PEPE Coin Update: As the Price Plummets, Whales Scoop Up 23 Trillion Tokens – Is a Revival Coming?

Jakarta, Pintu News – Pepe (PEPE), the large-cap meme coin on the Ethereum (ETH) network, has now entered its sixth consecutive week of decline. However, on-chain data shows that accumulation by smart money continues.

As interest in meme coins fades amidst weak market liquidity, the question arises whether PEPE still has a chance to bounce back.

PEPE Whale Wallet Bets on Bullish Reversal

Last month, James Wynn, a well-known trader on Hyperliquid (HYPE) who holds a large PEPE long position, predicted that PEPE’s market capitalization could reach 69 billion dollars by 2026. This prediction came just before the price of PEPE rose sharply. However, two weeks later, he confirmed that he had closed all his positions and sold his entire PEPE holdings.

Read also: Goldman Sachs Cuts Back on Bitcoin and Ethereum as It Ramps Up XRP and Solana Bets

Despite Wynn’s exit, other investors continue to accumulate PEPE. On-chain data from Santiment shows a significant change in behavior among the 100 largest wallets. In the past four months, after the big market sell-off in October, these wallets have accumulated around 23.02 trillion PEPE.

Santiment emphasized that large wallets are often instrumental in reversing altcoin trends and triggering strong price rallies.

“Smart money wallets have played a big role in making altcoins finally reverse course and print big gains. Retail sentiment is currently very bearish towards Pepe and meme coins, but expect coins that are undergoing heavy accumulation to eventually breakout again once Bitcoin can register sustained bullish momentum,” Santiment said.

PEPE Potential to Recover?

Analysts expect PEPE prices to potentially recover in the short term. However, caution is still needed as it is possible that a new local bottom will form before a truly sustainable recovery occurs.

Read also: Dogecoin Price Hovers at $0.09 Today: DOGE Potential for Further Decline?

PEPE’s recovery seems to be supported by some fundamental factors, but investors are still reluctant to shift capital to meme coins under current market conditions.

Market analyst Benjamin Cowen warns that in an increasingly tight liquidity environment, meme coins may be hit the hardest, with some even disappearing altogether.

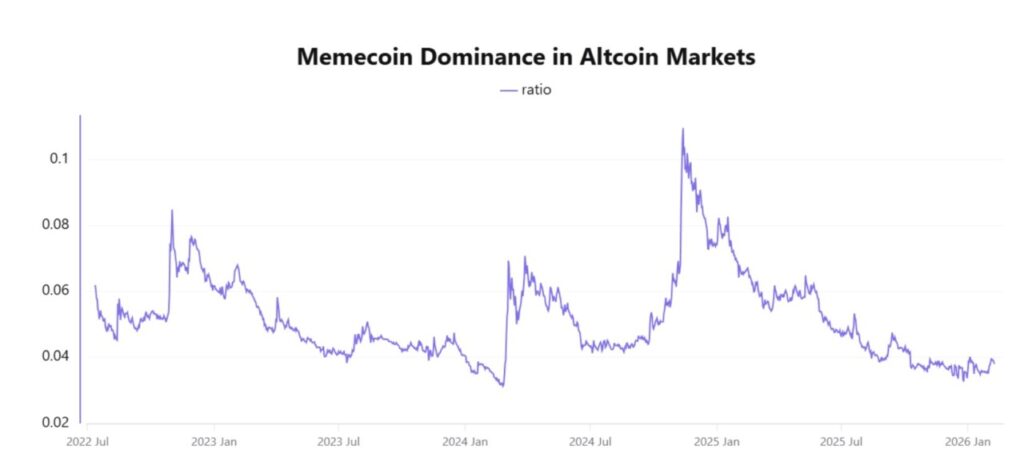

Data on the dominance of meme coins in the altcoin market-which measures the share of meme coin market capitalization to total altcoin capitalization-is also still at a low level.

A strong and sustained rise in this dominance ratio would be a clearer signal that a broader recovery for PEPE and the meme coin sector as a whole is underway.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Whales Accumulate 23 Trillion PEPE During the Price Downturn, Fueling Recovery Hopes. Accessed on February 12, 2026

- CoinCentral. PEPE Whales Accumulate 23T Coins Amid Price Drop Raising Recovery Hopes. Accessed on February 12, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.