Dogecoin Crashes to $0.10 — But On-Chain Data Reveals Quiet Accumulation Behind the Scenes

Jakarta, Pintu News – The price of Dogecoin (DOGE) has experienced a sharp decline in recent days, sparking concern in the market. The meme coin has fallen by 16% in four days, even breaching psychologically important levels.

While this move rattled short-term holders, the decline could be a positive signal for a healthier macro structure. Historically, corrections like this often open up favorable accumulation opportunities for DOGE.

So, how is the Dogecoin price moving today?

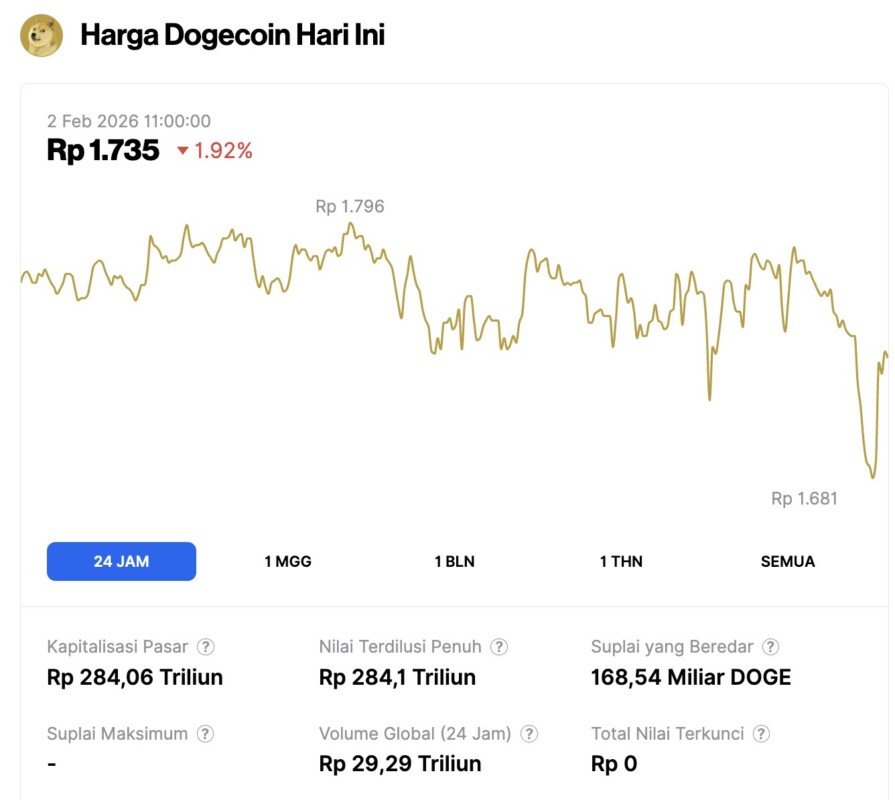

Dogecoin price drops 1.92% in 24 hours

On February 2, 2026, Dogecoin recorded a 1.92% decline over the past 24 hours, trading at $0.1029, or approximately IDR 1,735. During this period, DOGE fluctuated within a price range of IDR 1,681 to IDR 1,796, reflecting ongoing short-term volatility.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 284.06 trillion, while its 24-hour trading volume stands at approximately IDR 29.29 trillion, indicating active market participation despite the recent pullback.

Read also: Ethereum Price Tumbles to $2,100 Today: Will ETH Rise or Continue to Crash?

Dogecoin Holders Act Fast

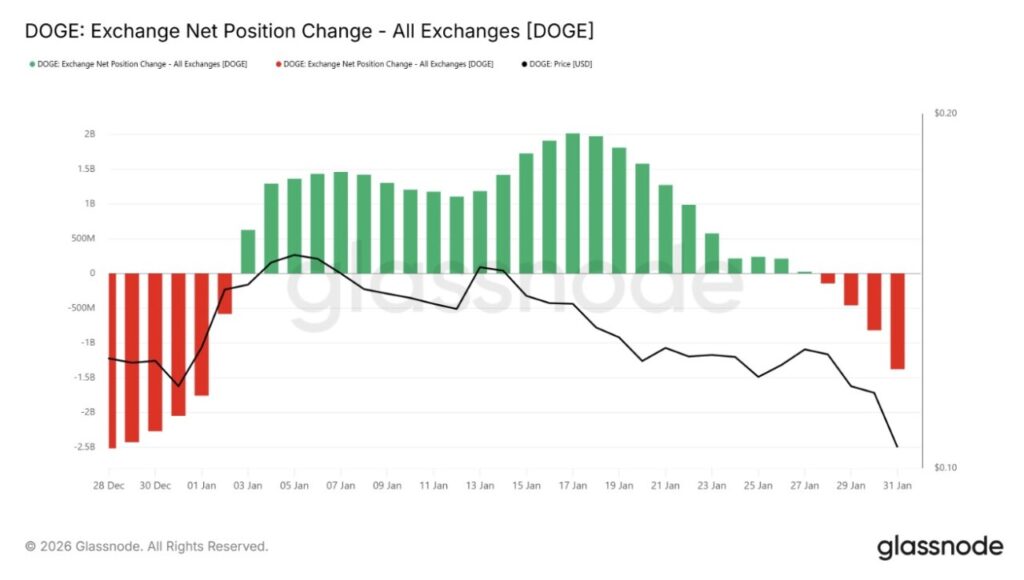

On-chain data shows that Dogecoin holders moved quickly when signs of price weakness began to appear. The change in net position on exchanges shows an increase in accumulation during the sell-off.

Buying pressure begins to dominate selling pressure when the price of DOGE drops below its recent average. This pattern indicates that investors saw the price drop as an opportunity rather than a danger signal.

This kind of accumulation often reflects the conviction of more insightful market participants. Instead of selling their assets, holders add to their holdings at lower prices.

This response helped to dampen downward pressure and stabilize prices. This pattern is in line with previous DOGE price corrections that were followed by recoveries.

Macro indicators also support this accumulation view. The Market Value to Realized Value (MVRV) ratio has entered the opportunity zone. Currently, DOGE’s MVRV is in the range of -17% to -25%, reflecting the presence of unrealized losses across the network.

Historically, Dogecoin tends to bounce back when MVRV is in this zone. As losses begin to saturate, selling pressure subsides as holders are reluctant to realize losses. During these phases, accumulation usually increases. Past price recoveries have also been preceded by a similar pattern once selling pressure begins to ease.

Read also: Dogecoin 2026 Price Prediction: Is It the Right Time to Invest?

DOGE Price Manages to Avoid a Deeper Correction

On February 1, Dogecoin was briefly trading around $0.105 after a four-day decline that erased around 16% of its value. As of February 1, DOGE had dropped to $0.094, its weakest intraday low in weeks.

Dip buying helped to arrest further declines. DOGE quickly made it back above the $0.100 level, which now serves as a short-term buffer area. Keeping the price above this zone is key to a potential recovery.

If DOGE is able to break $0.110, the upward momentum is likely to grow. This breakthrough could push the price towards $0.117, while recovering some of the recent losses.

However, downside risks still exist if momentum weakens again. If DOGE fails to hold above $0.100, selling pressure could reappear, bringing the price down to $0.094 or even lower. This scenario would invalidate the positive projections and delay the recovery until buying interest picks up again.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Dogecoin Holders’ Reaction to Price Crash. Accessed on February 2, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.