What’s Driving Today’s Crypto Sell-Off?

Jakarta, Pintu News – The price of Bitcoin (BTC) suffered one of the biggest daily declines in years, a sharp drop not seen since the FTX collapse. The largest crypto asset plummeted to an intraday low near $60,000, touching that level for the first time since October 2024 and erasing all gains made after the US presidential election.

This downward pressure quickly spread across the crypto market. Ethereum (ETH) dropped below $1,800, while Solana (SOL) fell below $70 for the first time since December 2023. Dogecoin (DOGE) also fell below the $0.10 mark, reinforcing the risk-aversion sentiment and triggering panic especially in tokens that are in high demand by retail investors.

With important support levels now broken across major assets, traders are beginning to question whether the crypto market – including Bitcoin – has truly exited its correction phase and entered into a full-blown bear market phase.

Market sentiment changes drastically after failing to break $100,000

Ever since Bitcoin failed to break the psychological $100,000 level and instead reversed course, market sentiment has changed significantly. Both retail and institutional investors have become more cautious, with confidence levels declining faster than in previous corrections.

Read also: A Bloomberg Analyst Explains Why Bitcoin Could Drop Back to $10,000

Unlike previous market crashes – which were triggered by major events such as the ICO bubble, the liquidity crisis due to COVID-19, the collapse of the Terra ecosystem, or the FTX bankruptcy – this one was not caused by one specific major event.

Rather, the downturn reflected a technical breakdown in the market structure, exacerbated by the weakening confidence of market participants and a decline in risk appetite.

Large-scale Liquidation of Long Positions

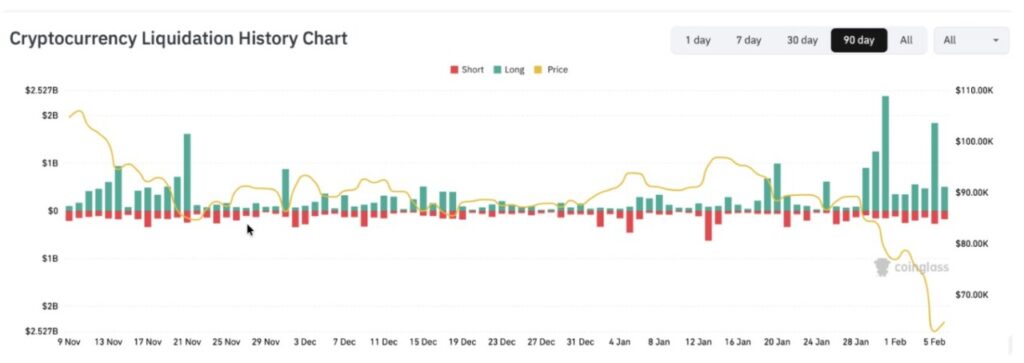

Over the past few days, the crypto market has been under intense pressure, with liquidation values repeatedly breaking the $1.5 to $2 billion mark. The latest drop hit the market particularly hard, with over $1.85 billion of long positions being liquidated, making it the second largest liquidation event of 2026, after the $2.4 billion event on January 31.

The impact was widespread and painful: more than 500,000 traders were forced out of their positions, as leverage collapsed across multiple platforms. The largest single liquidation occurred on Binance – a Bitcoin long position worth over $12 million – showing that even the big players are not immune to market pressure this time around.

Bitcoin Breaks Key Technical Support Level

Bitcoin’s price drop to $60,000 was mainly due to a technical breakdown, rather than any surprising news. The correction deepened after BTC failed to defend the $65,000-$62,000 support zone, which had previously resisted selling pressure several times in recent weeks.

Read also: XRP Drops to 14-Month Low of $1.42, Liquidity Crisis Triggers Downward Pressure on Prices

Once Bitcoin dropped below $62,000, the various stop-losses that had accumulated in the area were immediately triggered, rapidly increasing selling pressure. This paved the way to the next liquidity zone around $60,000, which was the point where prices temporarily stabilized.

This decline was further confirmed when BTC fell below important trend indicators, such as the 50-day and 100-day moving averages. Missing these levels saw them turn into new areas of resistance, reinforcing the bearish outlook among short-term and institutional traders.

Lack of Purchases on the Way Down: Why are Buyers Staying Away?

One of the striking things about Bitcoin’s drop to $60,000 was the lack of response from buyers. When the price broke through the $65,000-$62,000 support zone, there was no major buying, unlike the previous correction.

Any short-term bounce was immediately sold back, showing that traders were more focused on reducing risk than opening new positions.

With high volatility and massive liquidations continuing to occur, many market participants have opted to wait on the sidelines, waiting for clearer signals. This uncertainty makes Bitcoin even more vulnerable, giving sellers room to continue dominating and pushing the price down to the $60,000 range.

Conclusion: Is the Crypto Market Officially in a Bearish Phase?

The recent massive sell-off has definitely changed the mood of the crypto market. Bitcoin losing the $60,000 level, a series of multi-billion dollar liquidations, technical support breaking, and weak buying on price drops – all indicate that this situation is more serious than a simple correction. Investor confidence is weakening, risk appetite is declining, and market participants are no longer aggressively buying when prices fall.

However, declaring that we are officially in a bear market may be premature. A true bearish phase is usually characterized by sustained weakness and repeated failures to recover from key levels, rather than just sharp declines.

Right now, the crypto market is at a critical juncture-it’s no longer in an uptrend (bullish), but it hasn’t completely crashed either. What happens next will be crucial: if Bitcoin fails to reclaim important levels and the selling pressure continues, then this phase could easily turn into a full-fledged bear market.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Crypto Market Crash: $380B Wiped Out as $2.6B Liquidations Push Bitcoin to $60K. What’s Next? Accessed on February 6, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.