Dogecoin Climbs to $0.92 Today, But Data Signals a Possible 35% Drop

Jakarta, Pintu News – Dogecoin (DOGE) has broken a crucial support level that it has managed to hold for almost a year, sparking fears of a potential further decline. On February 12, the meme coin had dropped 2.18% and was trading around $0.09083.

This selling pressure comes at a time when bearish sentiment is dominating the overall crypto market. Trading activity increased despite the price weakness, with transaction volumes jumping 11% to reach $845 million over the same period.

So, how is the Dogecoin price moving today?

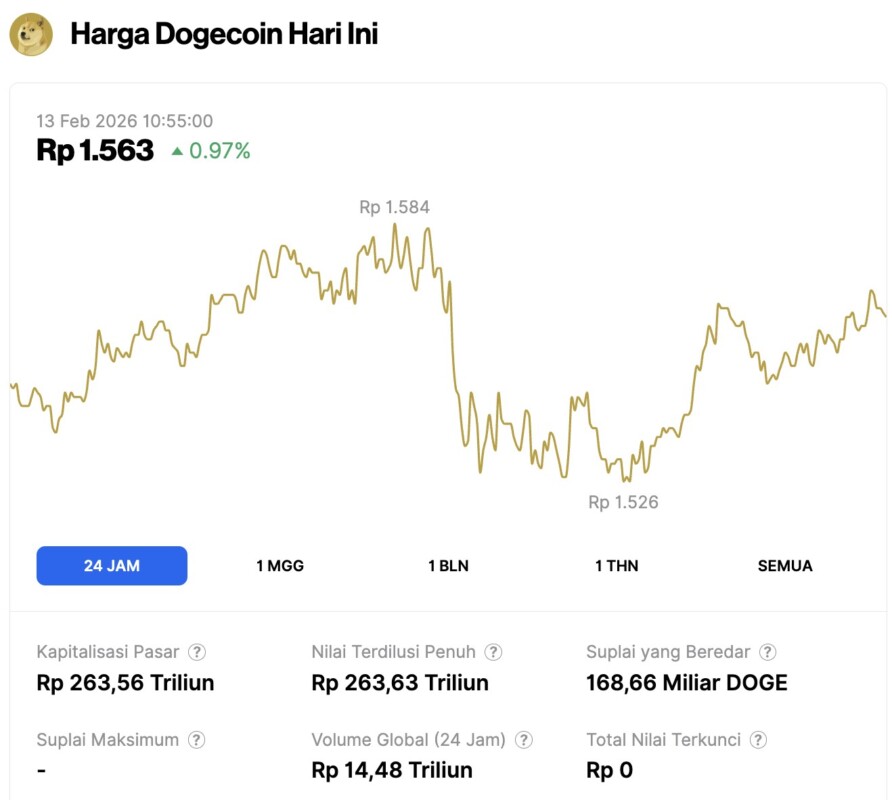

Dogecoin Price Rises 0.97% in 24 Hours

On February 13, 2026, the price of Dogecoin edged up by 0.97% over the past 24 hours, trading at $0.09288, which is equivalent to about IDR 1,563. During that period, DOGE fluctuated within a range of roughly IDR 1,526 to IDR 1,584.

At the time of writing, Dogecoin’s market capitalization is around IDR 263.56 trillion, with a 24-hour trading volume of approximately IDR 14.48 trillion.

Read also: Ethereum Price Holds at $1,900 as ETF Outflows Mount – Is ETH on the Brink?

Support Breakdown Unlocks Potential for Deeper Losses

On the daily chart (12/2), DOGE was noted to lose the support level at $0.095, which has been the price floor since February 2024. This technical failure marks a significant change in Dogecoin’s market structure.

Analysts warn that if the level is not recaptured soon, DOGE prices are at risk of correcting up to 35% in the next few days. The next minor support is around $0.0883 which could potentially be a temporary bounce area. However, if this level is also broken, the price could resume its decline towards around $0.05710, which is seen as the next strong support zone.

Currently, the Average Directional Index (ADX) value stands at 51.33, well above the important threshold of 25. The figure confirms that strong downtrend pressure is dominating DOGE’s price movement.

Analysts think the current level could be the bottom point

Not all market participants agree with the bearish view. A renowned crypto analyst recently revealed on the X platform that the current Dogecoin price could actually be a buying opportunity.

He referred to historical patterns, emphasizing that investors who used to miss DOGE at $0.0002 and $0.002 should start paying attention now. The analyst also shared a monthly chart showing the ascending trendline that has been supporting DOGE’s movement since 2017.

Read also: Bitcoin Price Slips to $67,000 Today as Analysts Warn of Further Declines

Based on that analysis, DOGE is currently testing the third major support on that trendline. The previous two tests in 2017 and 2021 were followed by significant price rallies. The chart indicates that Dogecoin’s long-term trend is still intact despite recent price weakness.

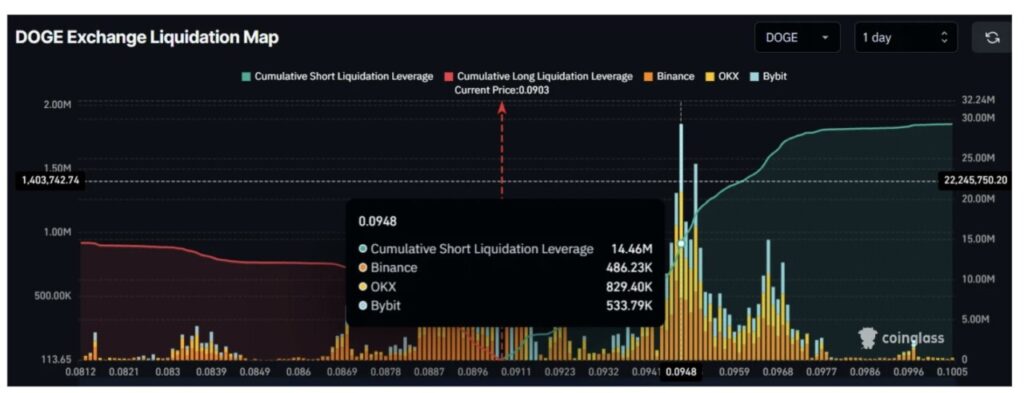

On the other hand, futures data shows strong bearish sentiment among leveraged traders. Short positions are currently much more numerous than long positions.

CoinGlass data shows traders have opened short positions worth $14.46 million, compared to just $8.26 million for long positions. These positions are concentrated in the area of important technical levels, which are around $0.0888 on the downside and $0.0948 on the upside.

The buildup of leveraged positions at these levels creates the potential for sharp price movements. In the event of a mass liquidation cascade, the price of DOGE could move rapidly in either direction, up or down.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpaper. Dogecoin Price Faces 35% Decline Risk After Losing Critical Support at $0.095. Accessed on February 13, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.