Solana Poised for Another Climb? On-Chain Data Highlights Both Opportunities and Risks

Jakarta, Pintu News – Solana (SOL) saw a sharp one-day recovery after being pressured and dropping in price earlier this week. SOL bounced back strongly as the overall crypto market added nearly $200 billion in total capitalization.

Aggressive dip buying managed to prevent a deeper drop, helping Solana stabilize and record a daily gain of around 12% despite continued uncertainty in the market.

Solana’s Long-Term Holders Not Too Bullish Yet

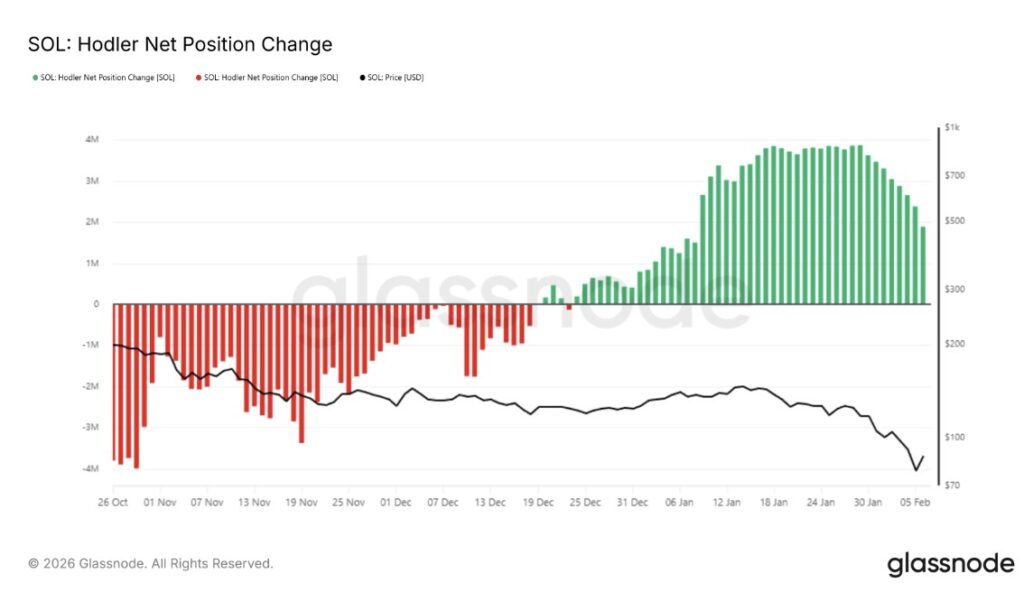

On-chain data shows that the buying momentum of long-term holders is slowing down. The HODLer Net Position Change indicator is seen declining, which means that accumulation from investors who usually support prices during market downturns is now diminishing. This change comes after the SOL’s sharp correction in the past week, which seems to have eroded the long-term confidence of some investors.

Read also: XRP vs Solana: Which Altcoin will Rebound First After Crypto Bear Market?

A sustained recovery will largely depend on whether long-term holders resume their accumulation. If their buying momentum remains weak, Solana could struggle to build solid gains.

Reduced support from this group reduces the market’s ability to absorb selling pressure, increasing the risk that the short-term rally will quickly fade without broader participation from long-term investors.

However, a number of momentum indicators are signaling that the selling pressure may be approaching its saturation point. The Money Flow Index (MFI) is now approaching an oversold area below the 20.0 level. Entering this zone usually signals excessive selling and is often followed by a stabilization phase or short-term price bounce.

Historically, Solana has only entered the oversold area three times in the past two and a half years. Each time it happened, it coincided with a significant price stabilization phase or uptrend reversal. If this indicator drops further, it could help SOL halt the decline and again attract dip-buyers looking to capitalize on the low prices.

SOL price recovery still quite possible

Solana’s price is currently hovering around $88 after rising about 12% on February 7, 2026. Earlier, in the same session, SOL had dropped approximately 13% to touch an intraday low.

Read also: Bitcoin Stumbles, Crypto Futures Trading Volume in Russia Skyrockets!

However, strongdip buying prevented the price from closing near $67, indicating active demand at lower levels.

Support from the overall positive movement of the crypto market has the potential to push SOL through the $90 area in the short term. To confirm a stronger recovery rally, SOL needs to again take the $100 level as support.

If this level is successfully recaptured, it will signal improved momentum and open up the opportunity for an increase towards the area around $110 as market confidence recovers.

However, downside risks remain if selling pressure from long-term holders persists. SOL’s failure to reclaim the $100 level could limit the upside potential and keep the price moving in a narrow range around $90.

In a weaker scenario, the price is likely to correct back to the area around $78. Such a move could potentially invalidate the bullish scenario and extend Solana’s corrective phase.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Will Solana’s Price Recovery Be Challenging? Here’s What On-Chain Signals Suggest. Accessed on February 9, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.