Dogecoin Climbs to $0.10—Is X’s Smart Cashtags Feature Driving the Surge?

Jakarta, Pintu News – The Dogecoin (DOGE) price briefly traded around $0.0999, down 1.05% on February 17 after failing to sustain gains above $0.115 following an 18% surge triggered by X’s announcement of Smart Cashtags.

This move saw DOGE drop back below the $0.10 psychological level as sellers defended the Fibonacci resistance area and the rally started to lose momentum. So, how will Dogecoin price move today?

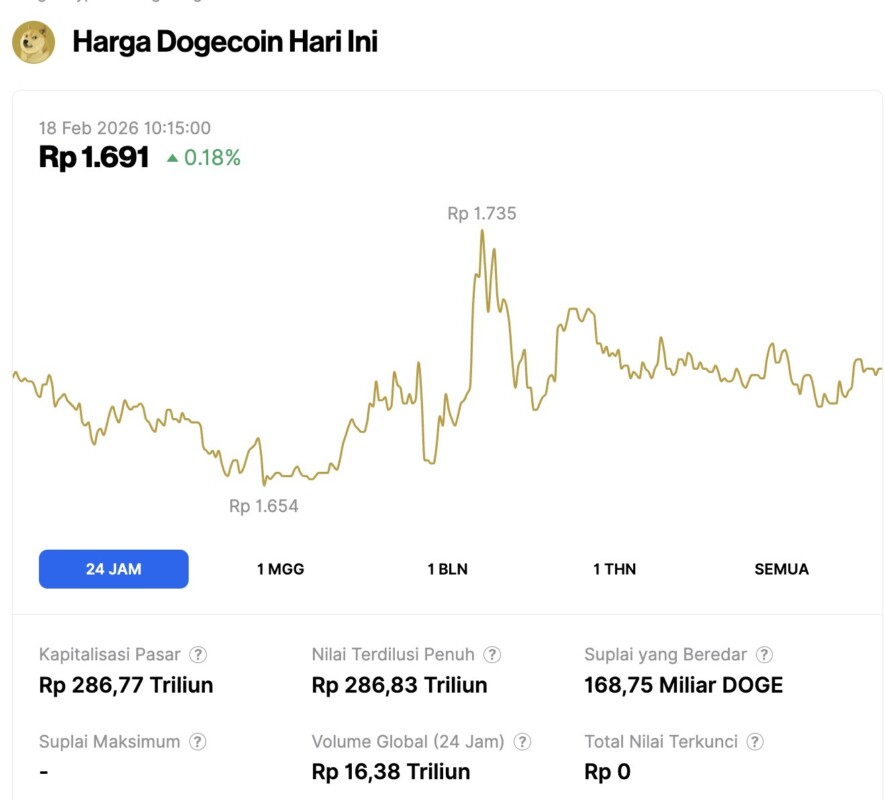

Dogecoin Price Rises 0.18% within 24 Hours

On February 18, 2026, Dogecoin edged up 0.18% over the past 24 hours, trading at $0.1007—equivalent to IDR 1,691. During the same period, DOGE fluctuated between IDR 1,654 and IDR 1,735.

At the time of writing, Dogecoin’s market capitalization is approximately IDR 286.77 trillion, while 24-hour trading volume totals around IDR 16.38 trillion.

Read also: Ethereum Holds Firm at $1,900 Amidst Signs of On-Chain Recovery

18% Surge Fueled by Smart Cashtags X

Nikita Bier, Head of Product at X, confirmed that the platform will be launching Smart Cashtags in the next few weeks, allowing users to trade stocks and cryptocurrencies directly from the timeline. This announcement immediately sparked a sharp reaction on Dogecoin, given DOGE’s long-standing association with Elon Musk as well as X’s massive user base.

