Dogecoin Holds Near $0.10 as Prices Attempt a Rebound from Oversold Levels

Jakarta, Pintu News – The price of Dogecoin (DOGE) stabilized at $0.106 on Tuesday (3/2), after experiencing a slight recovery the day before following a major correction last week.

On-chain data suggests that the dog-themed meme coin may be below its fair value and has the potential to rise in the near future. However, the overall technical structure still shows a bearish trend, so traders should remain cautious.

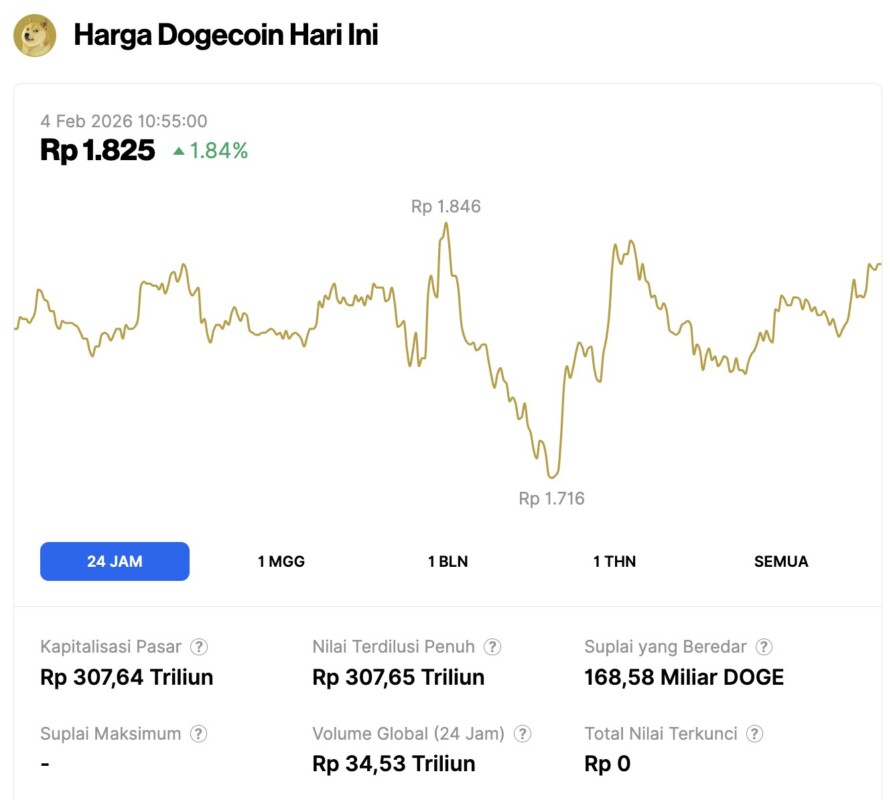

Dogecoin Price Rises 1.84% in 24 Hours

On February 4, 2026, Dogecoin saw a 1.84% gain over the previous 24 hours, trading at $0.1087, which is approximately IDR 1,825. During that time, DOGE fluctuated between IDR 1,846 and IDR 1,716.

At the time of writing, Dogecoin holds a market capitalization of roughly IDR 307.64 trillion, with a 24-hour trading volume of around IDR 34.53 trillion.

Read also: Ethereum Price Plunges to $2,200: Are Whale Addresses Sending ETH to Binance?

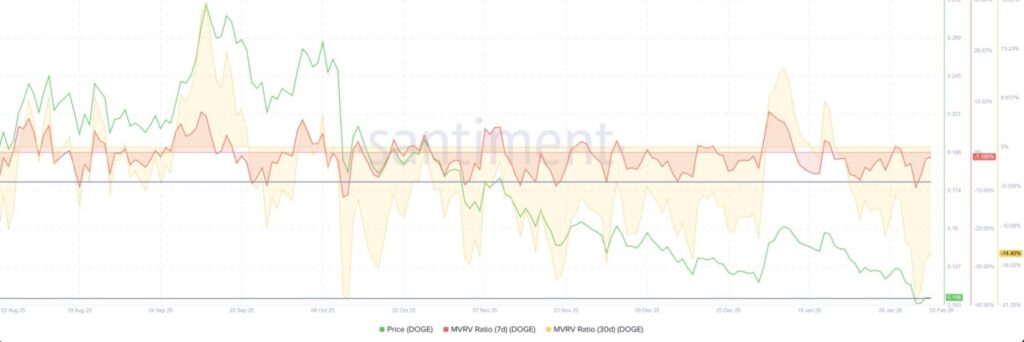

Dogecoin Shows Signs of Being Below Fair Value

Santiment’s Market Value to Realized Value (MVRV) method is used to determine whether a token is below or above its fair value over a period of time.

For Dogecoin (DOGE), the 30-day MVRV ratio (yellow line) stood at -14.40% on Tuesday, improving from -20.80% on Saturday. This is similar to the level last seen in the October 2025 market correction triggered by the US-China trade war.

Over the same period, DOGE’s 7-day MVRV (red line) stood at -1.16% on Tuesday, up from -8.52% on Saturday-also on par with the level during that October crash.

This negative MVRV reading indicates that Dogecoin is currently undervalued, as token holders have unrealized losses. Such a situation is often considered a potential buy signal and usually triggers increased buying pressure across exchanges.

Historically, when MVRV DOGE hits similar levels, the price tends to experience a recovery in the short term.

In terms of derivatives data, Dogecoin’s long-to-short ratio on Coinglass stood at 1.02 on Tuesday. A ratio above 1 indicates that the majority of traders expect the price to rise-a factor that could support DOGE’s recovery.

Dogecoin Price Prediction: DOGE Rises from Oversold Region

The Dogecoin price closed below the weekly support level of $0.119 on Thursday and fell more than 11% in the following two days, until retesting the October 10 low of $0.095 on Saturday. The DOGE price then saw a slight recovery through Monday, and on Tuesday, DOGE was trading at $0.106.

Read also: Bitcoin Slides Back to $76,000: What’s Next for BTC?r BTC?

If Dogecoin’s recovery continues, the price could potentially climb back towards the weekly support level of $0.119.

However, the main trend of DOGE is still bearish, so any short-term recovery is most likely just a dead-cat bounce – a momentary price increase within a larger downward trend.

The Relative Strength Index (RSI) indicator currently stands at 31, slightly recovering from the oversold zone and signaling a possible short-term price bounce, although downside risks remain.

Meanwhile, the MACD (Moving Average Convergence Divergence) indicator has been showing a bearish crossover since January 17 and still persists today, which reinforces the negative view on the price movement.

If DOGE resumes its downtrend, the price could drop again towards the $0.095 level from October 10th. If the price closes below that level, the downside potential could continue until the next weekly support at $0.078.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Dogecoin Price Forecast: DOGE steadies at $0.10 recovery hopes amid bearish trend. Accessed on February 4, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.