for Further Rise

The S&P 500 Index recorded a significant surge to reach the psychological 7,000 level, reflecting investors’ optimism towards economic growth and tech company profits. This risk-on sentiment was partly triggered by the stabilization of Bitcoin price above important levels, increasing capital allocation to risky assets. This index forecast sees the possibility of surpassing 7,100-7,200 if stock market momentum remains strong.

3. Bitcoin as a Global Sentiment Trigger

Bitcoin ‘s price holding around USD 88,000 signaled a consolidation of the crypto market and helped restore confidence in high-risk investors. BTC’s stability is seen as part of a series of risk-on rallies that have also affected capital allocation to assets such as stocks and commodities. The release of Bitcoin below key levels could affect the overall market sentiment and trigger adjustments in other asset classes.

4. The Role of Geopolitics in Determining Gold Demand

Heightened geopolitical tensions, including uncertainty in strategic regions and monetary policies, helped fuel demand for gold as a hedge. This demand remains strong even when stock markets are in an upward phase, suggesting a shift in capital allocation to hedge against global risks. Geopolitical pressures may extend the bullish phase of gold prices, forming new higher support levels.

5. Monetary Policy and US Dollar Factors

Interest rate decisions by central banks, such as the higher for longer policy , have created an environment where traditional assets such as gold remain attractive. The decline in the value of the USD index in recent months is usually a driver of commodity prices including gold, as it makes it more affordable for international buyers. These policy movements also influence stock indices such as the S&P 500 through economic growth expectations.

6. Asset Divergence: Gold vs Stocks vs Crypto

While gold showed a strong rally as a safe-haven, stock indices also set records, signaling there is not always the traditional negative correlation between asset classes.

This situation reflects more complex capital flows where investors maintain exposure to riskier assets while still seeking hedges in precious metals. The medium-term outlook for both asset classes suggests that diversification remains relevant in a context of continued uncertainty.

7. Implications for Investors

For investors, the combination of gold and stock index predictions shows that today’s financial markets are not just affected by one variable, but by the synergy between safe-haven assets, stocks, and crypto.

Novice investors should understand this relationship for a medium-term asset allocation strategy-for example, aligning exposure between gold as a hedge, stocks as a growth asset, and Bitcoin as a risk asset.

Monitoring macro metrics such as economic data, interest rate policies and geopolitical sentiment will help inform more informed investment decisions.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– CoinGape Staff/CoinGape. Gold and S&P 500 Price Prediction as BTC $88K Sparks Global Risk-On Rally. Accessed January 31, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.