8 Cryptocurrencies that Could Rebound After a Sluggish Market — What’s Driving the Potential

Jakarta, Pintu News – The crypto market entered February 2026 under heavy pressure. Bitcoin (BTC) is trading below $61,000 after falling more than 30% in the last 30 days, while the total market capitalization has already shrunk by more than $1.2 trillion from its peak in October.

Risk appetite has fallen sharply. Investors shifted capital to gold and other defensive assets amid rising global uncertainty. Meme coins and speculative tokens experienced the deepest declines.

However, history shows that major corrections are often a moment of market position “reset”. When the forced selling pressure begins to subside, capital usually returns to seeking out networks that have real use, regulatory clarity, and institutional interest.

That moment seems to be approaching. The question is: which projects will stand out when this “dust” starts to settle?

XRP

As of February 10, 2026, XRP (XRP) was briefly trading around $1.32, down more than 41% in the last 30 days – reflecting overall market pressure, not the weakness of the project. The end of Ripple’s legal dispute with the SEC has removed a major obstacle that for years limited institutional exposure.

Read also: Shiba Inu Entering Critical Bear Trap Phase – SHIB Potential 22x Rally?

Both parties withdrew their appeals, so the 2023 ruling stands and confirms that trading XRP on the secondary market is not classified as a security. This regulatory certainty is now starting to have a real impact.

Ripple successfully obtained an EMI license in Luxembourg and regulatory approval in Dubai, which strengthens their reach in the global payments sector. On the technology front, Ripple is preparing a native lending feature on the XRP Ledger as well as a secret token standard that utilizes zero-knowledge proofs.

Corporate adoption also continues to emerge, with Japan’s Gumi planning to allocate ¥2.5 billion of XRP cash by February. In addition, the spot XRP ETF launched at the end of 2025 has already attracted over $1.3 billion in fund flows.

Ethereum

Ethereum (ETH) was briefly trading around $1,914 on February 10, 2026, also down more than 40% in the last 30 days, putting ETH deep in its historical decline zone. However, large holders are moving in the opposite direction of the market panic.

On-chain data shows whales added nearly four million ETH throughout January, signaling confidence, not fear. Ethereum-based spot investment products still recorded net inflows despite the price weakness, led by funds associated with BlackRock and Grayscale. Development momentum also continued into 2026.

The upcoming Glamsterdam upgrade targets increased efficiency through enshrined proposer-builder separation, while the Hegota upgrade scheduled for later in the year aims to reduce state overruns and lower transaction costs.

Ethereum’s role as a settlement layer for tokenized real-world assets continues to grow as large financial institutions build directly on top of the network.

Solana

Solana (SOL) was briefly trading below $80 after dropping more than 42% in the last 30 days, breaching an important psychological level. But despite the price movement, the health of the network is looking stronger.

Firedancer officially launched on the mainnet in December 2025, bringing validator diversity and increasing network resilience.

The upcoming Alpenglow upgrade targets finality times of just milliseconds, opening up new application category opportunities. Solana’s network has handled traffic spikes of over 200 million daily transactions without downtime, extending its solid uptime record. Institutional interest has followed suit.

Read also: Crypto Market Sentiment Falls to Extreme Fear Levels: Golden Opportunity or Danger Signal?

Solana’s spot ETF has attracted cumulative inflows of close to $874 million, and Morgan Stanley has even proposed a similar product. Large companies like Western Union and JPMorgan are reportedly utilizing Solana’s infrastructure for stablecoins and debt issuance.

Sui

Sui (SUI) was briefly trading at around $0.91, down more than 50% in the last 30 days, making it one of the hardest hit large-cap networks. This decline contrasts with the rapid expansion of the ecosystem. The Mysticeti consensus engine has reduced transaction latency to under 390 milliseconds, making Sui one of the fastest production blockchains available.

Native USDC integration through Circle has turned Sui into a stablecoin liquidity hub, reducing reliance on bridges. Institutional access is increasing through the Grayscale Sui Trust, while the gaming sector is driving user growth thanks to the SuiPlay0X1 handheld console.

DeFi’s infrastructure is also maturing with the arrival of DeepBook V3, which provides a native order book for large transactions. TVL has surpassed $1.5 billion despite weak market conditions.

Avalanche

Avalanche (AVAX) was briefly trading around $8.3 after dropping around 42% in the last 30 days, but on-chain activity shows a different story. The network has become one of the main destinations for the tokenization of real-world assets.

The value of RWAs tokenized on Avalanche surged almost tenfold through 2025, reaching approximately $1.3 billion in the fourth quarter alone. BlackRock’s BUIDL fund launched on Avalanche with an initial $500 million, followed by other major banking institutions and index providers.

Institutional access expanded further with the arrival of the VanEck Avalanche ETF in January, which started recording inflows in just a few days. Product applications now also include reward staking, turning ordinary exposure into a yield-generating instrument.

