Michael Saylor aims to buy Bitcoin when BTC drops to USD 78,000!

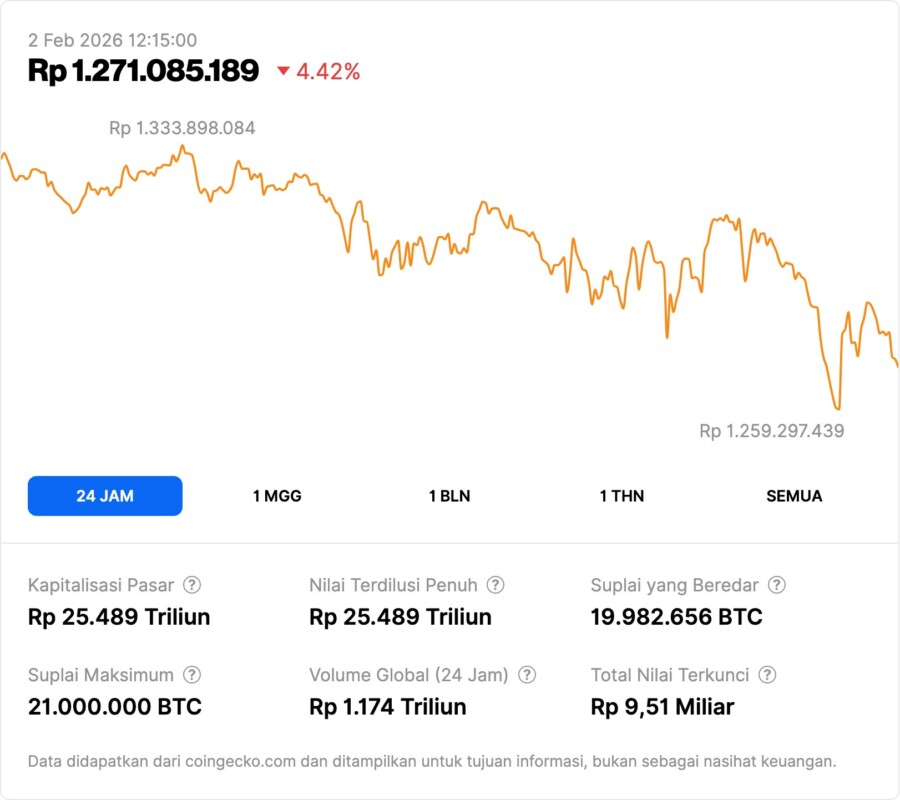

Jakarta, Pintu News – Under pressure from the late January 2026 crypto market, the price of Bitcoin (BTC) briefly slumped to around USD 78,000, reflecting a short-term weakening of demand. Encouraged by these market conditions, well-known executives in the Bitcoin world signaled that a buyback move was being considered. These market moves prompted a big question mark among young and novice investors as to the next direction of the world’s largest crypto asset.

Michael Saylor Signs to Buy Again as BTC Weakens

Michael Saylor, the executive chairman of Strategy, known as one of the largest public accumulators of Bitcoin, signaled in a social media post that the company may make further Bitcoin purchases. This signal came as the price of Bitcoin dropped to around USD 78,000, signaling considerable selling pressure in the market. This buying policy is usually publicized in the format of a visual alert followed by an official announcement the next day.

The market response to the signal did not immediately lift Bitcoin’s price significantly, indicating that the current support is more of a long-term nature, rather than an instant price boost. As capital opportunities are limited due to the weak performance of Strategy’s stocks and preferred instruments, the company’s ability to purchase large amounts of Bitcoin may still be constrained by capital market conditions.

Also Read: 7 Ethereum (ETH) 2026 Price Predictions: Bullish Targets, Risks & Projections

Bitcoin Weakens Below USD 100,000 and Market Psychology

Bitcoin’s price fell by almost 10% in recent days, reaching a low of around USD 78 000, signaling the market’s resistance to bearish conditions in the short term. This decline significantly weakened risk appetite in the crypto market, resulting in decreased demand for risky assets such as altcoins.

This strengthening risk-off outlook is also evident in the behavior of traders who are starting to consider bearish positions just as strongly as bullish bets at high levels. This suggests that market sentiment is still volatile and affected by large fluctuations in Bitcoin price.

BTC Buying Strategy and Capital Limitations

Saylor and Strategy often use “at-the-market” (ATM) programs that allow companies to sell their shares to raise capital for additional Bitcoin purchases. However, with the company’s common and preferred shares weakening, the capacity to raise capital through this method is limited. This implies that the next BTC purchase will likely be smaller than the previous accumulation.

This strategy is not just about buying low prices, but also part of a long-term commitment to Bitcoin. While capital costs and market pressures make this strategy less flexible in the short term, long-term commitment is still the main focus.

Market Response and Implications for Crypto Investors

The appearance of a Bitcoin buy signal by Saylor may imply that there is an opportunity to form a price floor if the market continues to weaken. However, this signal reflects a belief in the long-term value of Bitcoin rather than short-term price momentum. For young and novice investors, understanding the difference between long-term signals and short-term market reactions is key to managing expectations.

In addition, due to the limited liquidity of Strategy stocks, the impact of buying on the price of Bitcoin on the spot market may not be as great as in the past. This shows that institutional buying strategies do not always move the price directly, especially when market sentiment is still fragile.

Conclusion

Michael Saylor’s Bitcoin buying gesture as BTC drops to levels around USD 78 000 reflects the current dynamics of the crypto market: short-term price pressure remains strong, but long-term conviction is maintained by some institutional investors. For young investors, this news underscores the importance of distinguishing between long-term strategies and daily market volatility in navigating the cryptocurrency market.

Also Read: 7 Gold Price Predictions for February 2026: Rise, Scenarios & Risk Factors!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- CoinDesk. Michael Saylor signals another bitcoin buy as BTC price slumps to USD 78,000. Accessed February 2, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.