Ethereum Falls to $1,970 as Whale Activity Sends Mixed Signals

Jakarta, Pintu News – The price of Ethereum (ETH) is still under pressure after the latest drop that hampered the recovery momentum. On February 15, ETH was trading at around $2,087 and has broken the $2,000 level again, but has not been able to build a sustainable rise.

The challenge Ethereum faces is not just a matter of resistance levels, but also the existence of doubts among the main holding groups. Then, how will Ethereum price move today?

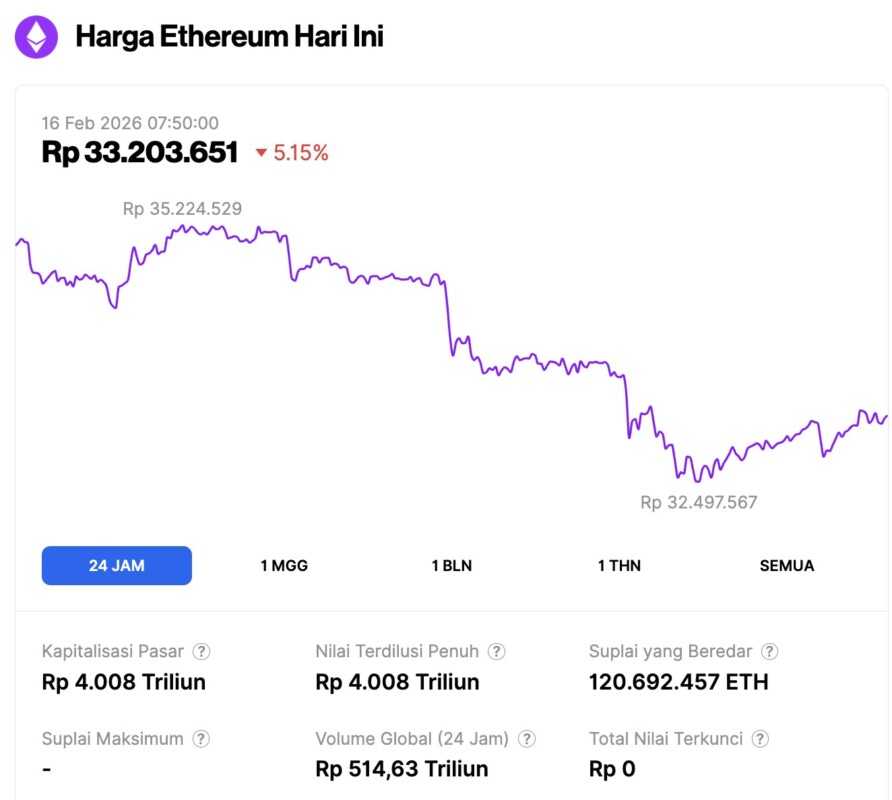

Ethereum Price Drops 5.15% in 24 Hours

On February 16, 2026, Ethereum was trading at around $1,970, or approximately IDR 33,203,651, down 5.15% over the past 24 hours. Within that period, ETH dipped to a low of IDR 32,497,567 and climbed to a high of IDR 35,224,529.

At the time of writing, Ethereum’s market capitalization is estimated at about IDR 4,008 trillion, while its daily trading volume jumped 82% to roughly IDR 514.63 trillion in the last 24 hours.

Read also: Top 3 Layer-2 Altcoins that Stand Out Right Now, What to Watch Out For?

Ethereum Whales Sell… Then Buy Again

Whales and long-term holders are two of the most influential groups in any crypto market. In the case of Ethereum, these two groups are giving mixed signals. This lack of synchronization has contributed to sideways price movements for a long time.

Addresses holding between 100,000 and 1 million ETH were recorded as selling around 1.3 million ETH on February 9-12. The sales value was equivalent to approximately 2.7 billion US dollars. However, within the next 48 hours, the same group bought another 1.25 million ETH.

This quick reversal represented nearly $2.6 billion of buying in the same week. Such large-scale buying and selling activity creates liquidity without a clear direction of movement. As a result, Ethereum’s price remains range-bound, instead of showing a firm upward or downward trend.

Ethereum LTH was accumulating… but now starts selling

The HODLer net position change metric further confirms these doubts. The indicator tracks changes in the balance of long-term holders (LTH). Since the end of December 2025, LTHs have been consistently accumulating ETH.

However, going into early February, that trend changed. Long-term holders reduced their buying activities and started to distribute (sell) lightly. While the selling pressure has not been aggressive, it shows the growing uncertainty among investors who are usually known for their strong conviction.

Read also: Meme Coin Predictions: How Will DOGE, SHIB, and PEPE Fare?

The mixed activity of whales, plus the more cautious attitude of LTHs, has limited the bullish momentum. Without continued accumulation from these dominant groups, Ethereum price will find it more difficult to break through major resistance levels.

ETH price stuck around $2,000

Ethereum briefly traded around $2,087 on February 15, and managed to hold the $2,000 threshold again. The next major resistance is at $2,241. To move towards that level, a clear bullish bias from a large group of holders is required.

With no firm accumulation yet, the most likely scenario is consolidation. Ethereum has the potential to continue moving around $2,000 while maintaining support at $1,902. The sideways movement may continue until stronger directional conviction emerges.

If whales and LTHs switch back to accumulation mode, Ethereum has a chance to break $2,241. A sustained rally could push the price towards $2,395 and even test $2,500. If the $2,500 level is successfully broken, the bearish assumptions will fall and this will confirm a stronger recovery trend.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Reclaims $2,000 – But Whale Charts Show More Worries. Accessed on February 16, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.