3 reasons Dogecoin (DOGE) is still being watched by investors in 2026

Jakarta, Pintu News – The crypto market continues to attract the attention of investors, including assets that were initially seen as meme coins such as Dogecoin (DOGE). In 2026, the discussion about DOGE is not only about price but also technical aspects such as cloud mining and real returns that can influence investment decisions. Recent analysis shows a number of factors that keep DOGE relevant despite short-term price pressure.

1. Dogecoin (DOGE) and Cloud Mining: What’s the Relationship?

Cloud mining is a method of mining crypto assets without having to own the hardware, allowing investors to “rent” computing power. In the context of Dogecoin (DOGE), this concept is attractive because mining DOGE traditionally requires electricity and specialized equipment. Cloud mining provides the possibility of real returns with more controllable operational costs, especially for investors who are not ready to invest in their own infrastructure.

From an investor’s perspective, cloud mining can help reduce the entry barrier to mining DOGE. The real return from this activity lies in the difference between the service fee and the value of DOGE generated. However, its effectiveness depends on the price of DOGE in the market, which requires regular price monitoring.

2. DOGE still attractive despite weakening price

Dogecoin (DOGE) often experiences sharp fluctuations due to its sensitive nature to market sentiment. The price of DOGE sometimes drops significantly when the broad crypto market goes down, but this also opens up buying opportunities during “market discounts”. These volatile price movements make DOGE a frequent concern for short-term investors.

According to some market analysts, the price drop could take DOGE into accumulation territory with a potential rebound when sentiment recovers. For risk-savvy investors, the down phase could be a strategic moment. However, it is important to understand that high volatility can also have a negative impact without proper risk management.

3. DOGE in 2026: The Role of Sentiment and Adoption

Dogecoin differs from many other cryptocurrencies in that its role is more closely tied to community and digital cultural narratives than pure technical utility. This makes DOGE often influenced by community sentiment, such as public figure endorsements or social media trends. Such sentiment can be a catalyst for price increases or decreases in the short term.

In the long run, the adoption of DOGE as a means of payment or part of an app ecosystem could expand its utility. However, investors need to understand that this utility is still far from mass adoption like blockchain networks that support smart contracts. A realistic approach to DOGE’s long-term prospects helps temper overly optimistic expectations.

4. Basic Strategy for Dealing with Dogecoin Volatility

Investments in DOGE should consider two main aspects: market volatility and personal investment objectives. In a basic strategy, gradual purchases with disciplined risk management are often recommended. This approach helps limit the impact of sharp price fluctuations on the total crypto portfolio.

In addition, investors need to do primary research on the mining mechanism, the cost of cloud mining services, and the liquidity of the market where DOGE is traded. By understanding these elements, investment decisions become more scalable. Education on technical mechanisms and fundamental factors remains necessary to deal with the dynamics of the crypto market.

5. DOGE at the Center of Global Crypto Market Flow 2026

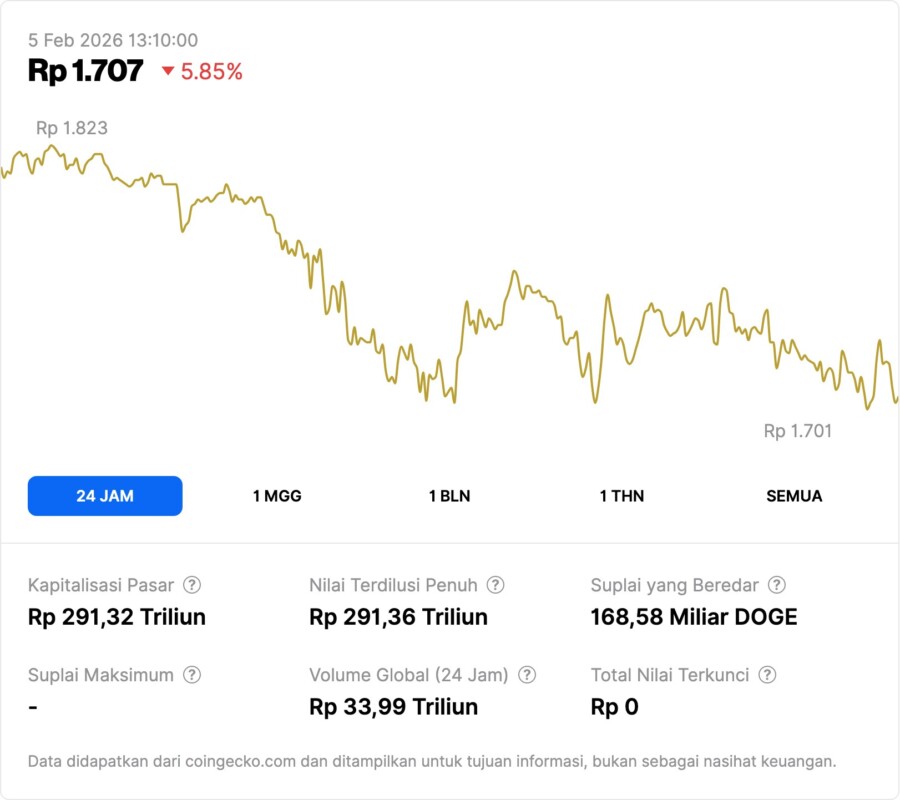

The cryptocurrency market as a whole continues to show significant volatility, driven by global macroeconomic factors and changes in investor sentiment. Within that ecosystem, DOGE acts as a high-risk asset yet remains attractive to some investors due to its volatility. Small price changes can have a big impact when combined with the conversion of value to rupiah; for example, if DOGE is trading at around USD 0.10, it is worth around Rp1,681 per coin at an exchange rate of 1 USD = Rp16,812.

For novice investors or those who want to understand the potential of DOGE more deeply, a combination of technical analysis, market sentiment, and cloud mining fees are important elements. Risks remain, but a thorough understanding can help create a strategy that is better prepared for the fluctuations of 2026.

Also Read: 4 Shocking Facts about Bitcoin Breaking Rp1.42 Billion: Similar to BTC April 2025 Technical Signal!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- NewsBTC. Is Dogecoin Still Worth Investing In?DOGE Rally Sparks Debate Over Long-Term Value. Accessed February 4, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.