Dollar-backed stablecoins are the “hidden weapon” of 2026: Start collecting USDT?

Jakarta, Pintu News – A stablecoin is a type of cryptocurrency designed to keep its value stable against a specific asset, usually fiat such as the US dollar (USD) or another asset as collateral. Stablecoins pegged to USD act not only as a medium of exchange in the crypto ecosystem, but also influence broader economic dynamics.

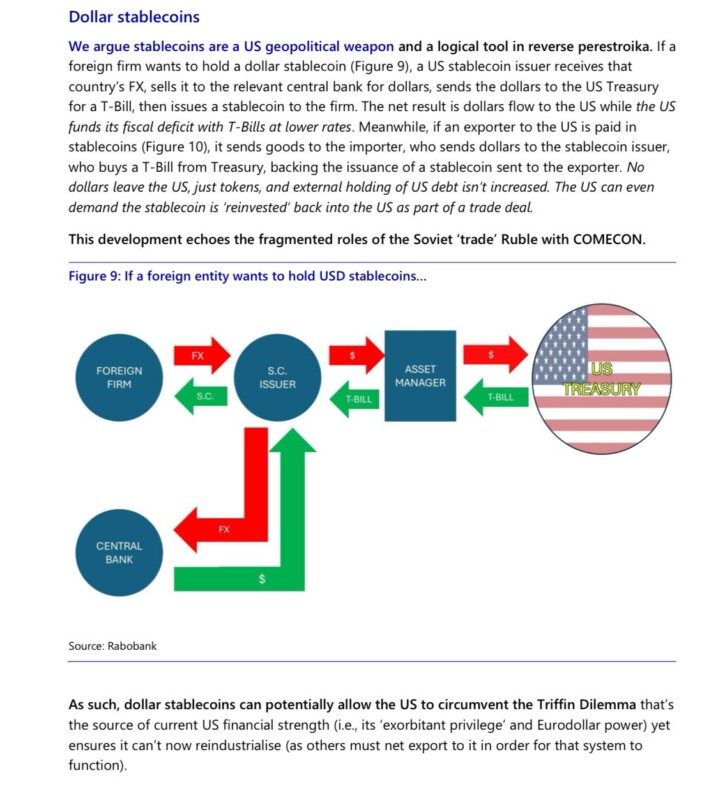

According to the Rabobank report cited, when companies from overseas want dollar-based stablecoins, issuers in the US will respond to this demand by buying USTreasury bills. This capital flow back to the US government and helps finance the fiscal deficit at relatively low interest rates, while those requesting the stablecoin only receive digital tokens without the need to transfer physical dollars.

This model allows the export of digital “American dollar leverage” as stablecoin tokens move between countries without real dollars moving out of reserves. This scheme is similar to the mechanism that once occurred in certain internal currency systems, but here it is done through a cross-border blockchain network.

Global Stablecoin Distribution Changes

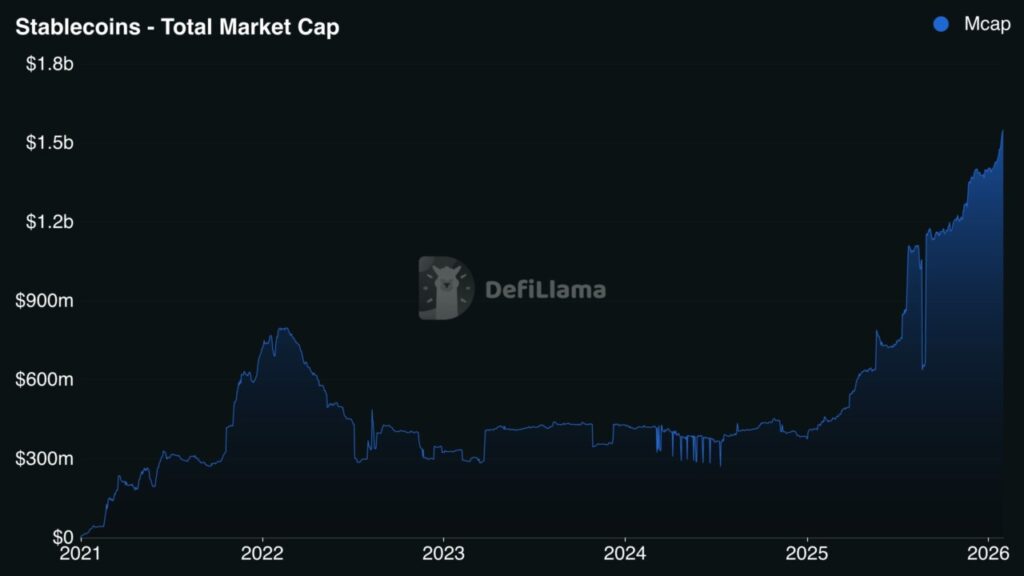

Although more than 99 percent of stablecoins have historically been pegged to the US dollar, marginal trends suggest that non-USD stablecoins are experiencing significant growth. The total supply of non-USD stablecoins is increasing sharply, signaling a growing interest in stablecoin types other than those directly linked to the American dollar.

This growth is relevant as most stablecoins are still dominant in the global market, but the diversification indicates changing preferences or needs across different economic ecosystems. It also reflects a small but significant shift in the structure of global crypto liquidity.

Also Read: 5 BTC History Facts February often bounces back after January slump!

