Gold Price Prediction: Wells Fargo Now Sees Prices Surging to $63.000 by 2026

Jakarta, Pintu News – Gold was trading at $5,050.28 (IDR 84,768,950) on February 11, up 0.38% in the last 24 hours. The precious metal has shown strength across multiple timeframes: up 3.12% in seven days, 11.98% in the last 30 days, and 22.57% in the last three months.

This positive performance came despite a sharp correction in late January and early February, which triggered a daily decline of around 9%. The price recovery back above the psychological level of $5,000 (IDR83,925,000) signaled the emergence of new momentum after heavy selling pressure.

Volatility Tests Bullish Structure

Gold briefly fell through the $5,000 level last week before quickly turning back up. This movement came after an overheated rally pushed prices into an area that was already considered “too high”. The strengthening of the US dollar came under short-term pressure, but buying interest soon resurfaced.

Read also: Antam Gold Price 5 Gram Today, February 11, 2026

The price briefly stayed in the area of the former breakout level, in the mid-$4,600 (IDR77,211,000) to $4,700 (IDR78,889,500) range, before climbing back up.

This movement pattern shows gold’s resilience amid an intense selling phase. Does its price structure still support the continuation of the uptrend? Recent price action indicates that market participants are still actively defending key levels.

Wells Fargo Raises Projections Significantly

Wells Fargo Investment Institute surprised the market on February 4, 2026 after aggressively raising its end-2026 gold price projection to a range of $6,100 to $6,300 (IDR102,388,500 – IDR105,745,500). This revision is a big jump from the previous forecast of $4,500 to $4,700, equivalent to an increase of about 35% to 40% in one step.

The bank attributed the revision to expectations of lower short-term interest rates as well as an increased need to hedge against policy surprises. They also highlighted continued demand from central banks as one of the key drivers behind the new outlook.

JPMorgan Joins Bullish Camp

JPMorgan expressed a similar view on February 2, projecting gold prices at $6,300 (IDR105,745,500) per ounce by the end of 2026. The bank emphasized that demand remains solid, both from official institutions and private investors, despite recent sharp fluctuations in prices.

Analysts argue that overall macro conditions are still favorable for gold, with medium-term momentum considered to be maintained. According to JPMorgan, diversification efforts away from traditional assets continue to be a key driver of demand. The message is clear: volatility has not been able to shake gold’s structural trend.

Central Banks Continue to Add Gold Reserves

Demand from the official sector remains an anchor for the market. Central banks bought about 230 tons of gold in the fourth quarter, bringing total purchases through 2025 to approximately 863 tons. JPMorgan now expects central banks to add another 800 tons of gold in 2026.

Read also: Gold Price Today, February 11, 2026: Up or Down?

China’s central bank extended its buying trend to 15 consecutive months, with total holdings rising to 74.19 million ounces. This sustained accumulation reflects the continued reserve diversification efforts of major economies.

Investor interest also appears to be strengthening. Holdings of gold-based ETFs increased, while demand for physical gold in the form of bars and coins remained solid. Portfolio allocations to gold widened as investors sought protection from macroeconomic and geopolitical risks.

Analysts emphasize that current demand levels are still well above the historical threshold needed to keep the market tight, even at high price levels. This trend reaffirms gold’s role as a versatile hedging instrument amid uncertain conditions.

Macro Data in the Spotlight

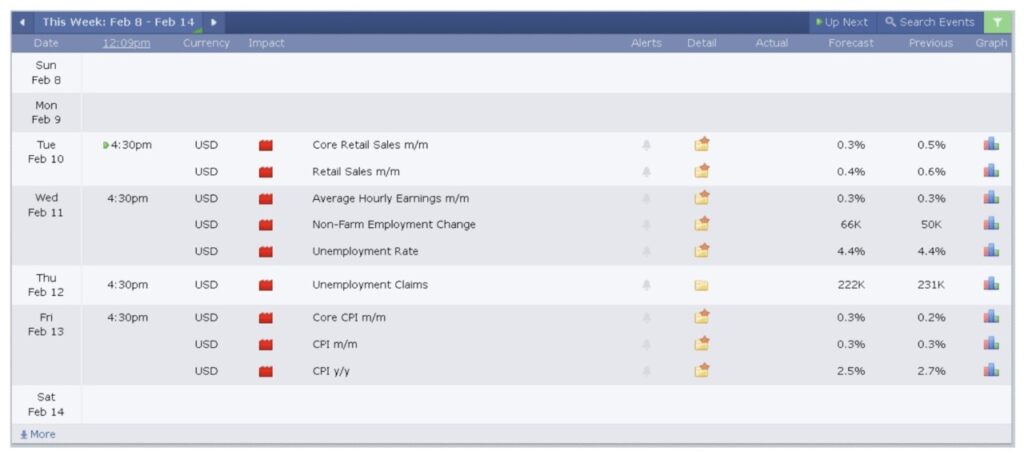

Markets are now shifting focus to key US economic data. This week sees the release of the delayed January Nonfarm Payrolls report on Wednesday, with projections of around 66,000 job additions, followed by the release of Consumer Price Index (CPI) data on Friday.

Both of these data have the potential to shape market expectations of the Federal Reserve’s interest rate policy path going forward – and could trigger increased volatility. For now, gold is still holding above the $5,000 level, while major banks keep signaling that the long-term direction is still upward.

Gold-Based Crypto: When Physical Assets Meet Crypto Technology

As blockchain technology develops, gold can now be owned not only in physical form such as jewelry or bars, but also in digital form through gold-based crypto assets.

One of the most popular is Tether Gold (XAUT), a physical gold-backed ERC-20-based stablecoin, where 1 token represents 1 troy ounce of pure gold. The gold is stored in vaults in Switzerland and each token is directly linked to certified gold bullion. The system uses automated algorithms to efficiently manage the allocation of gold and Ethereum addresses.

XAUt tokens are available and traded on various crypto exchanges. XAUt is also an attractive alternative for those looking to hedge against inflation or global economic uncertainty, while remaining within the digital asset ecosystem.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinapaper. Gold Price Forecast: Wells Fargo Delivers Massive Upgrade, Sees $6,300 by 2026. Accessed on February 11, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.