5 Strong Signs Bitcoin Could Break Rp2.5 Billion and Enter a New Bull Run

Jakarta, Pintu News – The price of Bitcoin (BTC) is back in the spotlight after analysts projected a potential increase towards $150,000 or around Rp2,520,900,000 (exchange rate of Rp16,806) by the end of the year. Although currently still moving around $67,853 or equivalent to Rp1,140,000,318, the opportunity for a big rally remains open if a number of technical and fundamental indicators begin to improve. The crypto and cryptocurrency market in general is still plagued by macroeconomic pressures and capital outflows. However, a number of signals suggest that the foundations for a new bull cycle are slowly taking shape.

Holding Above 200-Week SMA

The 200-week simple moving average (SMA) indicator has been a bellwether for the end of Bitcoin’s (BTC) bear market phase. In the 2015 and 2018 cycles, the price bounced off this level before entering a long-term uptrend. Even in 2022, the break below the line was short-lived before prices recovered. This level is now a crucial support again.

As long as BTC is able to stay above the 200-week SMA, the risk of a sharp drop can be suppressed. This line is also an indicator that selling pressure is starting to weaken. If the technical structure is maintained, there is a greater chance of building bullish momentum. Without the support of this level, the projection of Rp2.5 billion will be difficult to realize.

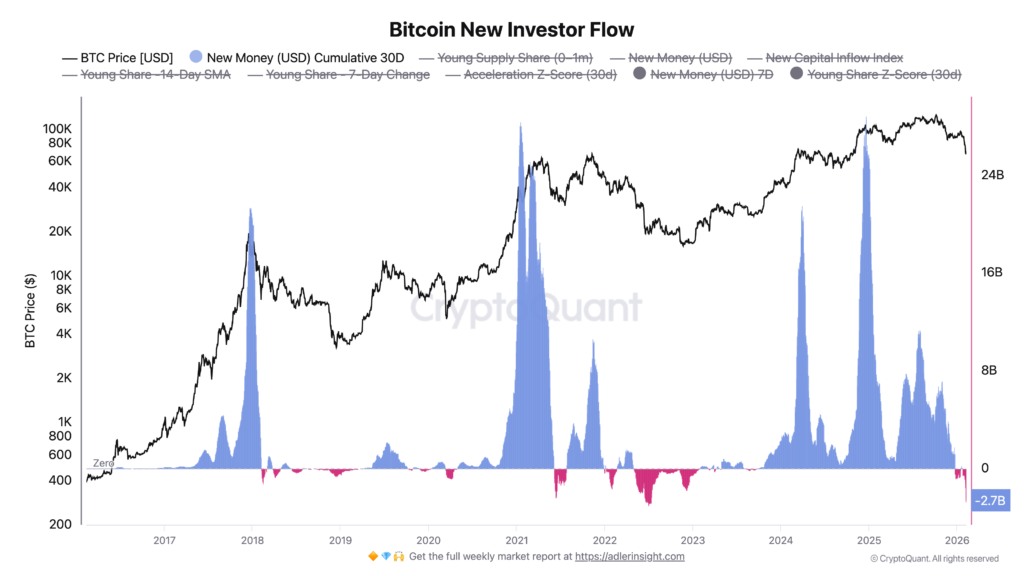

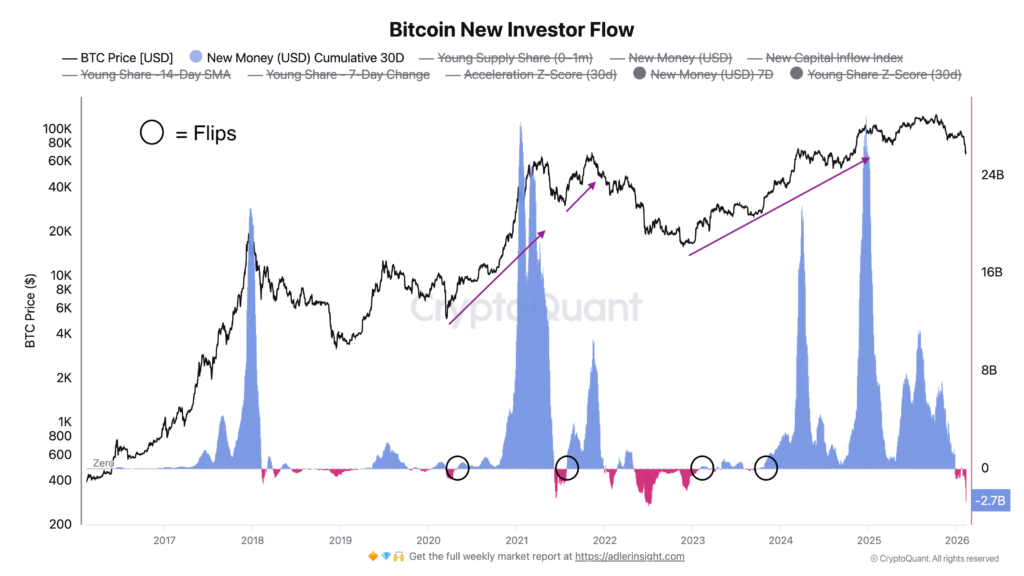

New Investor Flows Should Turn Positive

On-chain data shows that new investor outflows have reached $2.7 billion or around Rp45.38 trillion since February. This reflects the lack of fresh capital participation in the cryptocurrency market. In previous bull cycles, large rallies have always been preceded by a surge in inflows of new funds. Without a change in the capital flow trend, rallies are likely to be limited.

Bitcoin ETFs starting to record positive inflows is an early signal of improvement. However, the reversal should occur consistently over several weeks. The return of retail and institutional investors is the deciding factor for the sustainability of the uptrend. Without such support, the upswing is only temporary technical.

USDT Dominance Must Come Down