Stablecoin Payment Growth Through Crypto Card

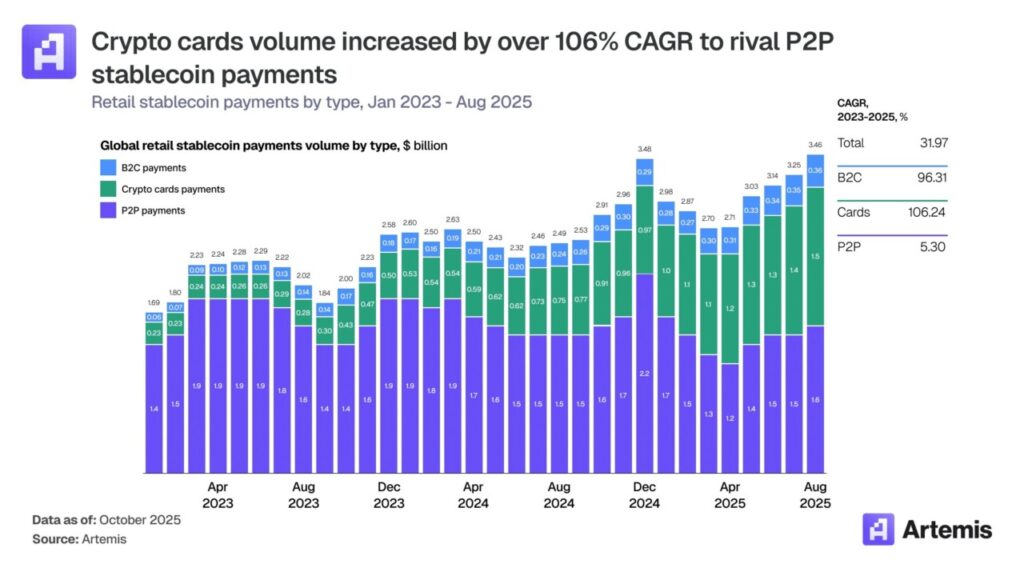

The growth of stablecoins is not only seen in the macro dimension or long-term mechanisms, but also in everyday use. One of the biggest modes of payment that is now growing fast is the use of crypto cards, which are payment cards backed by stablecoins.

According to the referenced data, the crypto cards market has reached a value of about 18 billion USD (equivalent to about Rp302 trillion assuming 1 USD = Rp16,788). The monthly transaction volume through this mode jumped by more than 100 percent per year, from around 100 million USD to more than 1.5 billion USD in that particular period.

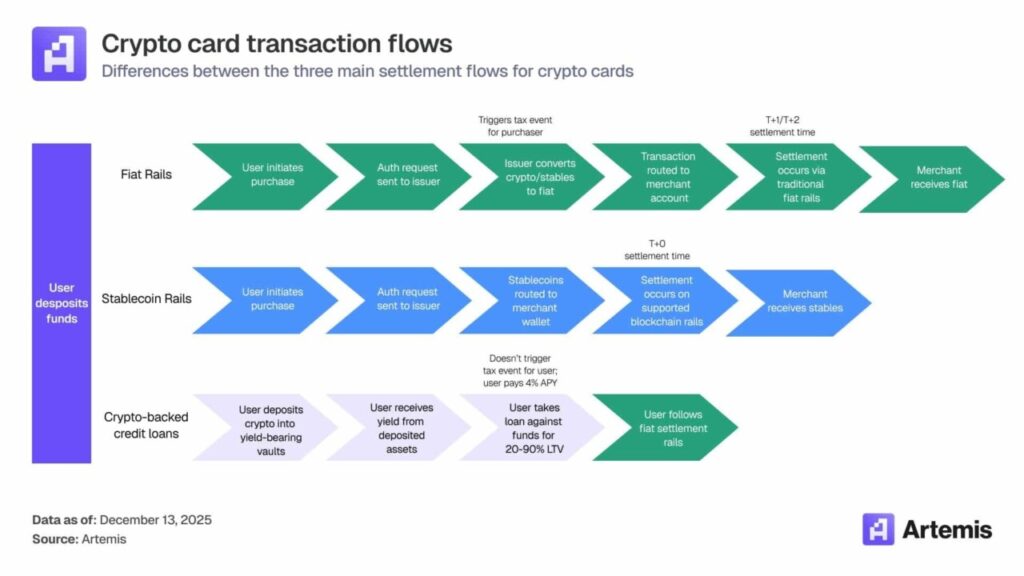

It’s worth noting that these crypto cards work on top of traditional payment networks like Visa and Mastercard. Stablecoins do not replace the main infrastructure of the card network, but work in the background to provide liquidity for the digital tokens used in the transaction settlement process.

Implications for the Economy and Crypto Dynamics

The fact that dollar-backed stablecoins can extend the influence of the US dollar without moving physical dollars demonstrates the complex relationship between blockchain technology and global monetary policy. Stablecoins are now a tool with the potential to influence capital flows and fiscal financing, especially when used cross-border.

The use of stablecoins in payments, such as through crypto cards, puts these crypto assets in a broader role than just a trading vehicle or speculative investment. Stablecoins are rapidly moving from niche DeFi to being part of the larger digital finance infrastructure and being used more frequently by mainstream users.

In general, an understanding of stablecoins that goes beyond the basic function of stable value suggests that this type of cryptocurrency is increasingly integrating with the mainstream economic system, both in terms of user micro-scale and macroeconomic implications.

Also Read: Michael Saylor aims to buy Bitcoin when BTC drops to USD 78,000!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Samyukhtha L KM/AMBCrypto. THIS is the stablecoin power angle that nobody is talking about. Accessed February 3, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.