3 Altcoins Are Quietly Moving Strongly in February 2026

Jakarta, Pintu News – Major pressure hit the crypto market again in late January 2026 after a massive sell-off sparked concerns about leverage, liquidity, and exchange stability. The conditions are reminiscent of last October’s massive sell-off that helped drag down sentiment towards Binance and its ecosystem.

Amidst renewed criticism, investors’ attention is starting to turn to how Binance ecosystem tokens are holding up under pressure. Price movements and on-chain data are now important indicators to assess whether market confidence is recovering or continuing to erode in the global cryptocurrency market.

PancakeSwap (CAKE)

PancakeSwap (CAKE) is the largest decentralized exchange on the BNB Chain network and one of the most representative tokens in the Binance ecosystem. Although it has now expanded to other blockchains, CAKE still has a strong attachment to the Binance sentiment as it is primarily based on the network.

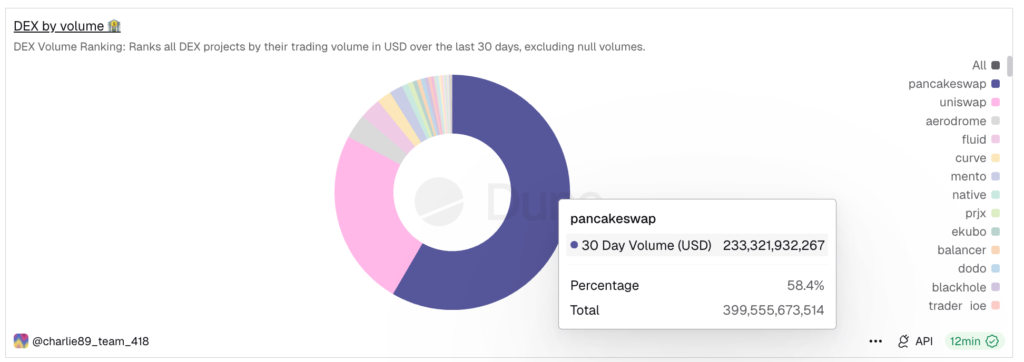

Amid criticism of Binance and the January crypto market turmoil, PancakeSwap still dominates decentralized trading activity. In the past 30 days, the platform controlled around 58.4% of global DEX volume, far surpassing its closest competitor.

On-chain data shows indications of consistent accumulation on CAKE. In the last 24 hours, the 100 largest addresses increased their holdings by about 1.79%, while CAKE’s balance on exchanges fell by almost 23.4%. This indicates that large investors, and possibly retail investors, are starting to secure positions off-exchange.

From a technical perspective, CAKE faces major resistance in the range of US$1.59 or around Rp26,650, with potential upside to the Rp31,500 to Rp33,500 area if the level is convincingly broken.

Read also: 3 Token Unlock in Early February 2026, Red Market Alert?

Aster (ASTER)

Among Binance ecosystem tokens, Aster (ASTER) stands out due to its strong association with Binance founding figure Changpeng Zhao. The decentralized trading platform operates intensively on BNB Chain and has the backing of YZi Labs as well as a number of executives with historical ties to Binance.

Despite negative sentiment returning to the fore after the late January market crash, ASTER has quietly attracted the interest of large investors. In the past seven days, whale holdings increased by about 21.61%, although public figure wallets reduced exposure.

ASTER’s price movement confirmed the accumulation pattern. After bottoming out in late January, ASTER’s price rebounded nearly 18% as the general cryptocurrency market stabilized.

Technically, a bullish divergence was formed on the daily chart, where the price printed a lower low while the RSI indicator formed a higher low. To maintain the trend reversal structure, ASTER needs to break the US$0.72 level or around IDR12,070, with further potential towards the IDR17,800 to IDR23,500 area if momentum continues.

Read also: 6 Important Facts Behind the MSCI Stock Market Warning that Shook the Indonesian Stock Exchange

BNB (BNB)

BNB (BNB) remains the most crucial token in the Binance ecosystem due to its function as the primary utility asset for transaction fees, staking, and network activity. As the native token of Binance and BNB Chain, BNB is highly sensitive to changes in sentiment towards the exchange.

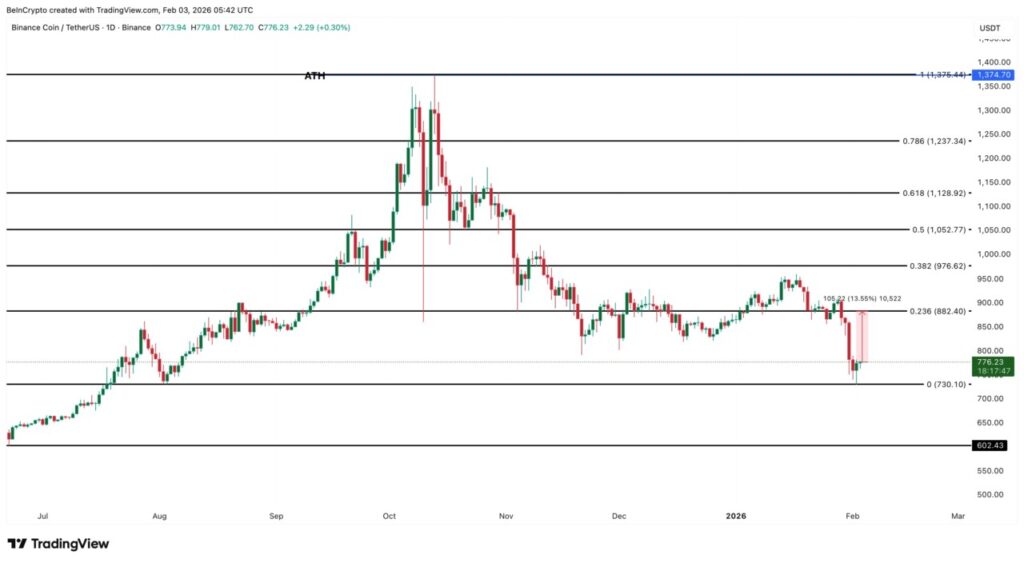

In the past month, the BNB price has fallen by around 12% and is now trading at around US$776, well below its peak last October. Overall, BNB is still around 43% below its record high.

Nevertheless, BNB’s long-term performance is still relatively solid compared to other major cryptocurrencies. On an annualized basis, BNB is still recording gains of around 26%, outperforming Bitcoin (BTC) and Ethereum (ETH). The main challenge currently comes from weakening social sentiment, with positive sentiment scores dropping to a six-month low.

From a technical perspective, the US$730 area or around Rp12.24 million is crucial support, while the nearest resistance is in the range of Rp14.79 million which needs to be broken to restore market confidence.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Binance Ecosystem Tokens To Watch In February 2026. Accessed February 7, 2026

- Featured image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.