23% of Traders Convinced of Fed Rate Cut in March, but Warsh Makes Markets Wary?

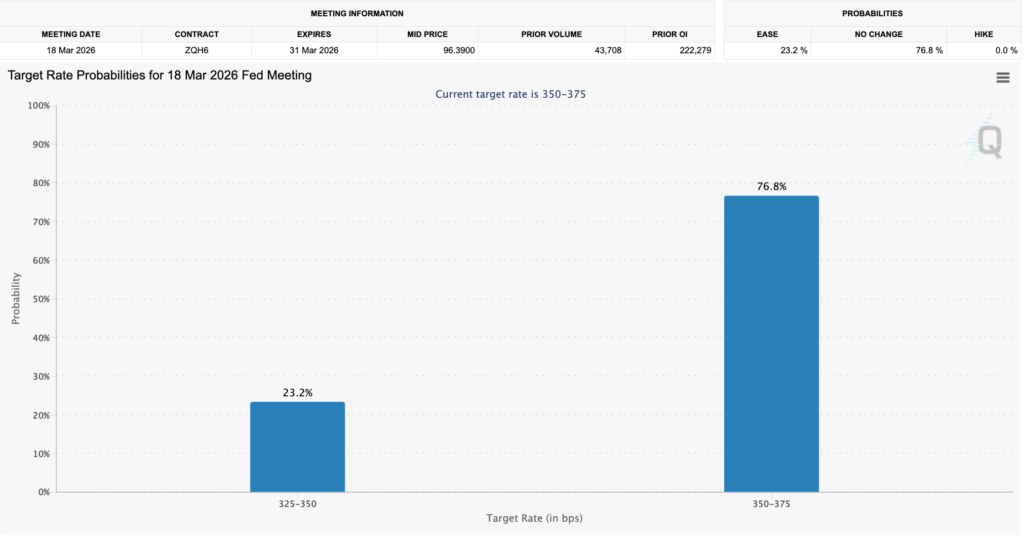

Jakarta, Pintu News – Expectations of an interest rate cut at the March 2026 Federal Open Market Committee (FOMC) meeting have begun to shift, with more than 23% of market participants now expecting the Fed to cut interest.

This shift comes amid concerns that Kevin Warsh, US President Donald Trump’s preferred Fed Chair nominee, will bring more hawkish policies. At the same time, the market is still trying to read the impact of the combination of expectations of limited cuts and potential long-term liquidity tightening on risky assets, including crypto.

Interest Rate Cut Expectations Rise to 23%

Data from CME Group showed that the share of traders predicting an interest rate cut at the March FOMC meeting rose to around 23%. This is an increase of almost 5 percentage points compared to the previous Friday, when only 18.4% of market participants anticipated an interest rate cut.

The majority of market participants expecting a cut estimated the scale of the cut at 25 basis points (bps). There is no significant consensus pointing to a more aggressive cut, such as 50 bps or more.

Although the percentage expectation of a cut has increased, the 23% figure still indicates that the market’s baseline scenario remains interest rates staying at current levels. In other words, market participants do not yet see the Fed making a quick turnaround towards a highly accommodative monetary policy.

Read also: New Era of Crypto: Tom Farley Forecasts a Wave of Large Acquisitions

Kevin Warsh’s Nomination and Liquidity Fears

The appointment of Kevin Warsh as the Fed Chair nominee to replace Jerome Powell, whose term ends in May, has been one of the main sources of market jitters. Analysts consider Warsh to be more hawkish, with the view that the Fed’s balance sheet is currently “trillions larger than necessary”.

Analyst Nic Puckrin attributes the sharp decline in precious metals in late January and early February to the market’s perception of Warsh being pro-high interest rates for longer. Investors’ expectations of an era of cheap liquidity and rapid easing were corrected.

Thomas Perfumo of crypto exchange Kraken rates these macro signals as “mixed”: on the one hand, Warsh’s nomination could signal credit and liquidity stabilization, but on the other hand it breaks expectations of liquidity expansion that crypto market participants had previously anticipated.

Read also: Bitcoin (BTC) Plummets Below US$70,000, Institutions are Crowding the Market?

Implications for Crypto Markets and Risk Assets

Interest rate and liquidity policies play an important role in the price dynamics of crypto assets. Interest rate cuts and liquidity easing are usually seen as positive catalysts as they lower funding costs and encourage investors to seek higher yields in riskier assets.

Conversely, an environment of high interest rates and tightened central bank balance sheets tends to depress asset prices, from stocks to Bitcoin and altcoins. Expectations of limited cuts in March, plus a potential medium-term hawkish stance, keep the strong rally in risk assets potentially on hold.

For the crypto market, the message is not a “new wave of stimulus”, but rather a possible stabilization at relatively high interest rate levels with liquidity not expanding much.

This puts the focus on project fundamentals, institutional inflows, and on-chain dynamics rather than relying solely on the “tailwind” of monetary policy. Investors who previously expected the next bull market to be underpinned by super-accommodative policies need to adjust expectations to a tighter macro landscape.

Conclusion

The rise in March 2026 FOMC rate cut expectations to 23% reflects limited hope that the Fed may begin to ease policy, but far from signaling aggressive easing. The nomination of Kevin Warsh as a Fed Chair candidate adds a new layer of uncertainty regarding the direction of the central bank’s liquidity and balance sheet.

For crypto and risky asset markets, this means an adjustment phase to the reality of high interest rates and more disciplined liquidity, where growth narratives and fundamentals will be more important than simply relying on the “spare tire” of monetary policy.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Over 23% of traders now expect interest rate cut at next FOMC meeting. Accessed February 9, 2026.

- Featured Image: Fortune

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.