4 Shocking Facts about Bitcoin Penetrating Rp1.42 Billion: Similar to BTC April 2025 Technical Signal!

Jakarta, Pintu News – Cryptocurrency price movements have once again caught the attention of global markets after Bitcoin (BTC) approached important price levels last seen in April 2025. This surge has led to renewed discussion among investors, particularly regarding the technical opportunities and accompanying risks in the maturing crypto market.

1. Bitcoin Returns to April 2025 Levels

Bitcoin (BTC) had touched a price area of around USD 85,000 or equivalent to IDR 1,426,980,000 assuming an exchange rate of 1 USD = IDR 16,788. This level was previously an important consolidation zone that formed the price structure in April 2025.

The return of prices to these areas shows that the cryptocurrency market still respects historical levels as a technical reference. For novice investors, this confirms that crypto movements cannot be separated from recurring patterns that can be objectively analyzed.

Also Read: 5 BTC History Facts February often bounces back after January slump!

2. Support Area and Price Rebound Potential

Technically, the USD 85,000 area serves as medium-term support for Bitcoin (BTC). This support is the point where buying and selling pressure tends to be balanced, thus triggering a potential price bounce or rebound.

If this support holds, the crypto market has a chance to see an upward movement in the short term without having to create excessive euphoria. However, failure to hold these levels could also open up room for further correction which needs to be anticipated rationally.

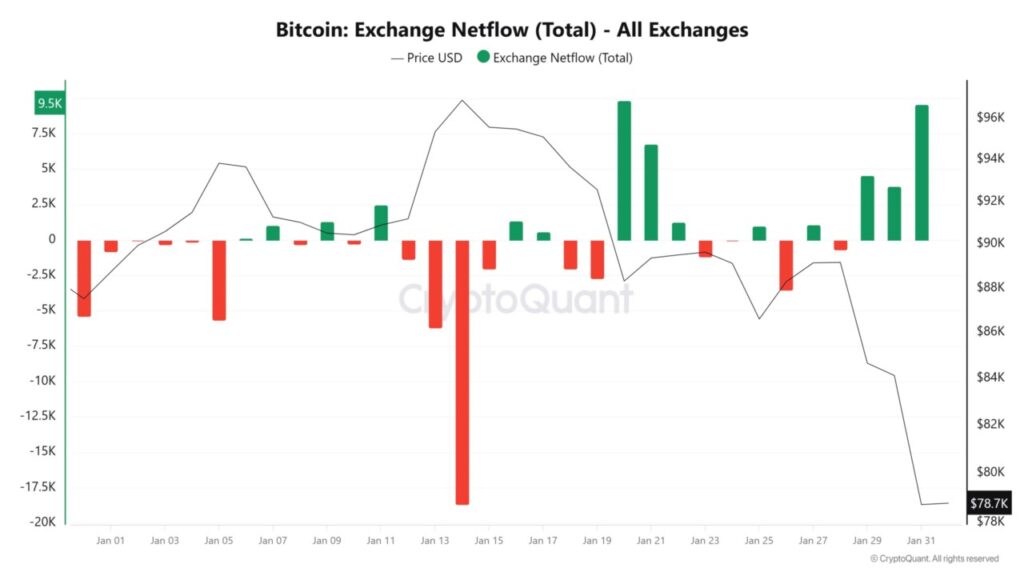

3. On-Chain Indicators and Market Sentiment

On-chain data shows that some short-term holders started realizing profits around this level. The phenomenon is common when cryptocurrency prices approach resistance or historically significant areas.

On the other hand, long-term holders are still relatively passive, indicating confidence in the fundamentals of Bitcoin (BTC) as a major crypto asset. The combination of these two behaviors creates a more stable market dynamic compared to previous cycles.

4. Implications for Beginners and Young Investors

For young investors, these moves serve as an important example that cryptocurrency volatility is not always synonymous with extreme speculation. Technical analysis and historical data remain key tools in understanding the direction of the crypto market in a more measured way.

A neutral, data-driven approach helps investors avoid the emotional decisions that often arise when Bitcoin (BTC) prices are at high levels. As such, understanding the market structure becomes more relevant than simply following short-term trends.

Also Read: Michael Saylor aims to buy Bitcoin when BTC drops to USD 78,000!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMBCrypto. Bitcoin hits April 2025 levels: $85K bounce for BTC possible if… Accessed February 3, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.