Deposit Interest: Explanation, Calculation, and Benefits

Jakarta, Pintu News – If you’re looking for a safe and hassle-free investment, time deposits are often your first choice. One of the most important things to understand before putting your money in a time deposit is the interest rate-how much return you get, how to calculate it, and how profitable it is compared to regular savings.

In this article, we’ll talk simply about what deposit interest is, the factors that affect it, how to calculate it, and the benefits you can get.

What is Deposit Interest?

Deposit interest is the interest paid by financial institutions to deposit account holders. This can be a certificate of deposit (CD), savings account, or a deposit account for a self-managed pension fund.

Read also: What is a Black Card? How to get it and its benefits!

Quoting Investopedia, the term is similar to “depo rate”, which usually refers to the interest rate paid in the interbank market.

Understanding Deposit Interest Rates

A savings account is an attractive place to keep money for investors who want to:

- Keeping capital principal safe

- Earns fixed interest even if it’s small

- Utilize deposit insurance protection, such as that provided by the Federal Deposit Insurance Corp. (FDIC) and the National Credit Union Administration (NCUA).

In many investment portfolios, there is usually a small portion of funds placed in deposit accounts, as these instruments provide liquidity (easy to withdraw) and keep capital safe.

What is the highest deposit rate in 2026?

Reporting from CNBC Indonesia, at the Board of Governors Meeting (RDG) on December 16-17, 2025, Bank Indonesia (BI) decided to maintain the BI-Rate at 4.75%. In line with that, the Deposit Facility interest rate remains at 3.75% and the Lending Facility is maintained at 5.5%.

Here is a list of deposit rates from various banks in 2026:

- Major commercial banks (BRI, Mandiri, BNI, etc.)

Deposit interest is in the range of ±2.25% – 3% per annum, depending on tenor and amount. - Digital banks & some smaller banks

Many offer interest rates in the range of 3.75% – 7.5% per annum, even:Polylang placeholder do not modify

Important note:

- There is no one official “highest” number because each bank has different promos, tenors, and terms.

- Interest rates that are too high can exceed the LPS guarantee interest limit, meaning that if you go above that level, your savings are not guaranteed by LPS if there is a problem with the bank.

How to Calculate Deposit Interest?

For how to calculate deposit interest, you need to know 3 things first:

- Nominal deposit (principal)

- Interest rate per year

- Length of placement (tenor) – e.g. 1 month, 3 months, 6 months, etc.

In general:

Gross interest = Principal × Annual interest rate × (Tenor in days / 365)

or if you want to keep it simple:

Gross interest ≈ Principal × Annual interest rate × (Tenor in months / 12)

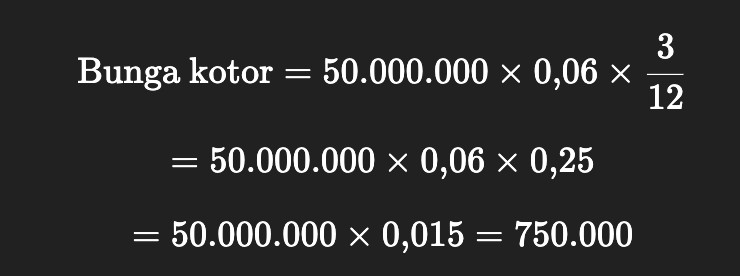

Example: 50 million deposit, 6% interest per year, 3 months tenor

Data:

- Principal = IDR50,000,000

- Interest = 6% per year (0.06)

- Tenor = 3 months → 3/12 years

Calculate the gross interest:

So gross interest for 3 months = Rp750,000

How is a Time Deposit different from a Savings Account?

Initial deposit

Both savings and time deposits require customers to deposit money for the first time (initial deposit). The difference:

- The initial savings deposit is usually lighter. There are savings products that can be opened starting from Rp100,000, depending on each bank’s policy.

- The average initial deposit for time deposits is much larger, around Rp8,000,000.

Interest rate

The next difference is in the interest:

- Savings interest is generally lower than deposits. The amount of interest can also be affected by

:Polylang placeholder do not modify

- Deposit interest rates are usually higher and there is no monthly admin fee. However, when you withdraw your deposit, the interest you receive will be taxed.

Timeframe & flexibility of withdrawal

In terms of time and ease of collecting money:

- Savings accounts don’t have a specific time period, so you can withdraw money at any time without a due date.

- Deposits have a certain tenor (period), such as 1, 3, 6, 12, to 24 months

.Polylang placeholder do not modify

Purpose of use

The final difference is in the customer’s objectives:

- Savings are generally used for short-term needs, such as daily transactions and funds that are often in and out.

- Deposits are more often used as long-term investment instruments, as they are low-risk and one of the safest savings products.

Read also: Google Authenticator: What are its Functions and Benefits?

Are Time Deposits Secured by LPS?

Are time deposits safe? In general, yes, deposits are safe. One of the main reasons is because there is a guarantee from the Deposit Insurance Corporation (LPS).

Reporting from MegaSyariah, LPS guarantees customer deposits up to a certain amount. This means that if something goes wrong with the bank where you keep your money, your funds are still protected. Currently, deposits of up to IDR 2 billion per customer per bank are included in the scope of the LPS guarantee.

