5 Shocking Facts: Crypto Market Volume Prediction Hits IDR 201 Trillion in a Month!

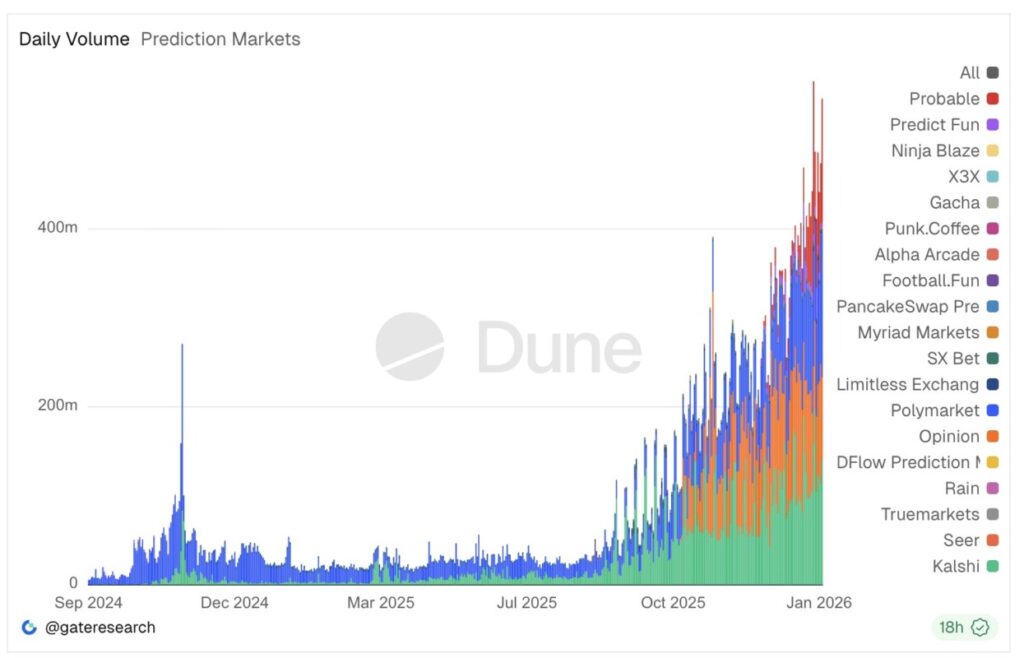

Jakarta, Pintu News – January 2026 marked a significant milestone for the development of the prediction market sector in the crypto and cryptocurrency ecosystem. The transaction volume of the global prediction market soared dramatically and broke new records, reflecting investors’ growing interest in probability-based instruments. This phenomenon marks a shift in market attention from mere asset price speculation to decentralized prediction of economic, political, and social events.

Market Volume Surge Predicted as Early as 2026

Throughout January, the total transaction volume of the prediction market reportedly exceeded USD 12 billion. If converted at an exchange rate of IDR 16,788 per US dollar, the value is equivalent to around IDR 201.5 trillion in one month. This makes January the period with the highest activity ever recorded in the sector.

This increase in volume shows that the prediction market is no longer a niche segment in crypto. The massive transaction activity reflects growing user participation and increased liquidity. For novice investors, this data is important to understand that the crypto market continues to evolve beyond conventional asset trading.

Also Read: 7 Ethereum (ETH) 2026 Price Predictions: Bullish Targets, Risks & Projections

Role of Key Platforms in Driving Activity

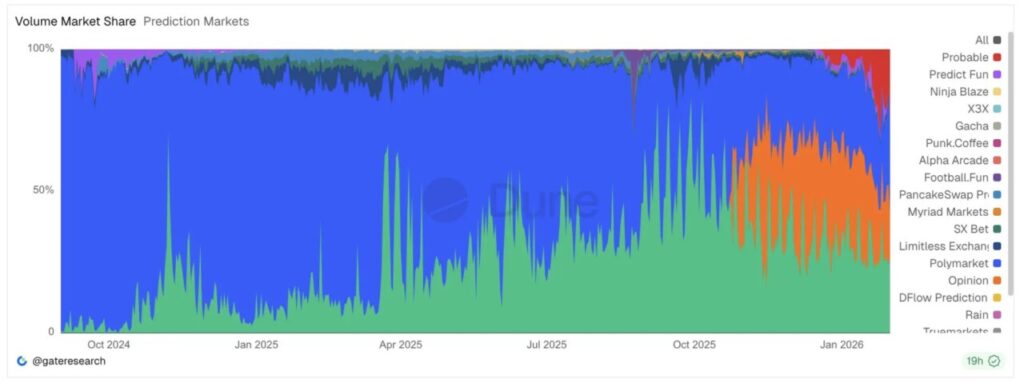

The surge in volume did not occur evenly, but was concentrated on a few large platforms. Polymarket, Kalshi, Opinion, and Probable each recorded transaction volumes of more than USD 1 billion. This contribution makes them the main drivers of growth in the prediction market.

The dominance of these platforms shows the importance of trust and liquidity in prediction markets. The more active users there are, the more accurate the price probabilities become. For young investors, this shows how network effects play a big role in the cryptocurrency ecosystem.

Prediction Market as a Crypto Ecosystem Extension

Blockchain-based prediction markets utilize smart contracts to create transparent and decentralized markets. It allows users to place positions on the outcome of an event, not just the price movements of cryptos such as Bitcoin (BTC) or Ethereum (ETH). As such, its functionality is broader than conventional spot or derivatives trading.

In the context of the crypto ecosystem, prediction markets are often viewed as information aggregation tools. Contract prices reflect the market’s collective probability consensus. For novice investors, this understanding is important so as not to equate prediction markets with gambling, but rather see them as a data-driven expectation formation mechanism.

On-Chain Revenue and Economic Impact

High activity throughout January also generated significant on-chain revenue. Total transaction fees recorded amounted to more than USD 11 million or around Rp184.7 billion. This figure shows that the prediction market is not only active in volume, but also contributes to the blockchain economy in a tangible way.

The revenue comes from transaction fees and contract settlements. For the cryptocurrency ecosystem, these fee streams are important because they support the sustainability of protocols and developers. From an educational standpoint, this data helps investors understand how blockchain utility can generate real economic value.

Implications for Young and Novice Investors

January 2026’s record volume suggests that interest in prediction markets could potentially continue. However, high activity does not necessarily mean lower risk. Prediction markets still contain volatility and uncertainty, especially since the outcome depends on external events.

For young investors, this phenomenon should be read as a signal of innovation, not an invitation to speculation. Understanding the mechanics, risks and functions of prediction markets is key before getting involved. With an educational approach, this sector can be understood as part of the increasingly diverse cryptocurrency landscape.

Also Read: 7 Gold Price Predictions for February 2026: Rise, Scenarios & Risk Factors!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cryptopolitan. January Prediction Market Volume Hits $12 Billion. Accessed February 2, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.