Tether’s (USDT) dominance in the crypto market increased to the 8.5%-9% range. This increase shows that investors prefer to keep funds in stablecoins rather than take risks. Historically, a decline in USDT’s dominance is often followed by a strong rally in Bitcoin. This inverse correlation is an indicator of capital rotation.

In the previous period, rejection at the area of dominance triggered a rise in BTC by more than 70% within a few months. If a similar pattern reoccurs, a huge rally could form. Therefore, the decline in USDT dominance is an important signal for the start of a new bull run. Without capital rotation, momentum is difficult to build.

Read also: 24 Karat Gold Price in Bandar Lampung Today [2026]

Quantum issue must be suppressed

The threat of quantum computing to Bitcoin’s cryptographic system is again a concern. Some analysis suggests that around 25% of BTC addresses are potentially vulnerable in extreme scenarios. However, experts believe that the threat is still far from practical realization. Estimates say the real risk will only appear in 20 to 40 years.

Steps to strengthen security by industry players are an important factor in maintaining investor confidence. If the roadmap for improving security is clear, concerns may subside. Technical stability is an important foundation for the cryptocurrency market. Without security assurance, institutional investors tend to hold back.

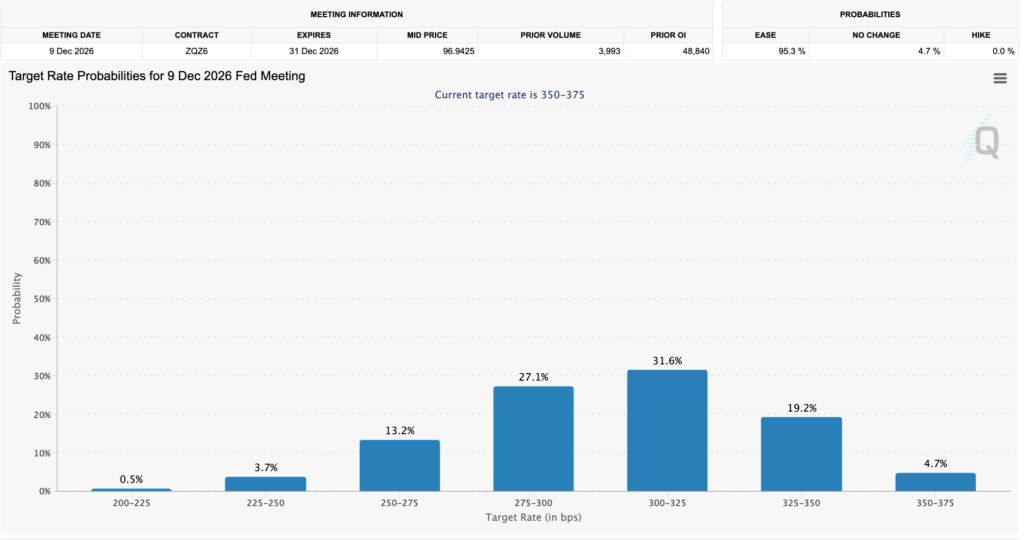

Fed Rate Cut

Federal Reserve policy is a macro factor that determines the direction of the crypto market. CME futures contracts indicate the potential for two rate cuts by 2026. Lower interest rates usually push investors out of bonds and into riskier assets. Bitcoin is one of the assets that benefit from such conditions.

If the cuts happen up to three times, market liquidity could potentially increase significantly. The low interest rate environment has historically favored cryptocurrency rallies. Risk-on fund flows could accelerate BTC’s upward momentum. Without monetary policy easing, the rally is likely to be slower.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. When will Bitcoin start a new bull cycle toward $150K? Look for these signs. Accessed February 14, 2026

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.