3 Potential Altcoins in Mid-February 2026

Jakarta, Pintu News – Entering the second half of February 2026, the altcoin market is again showing a positive stretch after a long period of consolidation and volatility. A number of tokens with high volatility are starting to attract investors’ attention due to technical signals that indicate trend continuation or potential reversal.

The increased buying momentum in some of these crypto assets is a sign that market sentiment is starting to turn optimistic. Here are three altcoins that are worth monitoring because they have the potential to provide significant gains in the near future.

Axie Infinity (AXS)

Axie Infinity (AXS) has managed to steal the show as one of the best performing altcoins in early February 2026. In the last 24 hours, AXS surged by 18%, reinforcing the uptrend it had been building since the beginning of the year.

This price spike indicates that the confidence of market participants is recovering after previously being pressured by high volatility. If this positive momentum continues, AXS has the potential to break the $1.65 level and pave the way to the resistance area at $1.92.

However, the risk of a correction remains to be watched out for if buying pressure is unable to be sustained. A price drop below $1.32 would signal a loss of uptrend support and could trigger a cautious shift in sentiment.

In the worst-case scenario, AXS could correct further to the $1.05 support area, invalidating the bullish projection. Therefore, price movements around these key levels are very important for market participants to watch.

Read also: 5 Strong Signs Bitcoin Could Break Rp2.5 Billion and Enter a New Bull Run

Kite (KITE)

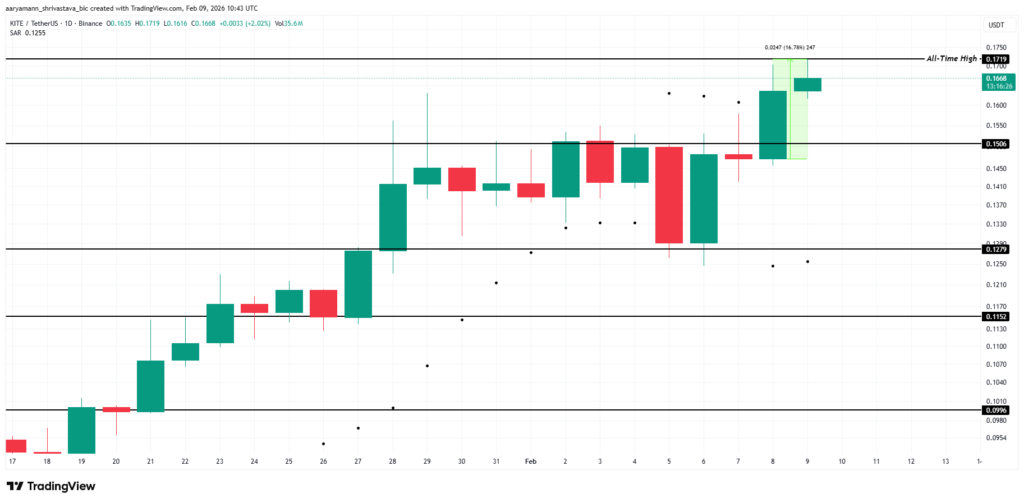

Kite (KITE) has been one of the most consistent altcoins to set new record price highs since early February. In recent trading, KITE managed to break the all-time high (ATH) at $0.1719, signaling very strong demand from traders chasing high-momentum assets. This price increase was supported by the bounce off the $0.1506 support area, which reinforced KITE’s bullish structure. The Parabolic SAR indicator remaining below the price also confirms the active uptrend.

Nevertheless, potential profit-taking remains a threat after a series of ATH milestones. In the event of a sharp drop below the $0.150 level, KITE’s bullish structure will begin to weaken and open the door for a deeper correction to the $0.127 area. This scenario would invalidate the upside projection and signal a longer consolidation phase. Therefore, defense in the support area is key to the continuation of KITE’s positive trend in the near term.

Also read: 5 Simple 17K Gold Rings Perfect for Lebaran

BankrCoin (BANKR)

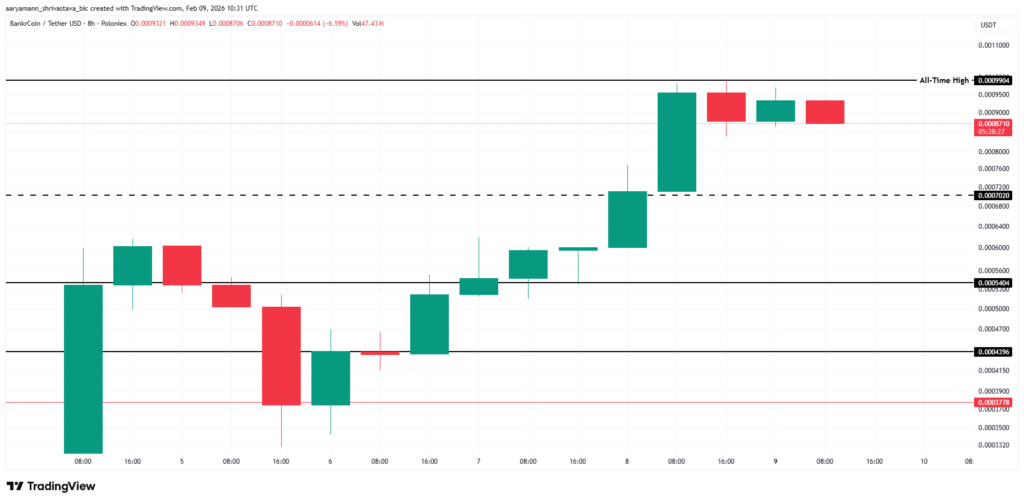

BankrCoin (BANKR) showed solid bullish strength after an impulsive breakout from the $0.0007020 resistance, which has now turned into support. BANKR’s price spiked close to a record high of $0.00099, and then experienced tight consolidation around $0.00087.

This price structure indicates the potential for a healthy continuation of the uptrend, not distribution, so BANKR is worthy of being on investors’ radars. If the $0.00087 area can be maintained, the opportunity to retest the ATH at $0.00099 is very wide open.

A clean breakout above $0.00099 would take BANKR into the price discovery phase with the next target at $0.00110. The strength of the uptrend is supported by a large bullish candle, increasing transaction volume, as well as a shallow pullback.

However, the validity of the bullish trend will be invalidated in the event of an 8-hour price close below $0.0007020, signaling the breakout failed and momentum turned neutral. A deeper correction below $0.0005404 would completely invalidate the bullish structure and trigger a new consolidation phase.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Altcoins to Watch in the Second Week of February 2026. Accessed on February 15, 2026

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.