Ethereum Under Pressure as Vitalik Buterin Moves 5,493 ETH and Trend Research Dumps 20,000 More

Jakarta, Pintu News – Ethereum (ETH) is facing increased selling pressure today as investors weigh whether to buy on the dip or continue selling after the crypto market crash.

This decline came as increased ETH selling activity on the network, including by Ethereum co-founder Vitalik Buterin, and also by Trend Research, reinforced the negative sentiment in the market.

Ethereum Founder Vitalik Buterin Sells His ETH

Vitalik Buterin, the creator of Ethereum, has sold another portion of his ETH holdings. According to a Lookonchain report on February 3, he sold 493 ETH worth about $1.16 million. This sale comes after previously selling 211.84 ETH for 500,000 USDC.

Read also: Ethereum Price Plunges to $2,200: Are Whale Addresses Sending ETH to Binance?

On-chain data also shows that Buterin converted more than 5,000 ETH into WETH. This move was likely in preparation for further sales, aimed at supporting the Ethereum ecosystem. Although the amount is not large, the timing of this sale-which coincided with the crypto market crash-has sparked panic among investors.

Vitalik Buterin himself confirmed that he withdrew 16,384 ETH to fund open-source projects focused on security, privacy, and thorough verification technologies, as part of the Ethereum Foundation’s “light retrenchment” phase.

The funds will be allocated gradually over the next few years, rather than sold all at once, to avoid concerns of short-term volatility.

Trend Research continues to offload ETH holdings

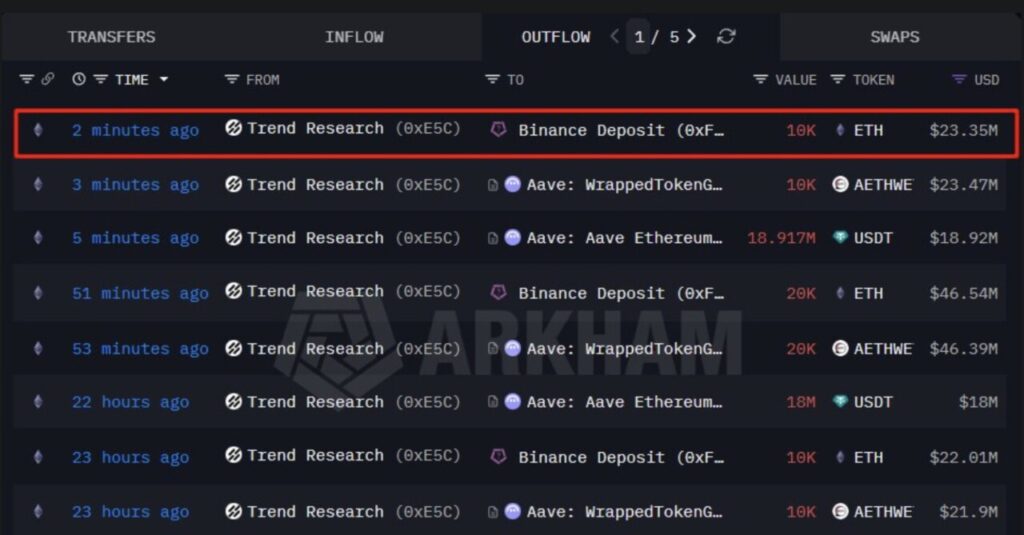

In addition, Trend Research today deposited 30,000 ETH into Binance, further adding to the selling pressure against Ethereum.

Based on data from Onchain Lens, the company has sold a total of 93,588 ETH in recent days for the purposes of selling and repaying loans related to their leverage position.

Blockchain intelligence platform Arkham revealed that Jack Yi’s Trend Research suffered a loss of $400 million. The Ethereum whale started selling massive amounts of ETH to Binance to avoid liquidation. Their ETH exposure is now down to $1.33 billion from nearly $2 billion last month.

Notably, the liquidation price range for Trend Research’s holdings is between $1,781 and $1,862.

Read also: Dogecoin Holds Near $0.10 as Prices Attempt a Rebound from Oversold Levels

Ethereum price drops after rebounding more than 6%

The price of Ethereum has fallen again after rising by more than 6%, and is now trading at around $2,320. The increase came thanks to buying when the price fell by traders and whales.

Interestingly, Singaporean bank DBS Bank has accumulated 24,898 ETH in just one week when the price of Ethereum plummeted more than 30% to below $2,200.

In the past 24 hours, the lowest price of ETH was recorded at $2,158, and the highest at $2,393. However, trading volume fell by 15% over the same period, signaling a decline in trader interest. To confirm the uptrend, Ethereum price needs to hold above the 200-week moving average again, which is at $2,451.

Crypto analyst Daan Crypto Trades noted that the ETH/BTC pair failed to defend the 0.032 level. He mentioned that bearish sentiment has increased since the whale that was active on October 10 suffered a loss of $110 million in one day.

He estimates that the level range of 0.026 to 0.03 is an important area to watch.

Meanwhile, data from CoinGlass shows that there has been selling activity in the derivatives market in recent hours. Currently, the total open interest (active futures contracts) for ETH futures fell by almost 1% to $28.16 billion in the last 4 hours. Open interest for XRP futures has also decreased by almost 1% on CME and 0.40% on Binance, reflecting the recent increased selling pressure.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery. Accessed on February 4, 2026

- Coingape. Ethereum Slips as Vitalik Buterin Moves 5,493 ETH, Trend Research Dumps 20K ETH. Accessed on February 4, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.