5 Facts AAVE Faces IDR78.5 Trillion Pressure from Bitcoin Crypto Shock

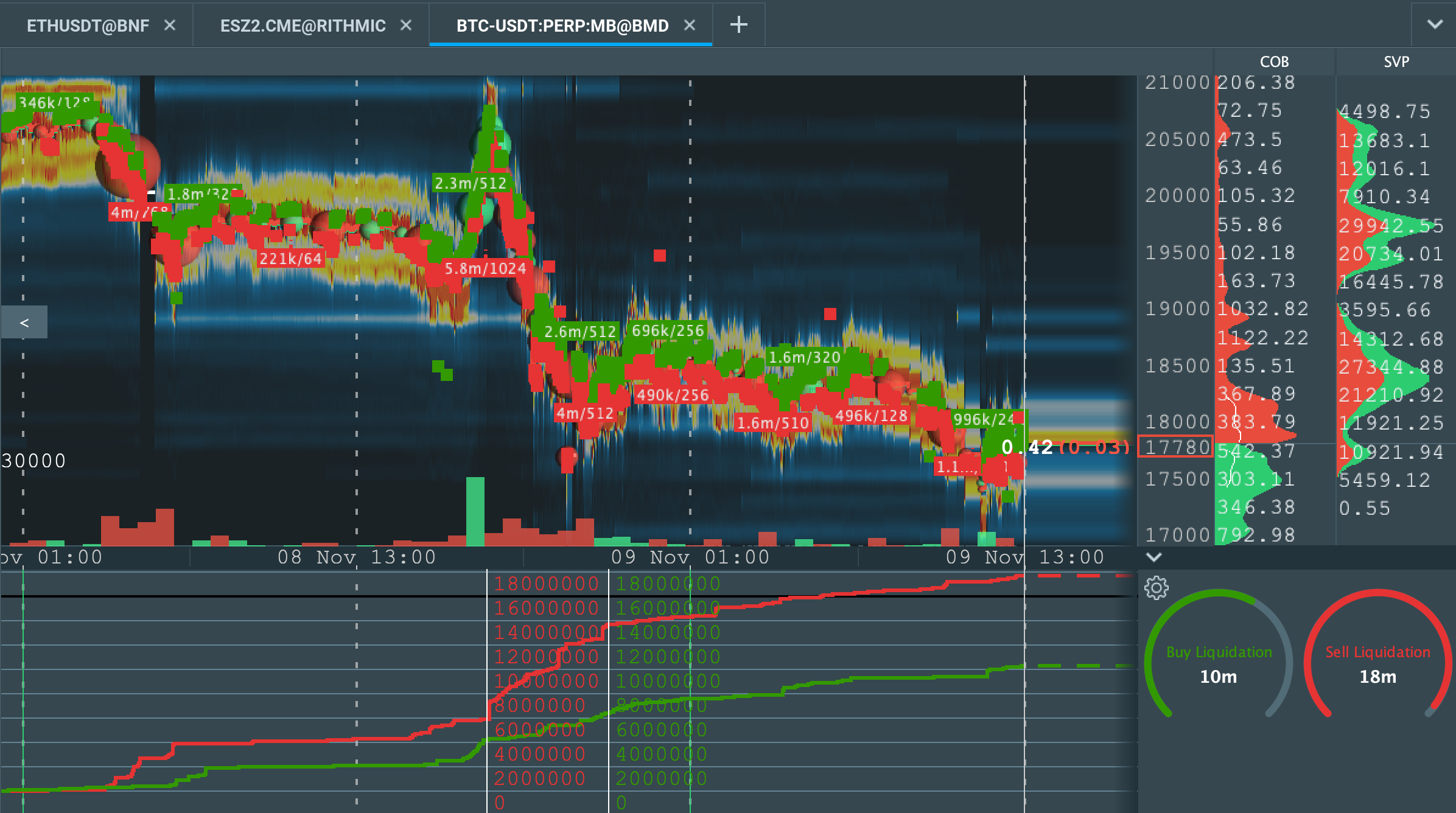

Jakarta, Pintu News – The cryptocurrency market has been rocked yet again after Bitcoin’s (BTC) volatility spike triggered potential major liquidations across various DeFi protocols. One of the most affected was AAVE, a blockchain-based lending platform, which faced asset stress worth around $4.65 billion or Rp78.5 trillion. However, instead of collapsing, AAVE showed its resilience through sophisticated risk management and stress systems.

1. Bitcoin (BTC) turmoil is AAVE’s tough test

When the price of Bitcoin (BTC) plummeted sharply, the domino effect was immediately felt in the DeFi sector. Collateral values declined, triggering a potential massive liquidation at AAVE. However, thanks to an automated risk management system, AAVE managed to withstand the destructive effects of such volatility.

Interestingly, the IDR 78.5 trillion pressure became a sort of “stress test” for the protocol. As a result, the AAVE system continued to function without major disruptions, demonstrating a stability rarely found in other lending platforms in the crypto world.

Also Read: 5 Fun Facts: Bitcoin Often Rebounds in February – Lessons from Historical Data

2. “Stress Engine” Mechanism to the Rescue

AAVE relies on the Stress Engine, a simulation system that tests extreme scenarios such as crypto price crashes. This system allows the development team to predict and prepare mitigation measures before a crisis actually occurs.

In the latest case, Stress Engine monitors the potential impact of Bitcoin liquidation on the AAVE protocol. With real-time calculations, the system ensures that loan positions remain safe and do not trigger a liquidation spiral that damages the cryptocurrency ecosystem.

3. Yields Remain Stable Despite Market Volatility

One of the advantages of AAVE is its ability to keep yields competitive even when the crypto market is in turmoil. When other assets experience a drastic decline, AAVE is still able to provide a relatively stable return for lenders.

This factor keeps AAVE attractive in the eyes of retail investors and users, especially for those looking for investment alternatives beyond direct trading of cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH).

4. Long-term Impact on the DeFi World

The mini-crisis experienced by AAVE is an important lesson for the entire DeFi sector. The use of data-driven stress systems is an urgent need to avoid domino effects in the future.

In addition, trust in AAVE has actually increased after this event. Data transparency, strong governance, and adaptability to market conditions show that DeFi can grow more mature and resilient in the face of global crypto market turmoil.

5. The Future of AAVE and Crypto Ecosystem Adaptation

Going forward, AAVE plans to expand the Stress Engine system to more blockchain assets and networks. This is important to anticipate cross-platform risks, especially as more crypto assets are used as collateral for loans.

With the cryptocurrency market constantly evolving and volatility being part and parcel, adaptive approaches like the one AAVE is implementing could be a new model for security and resilience in the global DeFi ecosystem.

Conclusion

AAVE’s IDR 78.5 trillion stress event was not only a test, but also a proof. Amidst the uncertainty of the crypto market, AAVE showed that innovation and technological readiness can protect the value and trust of users. Investors, both novice and professional, can take away a valuable lesson: in the volatile crypto world, true strength lies in risk management and adaptation.

Also Read: 5 AI Perspectives: Will XRP Fall Below $1 in February 2026?

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMBCrypto. Aave’s $4.65B Stress Engine: From Bitcoin Liquidation Shock to Protocol Yield. Accessed February 9, 2026.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.