4 Signs Bitcoin is in the Early Stages of a Bear Market: When Will It End?

Jakarta, Pintu News – Bitcoin (BTC) has fallen 23.4% so far this year, having previously lost more than 6% in 2025. Its price continues to be under pressure, with the major crypto currently trading at $67,214.

Amidst these conditions, one big question still weighs on market sentiment: when will Bitcoin’s downward trend end? Four major signals suggest that the asset may still be in the early phase of a bear market, which opens up the opportunity for further declines.

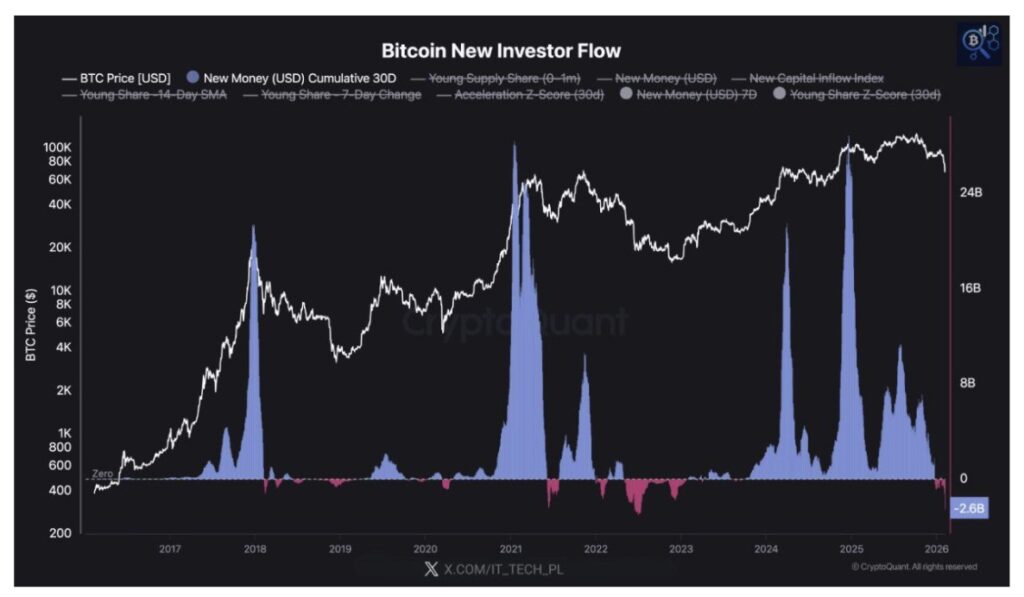

Capital Outflows Confirm Bearish Change in Sentiment

Investment flow data provided the first warning signal. Data from CryptoQuant shows that the inflow of new investors has now turned negative. An analyst said that this indicates that the current sell-off is no longer being sustained by the influx of new capital into the market.

Read also: Crypto Market Sentiment Falls to Extreme Fear Levels: Golden Opportunity or Danger Signal?

The analyst explained that in the bull market phase, capital flows actually tend to increase when prices correct, as investors take advantage of the decline as a buying opportunity. Conversely, in the early stages of a bear market, what is often seen is capital withdrawal amidst weakening market conditions.

“The current data is similar to the phase after prices reach ATH, where marginal buyers exit the market and price movements are driven more by internal rotation, rather than by net capital inflows. In the absence of new inflows, the price increase is only corrective in nature. This pattern is in line with the early characteristics of a bear market: liquidity is shrinking and market participation is narrowing,” the analyst added.

Technical Patterns Suggest There’s Still Room for Bitcoin’s Further Decline

Crypto analyst Jelle highlighted historical cycle data to map out potential downside risks at the moment. He explains that in previous major bear markets, prices typically formed a bottom below the 0.618 Fibonacci retracement level calculated from the previous cycle peak.

In the earliest cycles, the correction was much deeper, with Bitcoin falling about 64% below that 0.618 level. However, in subsequent cycles, the depth of the decline tended to diminish.

In the last bear market, the bottom formed about 45% below that retracement threshold, indicating a pattern of declines that have gotten shallower over time.

“The 0.618 level of the current cycle peak is around $57,000. If this time Bitcoin forms a bottom only 30% below the 0.618 retracement, we are still talking about a potential drop to around $42,000,” the analyst said.

