Dogecoin Price Slips Today as Selling Pressure Mounts and Bears Take Control of the Short-Term Trend

Jakarta, Pintu News – Dogecoin (DOGE) is still struggling to gain momentum as short-term price movements show continued selling pressure.

On the 4-hour chart (10/2), DOGE is moving in a fairly clear bearish structure, characterized by a consistent series of lower highs and lower lows. This pattern confirms that sellers are still in control of the market’s direction.

As a result, any attempted rebound provokes renewed selling pressure instead of being followed by strong buying interest. Currently, market participants are monitoring key technical areas for early signals on whether prices could potentially start to stabilize or continue to fall further.

Dogecoin Price Drops 2.61% in 24 Hours

On February 11, 2026, Dogecoin slipped 2.61% over the past 24 hours, changing hands at $0.09341, which is equivalent to IDR 1,568. During that period, DOGE traded within a range of IDR 1,613 to IDR 1,545.

At the time of writing, Dogecoin’s market capitalization is approximately IDR 263.09 trillion, with a 24-hour trading volume of around IDR 13.84 trillion.

Read also: Dogecoin Meme Coin Price Prediction: Whale Crypto Buys 250 Million DOGE Tokens!

Bearish Structure Limits Recovery Efforts

DOGE is currently trading below all major exponential moving averages (EMAs), which further confirms the ongoing downtrend. Moreover, the EMA array is also in a bearish formation, confirming the still strong downward momentum.

The 200-period EMA in the $0.125-$0.126 area continues to be the upper limit of the price movement, so this zone acts as a crucial level that must be broken to open up a trend change opportunity.

The short-term rebound has not been strong enough so far and failed to break the previous price peak. As such, the upside reflects a technical correction rather than a new accumulation phase.

Sellers are still actively defending the resistance area, so any upside attempts remain on hold. Price rejection around the former support area also signals a weakening of bullish conviction on shorter time frames.

The immediate resistance is in the $0.118-$0.120 range, which previously served as a breakdown area. As long as the price moves below this zone, sellers’ dominance is likely to persist. A broader recovery could only potentially occur if DOGE is able to convincingly break the EMA area around $0.125. Without reclaiming this level, the upside momentum remains fragile.

On the downside, DOGE finds short-term support around $0.112-$0.110, where buyers attempt to contain the downside. However, if this level is broken, selling pressure risks pushing the price down towards $0.105.

Furthermore, the $0.100-$0.098 area is both psychological and structural support if the selling pressure intensifies.

Derivative and Spot Data Indicate Caution

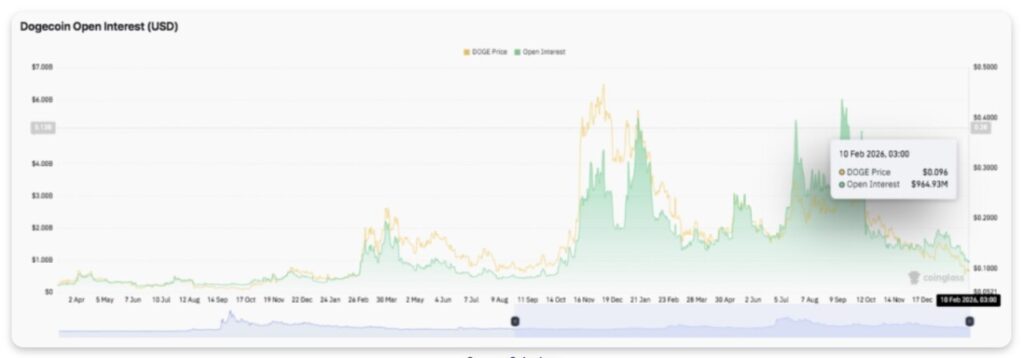

The derivatives data adds one more signal of concern. Dogecoin’s open interest has previously spiked during strong rallies, reflecting high leverage and speculative activity. However, every time open interest has widened, the movement has been followed by a sharp contraction due to a wave of liquidation.

Currently, the latest open interest value is around $1 billion. As such, the use of leverage appears more restrained and the confidence level of market participants is still weak. Historically, such a shrinking phase often precedes an increase in volatility, although the direction in which it moves later depends largely on the re-entry of new participation.

Read also: Bitcoin Price Hovering at $69,000 Today: BTC Predicted to Reach $150K in 2026?

Spot flow data also supports the cautious view. The majority of the session was still dominated by net outflows, signaling continued distribution pressure. Moreover, sharp spikes in outflows often coincide with price declines, rather than accumulation phases.

Meanwhile, the momentary surge in inflows was not strong enough to change the magnitude of the trend. Hence, market sentiment remains on the defensive as February progresses.

Dogecoin (DOGE) Price Technical Outlook

Dogecoin’s price movement is still tightly organized with it trading in a fairly clear short-term bearish range. On the 4-hour chart (10/2), DOGE continues to form lower highs, so downward pressure is maintained.

The upside level has also been quite firm, with the $0.118-$0.120 area being the initial resistance zone. If the upside push strengthens, the next target is in the range of $0.125-$0.126, where the 200-period EMA limits the price increase and serves as a key level that the bullish camp should reclaim. In case of a confirmed breakout above this EMA, the upside space could potentially widen towards $0.135 and $0.140.

On the downside, the $0.112-$0.110 area is still the immediate support that buyers are seeking to keep the price stable. If this zone is broken cleanly, the risk of a drop towards $0.105 will increase, followed by the $0.100-$0.098 psychological area.

Overall, the current technical structure shows DOGE is still consolidating in a bearish pattern, rather than forming the foundation of a trend reversal.

Will Dogecoin Rise?

Dogecoin’s near-term outlook depends heavily on buyers’ ability to hold $0.110 support long enough for there to be a chance of testing resistance above it.

As long as the price remains below $0.125, the rally is likely to be corrective in nature. However, the narrowing of the range between support and resistance hints at the potential for increased volatility ahead.

If the bullish momentum strengthens accompanied by improved inflows, DOGE could try to recover towards the $0.135 area. However, failure to sustain the $0.110 level opens the risk of a further drop to around $0.100.

For now, DOGE is at an important crossroads zone, where confirmation from price action and fund flow data will determine the next direction.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Dogecoin Price Prediction: DOGE Faces Sustained Pressure as Bears Retain Short-Term Control. Accessed on February 11, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.