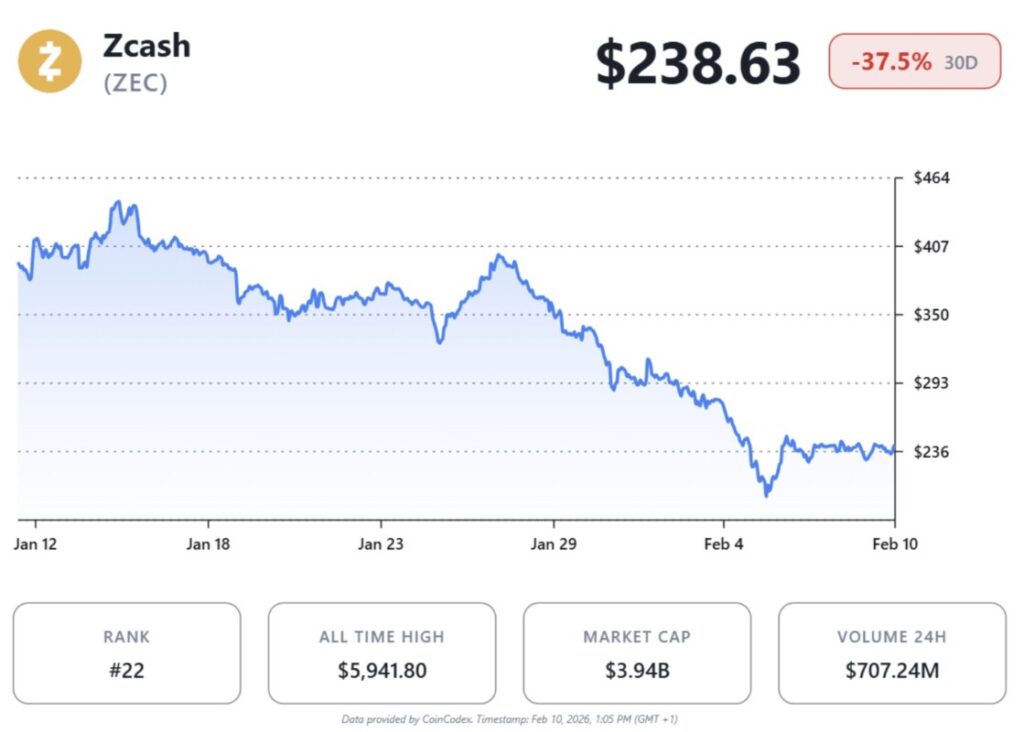

Zcash

Zcash (ZEC) was briefly trading around $214, down more than 56% in the last 30 days, reflecting extreme selling pressure in the privacy asset segment. A number of structural changes are now beginning to reshape the project.

Read also: XRP Price Prediction: Break-Even Signal Emerges Amid Market Reset Phase

The Zcash Foundation has laid out its 2026 strategy that focuses on modular infrastructure and independent node development through Zebra.

Advancements to the FROST signature scheme promise increased wallet security and better multisignature capabilities. Governance changes also shifted the dynamics of the ecosystem, with former core developers launching new products such as the cashZ wallet. One major burden was lifted in January when the SEC concluded its investigation with no further action.

With privacy issues back in the regulatory spotlight in many countries, does Zcash have the potential to become relevant again as compliance and anonymity begin to find common ground?

Hedera

Hedera (HBAR) was trading around $0.082, down almost 35% in the last 30 days, but its adoption continues to grow at the institutional and government level. The Hedera-based platform has been integrated with the Federal Reserve’s FedNow system, enabling real-time transaction settlement to ISO 20022 standards.

The United States Department of Defense also utilizes Hedera-connected infrastructure through Taekion to ensure data integrity. Policy recognition followed, with Hedera explicitly mentioned in the White House Digital Asset Report.

Corporate partnerships have widened, including a multi-year partnership with McLaren Racing focused on large-scale digital collectibles. A mainnet upgrade in February improved smart contract automation, while the governance board added Repsol to explore digital identity solutions for millions of users.

Stellar

Stellar (XLM) was trading around $0.155, down more than 35% in the last 30 days, in line with the broader market correction. But the network’s fundamentals continue to strengthen. The value of real-world assets tokenized on Stellar has surpassed $1 billion, on the back of financial institutions seeking regulatory-compliant infrastructure.

Partnerships with Visa and Mastercard support cross-border stablecoin settlement as well as digital identity solutions. The establishment of Soroban has taken Stellar beyond payments, paving the way for decentralized exchanges and lending protocols at scale for the first time. Developer activity has soared, with the number of active accounts up 40% year-on-year.

Stellar-based products like Franklin Templeton’s on-chain money market fund continue to grow. As traditional finance increasingly migrates to on-chain, is Stellar’s focus on compliance a strategic advantage?

Overall, the February 2026 market was filled with fear, forced liquidations, and a sharp shift away from risky assets. But beneath the falling prices, infrastructure foundations, regulatory clarity, and institutional adoption continued to move forward.

When volatility subsides, capital usually returns first to networks that are already serving real users. The question is no longer one of survival, but one of positioning. Of these eight networks, which one will seize the next wave of trust?

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpaper. We Picked 8 Cryptocurrencies to Invest $1,000 in for February 2026. Accessed on February 13, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.