Is Bitcoin Cheaper Than Gold? A Rare Signal Linked to an 11,800% Rally

Jakarta, Pintu News – The crypto market has once again produced a rare signal: the value of Bitcoin (BTC) to gold (XAU) has dropped to its lowest point in history after adjusting for global money supply. A number of analysts consider this condition makes Bitcoin (BTC) look much “cheaper” than gold, even called more attractive than the phase before the 2015-2017 bull market.

However, not everyone is convinced that the flow of funds from precious metals to cryptocurrencies will happen anytime soon. Amidst the debate, on-chain data shows long-term holders are starting to accumulate again as prices weaken.

BTC-Gold Ratio Enters Historical Undervalued Zone

Bitwise Europe data highlights that Bitcoin’s (BTC) weakness against gold (XAU) is now in a region that once coincided with a major turning point. This extreme zone was last seen in 2015, when Bitcoin (BTC) was extremely undervalued compared to gold. After that period, Bitcoin (BTC) shot up by around 11,800% to reach a peak of around $20,000 from around $165 in two years.

This historical pattern has led some analysts to view the current opportunity as more attractive than in the run-up to the previous big rally. Michaël van de Poppe echoed the view that the depressed ratio condition could open up room for an aggressive recovery.

The prevailing narrative is Bitcoin’s (BTC) potential “catch up” to gold (XAU) when risk sentiment improves again. However, ratio indicators are not a guarantee of price direction, but rather probabilistic signals that need to be confirmed by other factors.

Also read: Bitcoin price plummets to $77,000, is this really the lowest point of the cycle?

Gold to Bitcoin Capital Rotation Still Debated

Some analysts expect capital rotation from gold to Bitcoin (BTC) to start in February or March. André Dragosch of Bitwise Europe and Pav Hundal of Swyftx are among those who think a shift in interest could occur when investors start looking for higher-risk assets. For background, gold has recorded strong gains in the past year, while Bitcoin (BTC) is down about 18% over the same period.

This performance imbalance often triggers speculation that lagging assets have the potential to catch up. However, Benjamin Cowen cautions that such a rotation does not happen automatically, let alone in a short period of time. He thinks Bitcoin’s (BTC) downward trend could last longer, including the possibility of continued weakness relative to the stock market.

On the other hand, commodity projections are also still favorable for the precious metal, with Citi assessing that silver is likely to continue strengthening due to demand from China and a weakening US dollar. RBC Capital Markets even predicts gold could reach $7,000 by the end of 2026, so gold’s appeal could remain strong for longer.

Also read: XRP Price Prediction: Why $7 Target is Still Holding Despite Price Crash

Long-Term Holder Accumulation Strengthens as Price Weakens

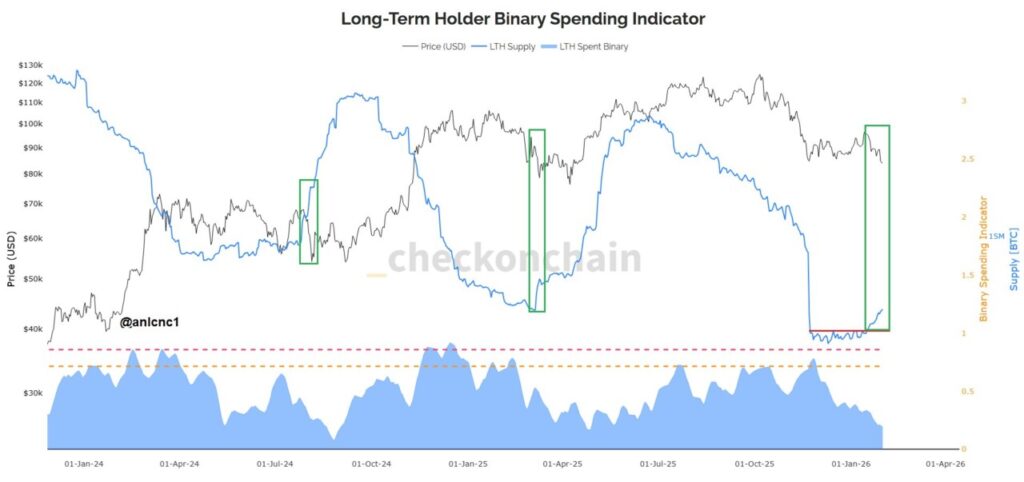

Amid the January correction, on-chain data shows long-term holders are starting to absorb the selling pressure. Supply held by Long-Term Holders (LTH), entities that hold Bitcoin (BTC) for more than 155 days, was seen recovering during the downturn. This change is often read as a sign that more patient players are taking advantage of discounted prices to build positions.

When LTH increases, the market often gains a more stable foundation for the subsequent recovery. In addition, the LTH Spent Binary metric, which describes the propensity of LTH to sell or hold, continued to decline during the sell-off. The decline in the metric indicates that the distribution pressure from long holders has eased, allowing for a tighter supply in the market.

Analyst Anil thinks the combination of LTH supply recovery and the weakening of its historical selling activity precedes a more durable bottom. The example mentioned occurred after the April 2025 low point, when LTH supply recovered first and Bitcoin (BTC) price followed up by about 60% about a month later.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Bitcoin vs. gold: BTC is a better opportunity than 2017. Accessed on February 2, 2026

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.