This indicates that the price could still fall further. In addition, a number of other experts have also previously projected that Bitcoin could potentially find a bottom even below $40,000.

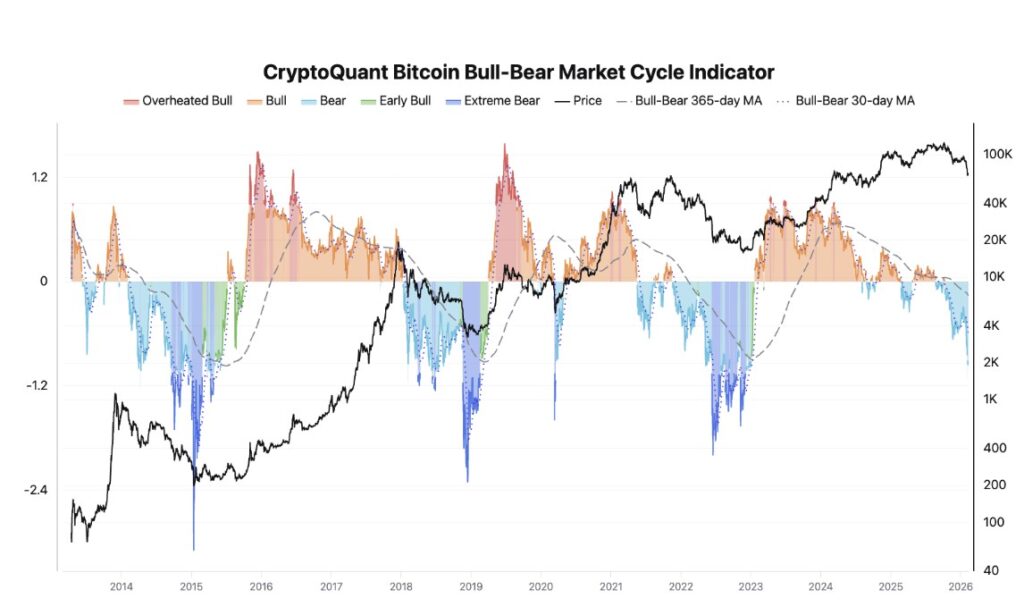

Market Cycle Indicators Point to Continued Downside Risk

In addition, the Bull-Bear Market Cycle Indicator, which monitors the overall market cycle phase, suggests that bearish conditions have started since October 2025. However, so far the metric has not entered the region that is usually categorized as an extreme bear phase.

Read also: Bitcoin Price Drops to $67,000 Today: Analysts Forecast a BTC Crash?

In previous cycles, this indicator has moved into the dark blue zone, signaling a potential decline to lower levels.

Whale Collects BTC, but Recovery May Take Time

Finally, on-chain data shows that Bitcoin whales continued to accumulate during the latest downturn, as BTC outflows from exchanges increased. The 30-day simple moving average (SMA) for exchange outflows has now risen to 3.2%.

This pattern is very similar to the first half of 2022. Although accumulation by whales is often seen as a positive signal, history reminds us to remain cautious. In previous cycles, a broader recovery only really took hold in early 2023.

The similarity in structure indicates that while “smart money” is starting to build positions, this does not necessarily mean a sharp rebound is imminent. Instead, the data suggests that the market may still be under pressure in the short term, even as long-term holders continue to add exposure.

Separately, analysis from Kaiko states that Bitcoin’s movement still appears to follow its traditional four-year cycle pattern. Based on this framework, the company stated:

“The four-year cycle framework predicts we are currently around the 30% phase.”

Combined, these four indicators point to the possibility that Bitcoin could still be under pressure. However, when exactly the bear market will end is still a matter of debate among experts.

Ray Youssef, CEO of NoOnes, said that it is unlikely that Bitcoin will experience a V-shaped recovery before the summer of 2026. Julio Moreno, Head of Research at CryptoQuant, also predicted that the current bearish phase could end in the third quarter of 2026.

In contrast, Bitwise’s CIO Matt Hougan expressed a more optimistic view, hinting that the end of the “crypto winter” may be drawing near.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 4 Signs That Bitcoin Is in the Early Stages of a Bear Market: How Long Could It Last? Accessed on February 13, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.