Bitcoin Falls to Rp1 Billion, Midpoint of Bear Market or Start of Rebound?

Jakarta, Pintu News – Bitcoin’s (BTC) plunge to USD 59,930 or around Rp1,007,783,580 has sparked new speculation in the crypto market. This 32% correction is the deepest since the 2024 halving and is considered by Kaiko Research as a possible “midpoint” of the current bear market. However, some analysts see this level as a potential local bottom. It is debatable whether the cryptocurrency market still has room to fall further.

32% Correction and Four-Year Cycle Pattern

According to Kaiko, the retracement of about 52% from the USD 126,000 peak is still relatively shallow compared to previous cycles. Historically, Bitcoin often drops 60% to 68% before forming a strong bottom. If the pattern repeats, the potential bottom could be in the range of USD 40,000-50,000 or around Rp672,240,000-Rp840,300,000. This suggests the downside risk has not been fully covered.

Spot crypto trading volume on the 10 largest centralized exchanges also fell by about 30%, from USD 1 trillion to USD 700 billion. This decline reflects weakening speculative interest. In previous cycles, a phase of volume weakness often occurred before a new period of accumulation began. This indicates that the market is entering an adjustment phase.

Also read: Signaling the First Bottom in 3 Years? Bitcoin price gives sign that selling pressure is easing

Deleveraging in the Derivatives Market

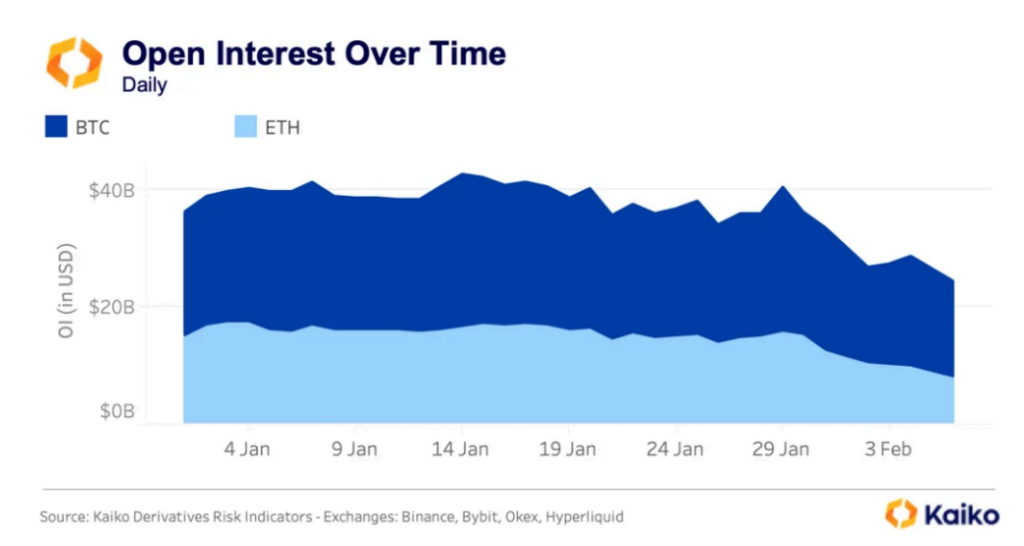

Open interest in Bitcoin and Ethereum (ETH) futures combined fell from USD 29 billion to USD 25 billion in a week. This 14% decline indicates deleveraging or a reduction in risky positions. Typically, this condition arises when market participants choose to be defensive. A reduction in leverage can help relieve excessive selling pressure.

Even so, Bitcoin is still moving within the framework of a four-year halving-based cycle. A number of catalysts that previously drove the rally are still considered relevant. Some analysts even say the discussion of a rebound is now more a matter of time, not probability. However, certainty of direction still requires further technical confirmation.

Read also: 10 Ways to Get Bitcoin for Beginners 2026

Is USD 60,000 Bottom Already?

The USD 60,000 level is close to the 200-week moving average which has historically been a strong support. Some analysts consider this area solid enough to be a local bottom. The Relative Strength Index (RSI) indicator also dropped to its lowest level since 2018 and 2020, signaling oversold conditions. Investor sentiment is also at a very low point.

However, Kaiko thinks the current retracement is still relatively shallow compared to previous cycles. If the pressure continues, additional volatility remains possible. Without new catalysts in the crypto market, price movements could potentially remain volatile. Therefore, confirmation of a trend reversal is not yet fully established.

Conclusion

Bitcoin’s correction to around Rp1 billion triggered two views: the midpoint of a bear market or a local bottom. Volume and derivatives data show weakness, but oversold indicators are starting to appear. In the dynamic cryptocurrency market, the next direction depends on the strength of support and the influx of new demand. Investors need to remain disciplined in managing risk amid uncertainty.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin’s $60K crash may mark halfway point of bear market: Kaiko. Accessed February 12, 2026

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.