3 Crypto that Could Explode or Collapse This Week

Jakarta, Pintu News – Crypto markets ran wild again over the weekend, with sharp spikes and drops altering the short-term opportunity map. This left many altcoins in a technically sensitive area, where small movements could trigger larger trend changes.

With uncertainty still looming, the main focus is on assets that are testing support or have recently set record prices. Three prominent names to monitor are Dogecoin (DOGE), Stable (STABLE), and Polygon (POL) as each is at a point of direction.

Dogecoin (DOGE)

Dogecoin (DOGE) is under intense pressure after dropping around 32% in the last two weeks and is trading around $0.114. The meme coin’s price is holding slightly above the $0.113 support area, which is now an important line of defense. It also marks a three-month low, reflecting the dominance of sellers and weakening short-term buying interest.

As long as this support has not been broken, the opportunity for a technical bounce is still open although the risk remains high. The key to Dogecoin’s (DOGE) movement is heavily influenced by its strong correlation with Bitcoin (BTC). The correlation coefficient hovers around 0.92, signaling a pattern that tends to move in the same direction and follow each other.

As such, the direction of DOGE could potentially be determined by how Bitcoin (BTC) closes trading ahead of the weekend as well as the global market response. If momentum turns positive, DOGE has a chance to test $0.122 and $0.128, then pave the way to $0.142 if those levels are successfully broken.

Read also: Hot on TV, Ripple (XRP) Price Suddenly Appears $126 on CNBC?

Stable (STABLE)

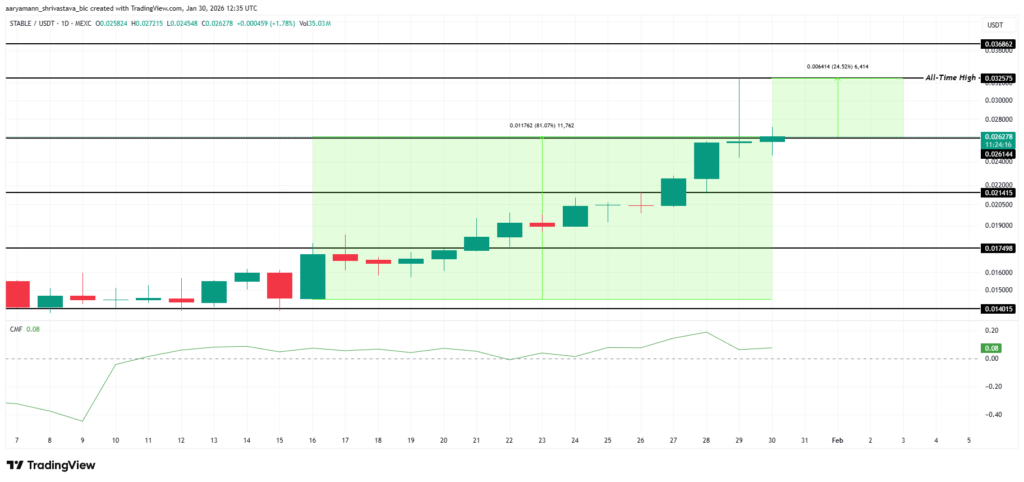

Stable (STABLE) has been aggressive with a gain of about 81% in the last two weeks and is moving around $0.0262. This rapid rally briefly pushed STABLE to an all-time high of $0.0325, signaling increased demand and speculation. However, the current price is still about 24% below its peak, so further upside room is still available.

Such situations often provoke the interest of short-term traders who pursue trend continuation. The fund flow indicators also gave relatively favorable signals for continued strengthening. Chaikin Money Flow is in the positive area, which generally indicates capital inflows and accumulation interest.

As long as the inflows persist, STABLE has the potential to continue its upward movement throughout the weekend. However, if the sentiment takes a sudden turn, selling pressure could drag the price to $0.0214, even further to $0.0174 which would turn the narrative into a profit-taking phase.

Read also: Tom Lee Reveals the Secret: Gold Skyrockets as Bitcoin Stalls, Here’s Why!

Polygon (POL)

Polygon (POL) has been one of the worst performing altcoins this week as its price continues to approach the all-time low of $0.0985. It is now less than 12% away from that low, so this area is seen as a crucial zone for market participants. Consistent selling pressure and unrecovered demand mean that downside risks remain dominant.

This puts POL in a fragile position, especially if the general crypto market weakens again. The all-time low was recorded on the first day of the year, followed by a sharp rebound of around 76% which unfortunately did not last long. After that rally lost steam, POL corrected by around 37% and is now hovering around $0.111.

Holding above $0.110 does provide some respite, but not enough to confirm a convincing trend reversal. The new recovery scenario looks stronger if POL is able to reclaim $0.138, as that level could invalidate the bearish outlook and restore market confidence.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins To Watch This Weekend | January 31 – February 1. Accessed February 2, 2026

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.