3 Reasons Stocks Keep Rising While Crypto Markets Only Consolidate in 2026

Jakarta, Pintu News – Global financial markets at the start of 2026 showed a move away from stocks and digital assets. Major US stock indices continue to set new records, while crypto markets are in a consolidation phase with sentiment and liquidity pressures.

This divergence reflects the different ways investors interpret risk: stocks are positioned as beneficiaries of macro and policy confidence narratives, whereas crypto assets are in a phase of adjusting to structures and expectations.

Crypto Market: High Derivatives Activity, Weakening Price Trend

The overall crypto market capitalization remains below US$2.5 trillion, signaling the absence of a strong uptrend impetus. Bitcoin is still the main anchor with around 58.2% dominance, suggesting that capital tends to be concentrated on large-cap assets and has not been flowing aggressively into higher-risk altcoins. Activity remains brisk, but prices are moving within a narrow range, confirming the “participation without acceleration” phase.

Derivatives data reinforced the picture. Monthly futures volume stood at around US$1.12 billion, surging 102.2% over the previous month, while perpetual volume reached US$1.48 trillion, up 27.37%.

On the other hand, the value of open futures edged down 1.74% to around US$3.6 billion, and perpetual value fell 5.39% to US$563.58 billion. Net inflows into crypto ETFs were around US$309.4 million in the past month, but still negative US$527.83 million on an annualized basis, signaling institutional interest has not fully recovered.

Also read: Silver Jewelry Price Today, Monday February 9, 2026

Sentiment, Community, and Crypto’s Position as a Risk Asset

Despite sluggish prices, the crypto community remains highly active on social media and discussion forums. Thematic narratives, sector rotations, and policy debates are ongoing, suggesting that structural interest has not vanished.

However, this activity has not translated into a strong price push as most market participants prioritize liquidity and capital protection. In the current configuration, crypto acts more as a pro-risk asset sensitive to macro shocks, rather than a defensive hedging instrument.

Market psychology indicators depict conditions of extreme caution. The Crypto Fear & Greed Index is at level 8, which indicates “extreme fear” and often correlates with a phase of waiting for a clearer catalyst.

Volatility tends to be compressed when market participants choose to hold positions rather than chase new trends. In this context, community engagement serves to maintain liquidity and narrative continuity, but not enough to trigger sustained price expansion.

Read also: RWA Perpetuals Explode in 2026, Gold and Silver Are the “New Stars” of Crypto Derivatives?

US Stocks and the Role of the Trust Narrative

In contrast to crypto, the United States stock market recorded strong positive momentum. The Dow Jones Industrial Average broke the 50,000 level for the first time with a gain of around 2%, symbolizing confidence in the economic outlook and policy stability. This rise was driven by broad participation across sectors-from industrials, to financials, to blue chip issuers-so it did not rest on a single growth theme.

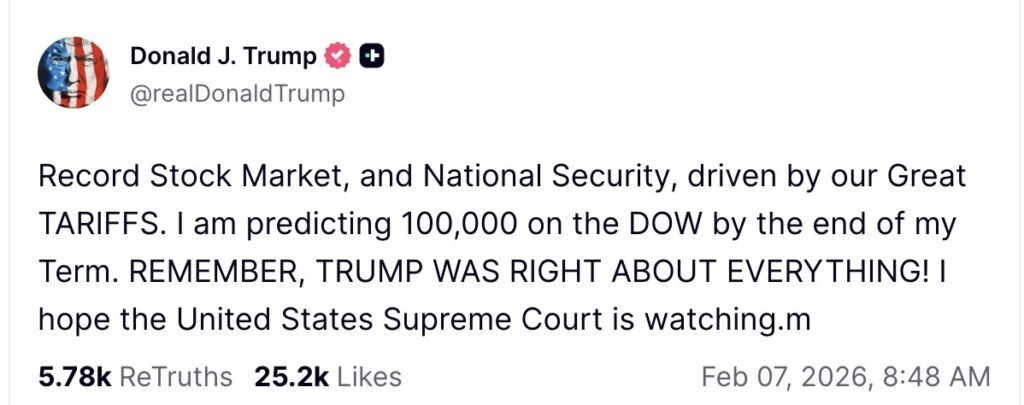

Political narratives have also reinforced this optimism. President Donald Trump publicly celebrated the Dow’s record on Truth Social, attributing the stock market’s performance to tariff policies and national security issues, even projecting the potential for the Dow to reach 100,000 by the end of his term.

For some domestic investors, such messages reinforce the perception that stocks are a reflection of national economic success. In effect, capital allocation to stocks remains heavy even though other assets-including crypto-are undergoing a consolidation phase.

Conclusion

The divergence in direction between stocks and crypto in early 2026 mainly reflects the asymmetry in confidence. US stocks are currently enjoying a “confidence trade” underpinned by a combination of macro data, policy stability, and a pro-market political narrative.

Meanwhile, the crypto market is in an adjustment phase, with high derivatives activity but limited price momentum, and fear-dominated sentiment. Understanding these dynamics demands an analysis that goes beyond price movements alone-encompassing market structure, liquidity flows, and the influence of communities and narratives that increasingly determine how investors interpret risks and opportunities.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coin Edition. Why Stocks Are Rising While Crypto Consolidates in 2026. Accessed February 14, 2026.

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.