In addition, deposits are also safer if the bank is supervised by the Financial Services Authority (OJK). OJK’s role is to ensure that banks operate according to the rules, maintain financial system stability, and protect customers from harmful practices.

Introduction to Deposit Rates and Benefits in 2026

Keeping Money Safe

Deposits allow you to store your money more securely in a depository institution such as a bank. Funds placed in the form of deposits are also guaranteed by the Deposit Insurance Corporation (LPS) up to a maximum of IDR 2 billion per customer per bank.

In addition, the value of the money you keep in a deposit is not affected by market movements or fluctuations. This makes the risk lower, although at the same time, the profit potential is also not as great as aggressive investment instruments.

More Favorable Interest Rates

Compared to regular savings, time deposits generally offer higher interest rates. The amount of deposit interest you receive will be determined by the bank based on the tenor you choose, such as quarterly or annually.

You also don’t have to worry about the interest rate becoming negative, as the interest percentage is fixed from the start and is fixed for the duration of the tenor.

Recurring Income Every Tenor

By saving your money in a time deposit, you can earn regular income from interest at the end of each tenor. Tenor is the storage period agreed between the customer and the bank when opening a deposit, for example 1 month, 3 months, or 12 months.

Through this scheme, you can still enjoy the returns in the form of interest that will be sent to your personal account at every maturity, without having to withdraw the principal every time.

Determinants of Current Deposit Interest Rates

Economic Conditions

The economic condition of a country greatly affects the amount of interest rates on time deposits. When the economy is growing and stable, interest rates tend to be higher. Conversely, when the economy is sluggish or in recession, the central bank usually lowers interest rates to encourage lending and spending, so the yield on deposits can also fall.

Interest Rate & Monetary Policy

The central bank’s decision on monetary policy – reflected through its benchmark interest rates (such as the repo rate) – has a direct impact on deposit rates. If the benchmark interest rate rises, banks’ cost of borrowing funds goes up, so they tend to offer higher deposit rates. If the repo rate goes down, the deposit rate usually goes down.

Inflation Rate

Inflation reduces the purchasing power of money over time. To prevent the value of an investment from being “eaten up by inflation”, ideally the deposit interest rate should be at least close to or above inflation.

As such, banks and financial institutions will take inflation into account when determining deposit rates. Higher inflation usually leads to higher deposit rates to compensate for the decrease in purchasing power.

Demand and Supply of Funds

The high demand for loans also affects deposit rates. When loan demand is high, banks need more funds, so they can offer more attractive deposit rates to attract deposits. When loan demand is low, banks may lower their deposit rates as they have less need for funds.

Bank Liquidity

Banks need to maintain the availability of funds (liquidity) for operations and lending. If banks are in need of funds, they can offer higher deposit rates to attract more customers to place their money there. If their liquidity is already strong, the interest rate offered may be less aggressive.

Government Regulations and Rules

Financial supervisory authorities or institutions can apply certain rules regarding interest rates and deposit products. These rules will affect banks’ room for maneuver in determining deposit interest rates. Banks must comply with applicable regulations when setting interest rates.

Tax Policy

The tax rules on deposit interest will affect the net proceeds you receive.

- Although the interest rate looks high, the real return can be lower after deducting income tax on interest.

- Therefore, when calculating the return on a deposit, it is important to take into account the interest tax as required in the respective country.

LPS Tax Risk and Tips to Maximize Return

When placing funds in a time deposit, you need to understand two things that can affect the end result: the risks associated with the Indonesian Deposit Insurance Corporation (LPS) and interest tax deductions. The Deposit Insurance Corporation (LPS) only guarantees deposits up to a certain limit and under certain conditions, such as a maximum amount per depositor per bank and an interest rate that does not exceed the LPS “guarantee interest”.

If the interest rate you take is far above the guaranteed interest rate, there is a risk that your deposits will no longer be guaranteed if something happens to the bank. On the other hand, any deposit interest will also be subject to final tax, so the return you receive will be smaller than the interest rate stated in the bank brochure.

To keep your return optimal, there are a few things you can do. First, pay attention to the after-tax interest and the LPS guarantee limit, don’t just be tempted by the large gross interest rate.

Secondly, you can spread your funds across multiple deposits or banks to stay within the LPS guarantee limit per bank. Third, choose a tenor that suits your needs-don’t go too long if you need liquidity, so you don’t get penalized if you have to withdraw before maturity.

Finally, regularly compare interest offers between banks and take advantage of promos that are still within the LPS safe corridor. That way, you can maximize your return without neglecting the safety and tax factors.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AU Bank. Factors Affecting Fixed Deposit Returns. Accessed on February 10, 2026

- MAS Bank. The Difference Between Savings and Deposits. Accessed on February 10, 2026

- CNBC Indonesia. List of Latest Deposit Interest Bank Mandiri, BRI & BNI January 12, 2026. Accessed on February 10, 2026

- Investopedia. Deposit Interest Rate: Definition, Fixed Vs. Variable. Accessed on February 10, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.