Gold Prices Slide on February 13, 2026 – What’s Driving the Drop?

Jakarta, Pintu News – Gold is currently trading at $4,978.06 (IDR 83.79 million), down 2.11% in the last 24 hours after falling back below the $5,000 (IDR 84.16 million) per ounce mark for the second time this month. In a matter of minutes, the precious metals market erased around $1.4 trillion of its total value, with gold spot prices slipping to near $4,900 and silver dropping to the $76 range.

This sharp move occurred in less than 30 minutes and triggered large liquidation candles on the intraday charts. The market value lost surpassed $1.2 trillion in the initial wave of selling.

Traders called the price action extremely aggressive and unusual, leading to initial speculation about the possibility of a “fat finger,” which is a large order error that triggers extreme volatility without a clear news trigger. However, the recent geopolitical news provided additional context to the move.

Geopolitical Shift Reduces Risk Premium

Recent reports suggest that Israeli Prime Minister Benjamin Netanyahu confirmed that US President Donald Trump prefers the path of a deal with Iran. This statement seems to lower the previously high geopolitical risk premium that is already reflected in commodity prices.

Read also: 24 Karat Gold Price Today, Friday, February 13, 2026

As tensions eased, traders began to close their defensive positions in gold and silver.

Precious metals are usually sought after when geopolitical uncertainty increases. However, when risk perceptions begin to decline, the flow of funds into safe haven assets like gold can quickly reverse. The timing of the diplomatic statement coincided with a sharp drop in prices, amplifying selling pressure.

Strengthening Dollar Pressures Gold Prices

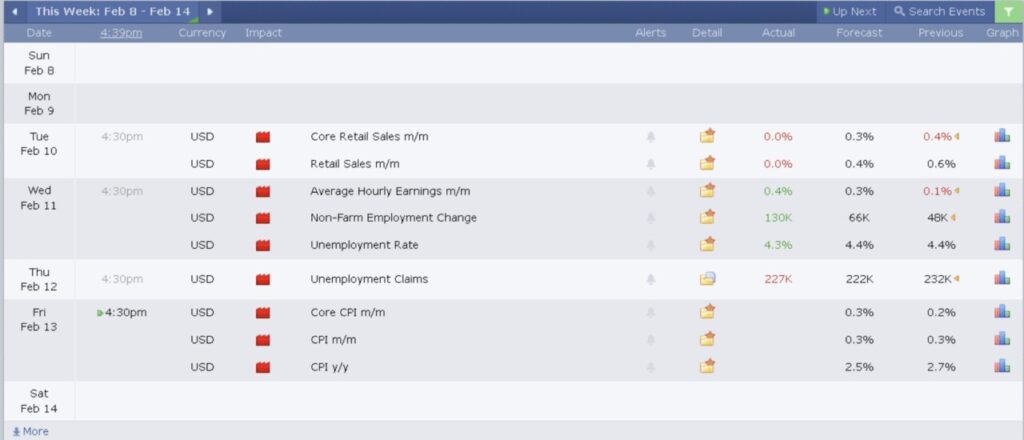

At the same time, macroeconomic data also added pressure on gold bullion. The January Nonfarm Payrolls report showed the US economy added 130,000 jobs, surpassing the forecast of 70,000. The unemployment rate fell to 4.3%, better than the projected 4.4%.

Jobless claims data released today recorded 227,000 claims, slightly above the forecast of 222,000, but still reflecting a fairly resilient labor market.

Strong employment conditions reduced the likelihood of a Fed rate cut in the near future. As the market begins to reduce expectations of policy easing, the US dollar bounces back from oversold conditions. A stronger dollar is generally a drag on gold as it makes it more expensive for holders of other currencies.

Currently, market participants are awaiting the release of the US Consumer Price Index (CPI) data scheduled for Friday. Economists project both headline and core inflation to rise 2.5% on an annualized basis, with a monthly increase of 0.3%.

The outcome of this inflation data could potentially be the next bellwether: a lower-than-expected reading could weaken the dollar and stabilize gold prices, while a higher reading could extend selling pressure on gold.

Liquidity Factor due to Holiday in China

Seasonal factors also come into play. China, one of the main drivers of spot gold demand, will close the market from February 13 to February 24 for the Lunar New Year holiday. This reduced activity from one of the world’s largest gold consumers has the potential to thin liquidity and magnify price swings.

Read also: Gold Selling Price Today, Friday, February 13, 2026

Currently, gold is already down about 3% in one session, briefly touching the $4,930 area at the intraday low. Silver corrected even deeper, dropping around 10% over the same period. This weakness reflects the coordinated liquidation action across the precious metals market.

Dip buyers try to lift prices again

Although the selling pressure was quite aggressive, buyers started trying to push gold prices back above the $5,000 level. The intraday movement showed an attempt to rebound when the price touched the support zone. However, it remains unclear whether this level can hold.

This quick sell-off confirms how swiftly market sentiment can change when macro data, geopolitical developments, and market positioning converge at the same time. With CPI data on the horizon and liquidity reduced by the long holiday in China, gold price volatility has the potential to remain high.

For the time being, the $5,000 level is an important limit, both psychologically and technically. The question is: are buyers able to regain control of the market, or is the price preparing for one more wave of decline? The next trigger could come sooner than expected.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpaper. Gold Crashes Below $5,000 as $1.3 Trillion Wiped Out in 2 Hours. Accessed on February 13, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.