Rupiah Exchange Rate Today, Friday, January 30, 2026: Weakened

Jakarta, Pintu News – The rupiah exchange rate today is Rp16,787 per US dollar. The rupiah recorded a weakening of 32 points or 0.19 percent in trading on Friday (30/1/2026), compared to its previous position at IDR 16,755 per US dollar.

Dollar to Rupiah Rate Today, January 30, 2026

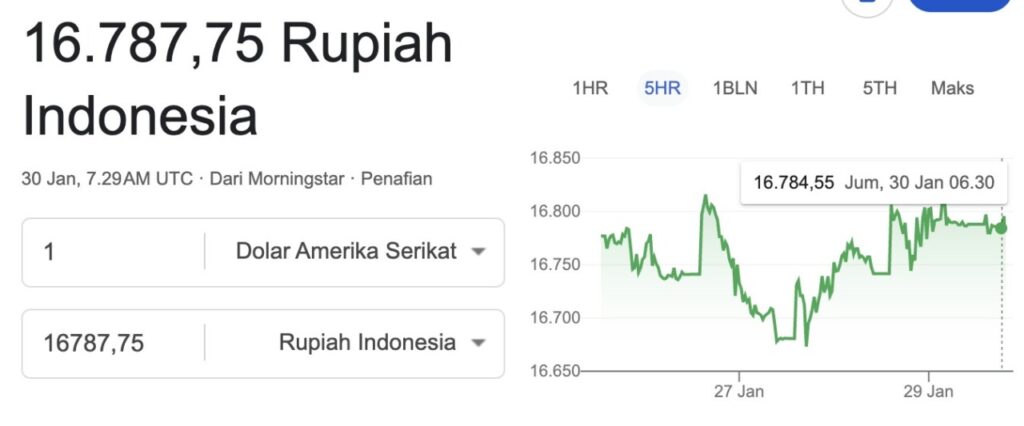

The chart shows the movement of the United States dollar (USD) exchange rate against the Indonesian rupiah (IDR) in the five-day period to January 30, with the latest rate at around IDR 16,787.75 per USD.

Throughout the period, the rupiah moved with moderate volatility, starting from the IDR 16,750-IDR 16,770 area, weakening to near IDR 16,820, then temporarily strengthening to the range of IDR 16,680-IDR 16,700 around January 27. This movement reflects the market’s response to short-term sentiment and temporary capital flows.

Towards the end of the period, the dollar strengthened again against the rupiah to breach IDR 16,800 before moving relatively sideways. This pattern indicates a temporary balance between global pressures and domestic factors, in the absence of strong catalysts that trigger extreme movements.

Overall, the rupiah is still volatile but stable in the range of IDR16,750-Rp16,800, reflecting the wait-and-see attitude of market participants towards the direction of global monetary policy and the development of international economic risks.

Also read: Silver Jewelry Price Today, Friday January 30, 2026

What are the Factors for Rupiah Movement Today?

Today’s rupiah movement was mainly influenced by the strengthening of the US dollar in line with market expectations that the Fed’s interest rates will stay high for longer. The increase in US bond yields encourages the flow of funds into dollar-denominated assets, putting pressure on emerging market currencies, including the rupiah. Global sentiment that still tends to be risk-off makes investors more cautious towards risky assets. This condition keeps the rupiah volatile in a limited range.

Domestically, pressure also came from the weakening stock market and market participants’ wait-and-see attitude towards Bank Indonesia’s monetary policy. Investors are still scrutinizing the central bank’s intervention measures as well as macroeconomic stability amid global uncertainty.

However, Indonesia’s economic fundamentals are considered relatively well-maintained so as to prevent the rupiah from weakening further. This combination of global and domestic factors has shaped the volatile but stable movement of the rupiah today.

Read also: Antam 250 Gram Silver Price Today, Friday, January 30, 2026

The Role of Tether (USDT) in Rupiah Exchange Rate Movement

As blockchain technology evolves, Tether (USDT) has become one of the most widely used crypto assets as a digital representation of the United States dollar. USDT is a stablecoin whose value is pegged 1:1 to the US dollar, so it is designed to maintain price stability amidst crypto market volatility.

In the context of the rupiah exchange rate, the movement of USDT is directly related to fluctuations in the rupiah exchange rate against the US dollar. When the rupiah exchange rate strengthens, the price of USDT denominated in rupiah tends to be lower or stable, and vice versa. This makes USDT an instrument that is often used by investors to maintain asset value, manage liquidity, and make transitions between crypto assets without being exposed to the risk of high volatility.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.