Memecoin is very sensitive to platform-level news, especially when it comes to Musk and potential new demand channels. The thought that millions of X users could gain access to crypto trading directly from their feeds sent sent sentiment soaring, that DOGE pushed from below $0.09 to a peak of around $0.115 in 24 hours (17/2).

However, this rally is still driven more by narrative than fundamentals. Smart Cashtags are not really active yet, so the real potential demand for the feature is still speculative.

Current price movements reflect anticipation rather than adoption, making DOGE vulnerable to a correction if the euphoria dies down before the feature is officially launched.

Open Interest Falls as Options Betting Explodes

Based on Coinglass data, Dogecoin’s open interest fell 0.72% to $1.18 billion despite an 18% rise in price. Volume also fell 28.49% to $2.34 billion. The drop in open interest as the price rose indicates the rally may have been driven in part by short covering, rather than a large influx of new long positions.

Meanwhile, options open interest jumped 173.14% to $106.40K, indicating traders were more prepared for continued volatility than having strong directional conviction. The long/short ratio shows a very sharp bullish bias: Binance account 2.59, OKX 3.59, and top traders 3.09.

Read also: Bitcoin Slips to $67,000 as Long-Term Holders Stand Firm

The 24-hour liquidation data (17/2) recorded $3.95 million liquidation of long positions versus $951.32K in short positions, confirming this rally triggered forced liquidation from both sides.

In general, when open interest declines while prices rise and options activity surges, it often leads to a short squeeze-driven move instead of steady accumulation. This kind of structure suggests the rally is reactive and could lose continuity if a new catalyst does not emerge.

Fibonacci Resistance Resists Recovery Efforts

On the daily chart (Feb 17), Dogecoin is testing the 0.382 Fibonacci retracement level at $0.1088 after bouncing off the $0.079 low. The 0.5 Fibonacci level is at $0.1179, while 0.618 at $0.1270 is the next major resistance cluster. The Supertrend indicator turned bearish at $0.1153, confirming that sellers are still in control of the daily trend.

Graphical overview:

- 20-day EMA at $0.1039 becomes the nearest resistance

- Bearish supertrend at $0.1153 limits upside

- Fibonacci level of 0.382 at $0.1088 was tested but rejected

- $0.079 (Fibonacci basis) acts as macro support

Dogecoin fell from above $0.28 in early January to $0.079 on February 11, a drop of around 72% from peak to trough. X’s announcement of Smart Cashtags triggered the sharpest one-day recovery since that decline, but the price failed to close above the 0.382 Fibonacci level. Sellers defended that area and pushed DOGE back down below $0.10.

In case of a daily close above $0.1088, DOGE will reclaim the 0.382 level and make the $0.1153 area reachable again. Breaking the Supertrend at $0.1153 could signal the beginning of a trend reversal, as well as open up opportunities towards Fibonacci 0.5 at $0.1179.

Intraday Structure Shows Consolidation After Spike

On the 1-hour chart (Feb 17), DOGE is seen consolidating around $0.10 after a sharp spike up to $0.115. The Parabolic SAR indicator is at $0.10114 and acts as an immediate resistance. The RSI stands at 41.71-still relatively neutral, but likely to weaken as the price gives back some of the gains from the post-announcement rally.

The structure shows:

- Price weakens again to around $0.100 after being rejected at $0.115

- SAR turned bearish and is above the current price

- Formed lower highs since the $0.115 peak

Buyers are trying to defend $0.099 as support. If the price breaks below $0.099, the next potential test area is $0.095, and it could eventually retest the $0.090 demand zone.

Conversely, if DOGE is able to reclaim $0.10114 and break $0.105, it could potentially reverse the SAR and be a signal that buyers are trying to resume the recovery.

The $0.10 psychological level became the closest battleground: sellers were seen aggressively defending it after the spike, while buyers sought to make it a support before attempting the next upward push.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinedition. Dogecoin Price Prediction: DOGE Surges 18% On X Smart Cashtags But Faces Fibonacci Resistance. Accessed on February 18, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.