Meme Coin Price Prediction: Bears Drive Dogecoin, Shiba Inu, and Pepe to the Brink

Jakarta, Pintu News – Meme coins such as Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) came under pressure on Tuesday, continuing their decline since Sunday.

Derivatives data showed significant outflows from the Open Interest of DOGE, SHIB, and PEPE futures contracts, which was mainly due to massive liquidation of long positions. Technically, these meme coins are still at risk of further weakness as selling pressure resurfaces.

Meme Coin is Under Broader Market Pressure

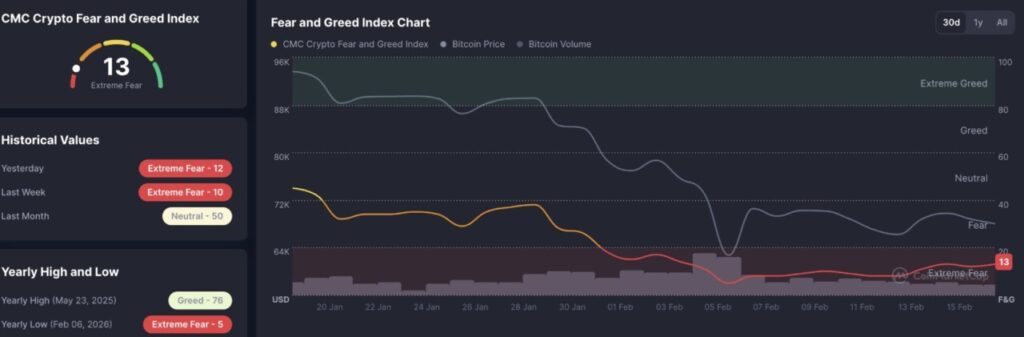

Amidst general crypto market volatility, meme coins are struggling to sustain a surge in interest from retail investors. On Tuesday (Feb 17), the Crypto Fear and Greed Index stood at 13, signaling extreme fear conditions in the market.

Read also: Dogecoin Price Rises to $0.10 Today: Effect of Smart Cashtags Feature in X App?

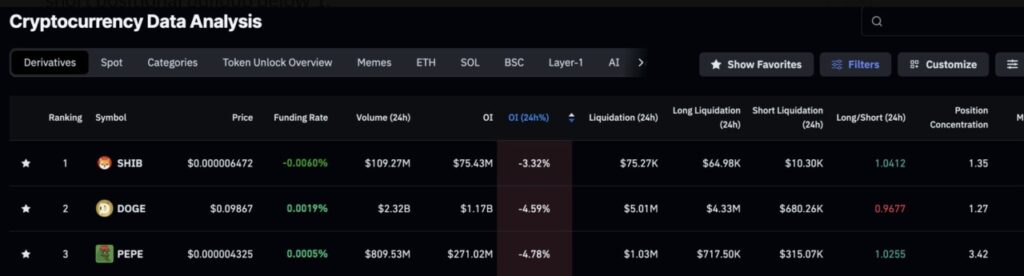

CoinGlass data shows Dogecoin’s Open Interest (OI) on Tuesday stood at $1.17 billion, down more than 4% on February 17. This decline indicates traders are reducing risk exposure. The “risk-off” sentiment resonated with a 24-hour liquidation total of $5.01 million, of which $4.33 million was a liquidation of long positions. This suggests the outflow of funds was largely triggered by forced liquidation of long positions.

As a result, the long-to-short ratio dropped to 0.9677, which means that the accumulation of short positions is starting to dominate as the number is below 1. Meanwhile, the OI of SHIB and PEPE futures also declined. On Tuesday, SHIB OI stood at $75.43 million (down more than 3%), while PEPE OI stood at $271.02 million (down almost 5%).

Dogecoin weakens again and risks erasing gains

On Tuesday (17/2), DOGE briefly traded below the psychological level of US$0.1000 and fell around 2% on the day. This decline continued for the third consecutive day, while the price tested the February 6 closing level of $0.0984.

If price closes trading convincingly below that level, DOGE could potentially drop to test the February 11 low of $0.0879, with an additional area of support at the S1 pivot point at $0.0803.

The technical indicators on the daily chart show that the bullish momentum is starting to fade. The RSI is at 42 and moving down from the center line, signaling that there is still room for a decline before entering the oversold area. Meanwhile, MACD is still in the positive area, but the narrowing positive histogram indicates that the upward force is weakening.

Conversely, if Dogecoin is able to record another daily close above $0.1000, it could be a signal that the downward pressure is starting to ease and open up opportunities for a continued recovery towards $0.1161.

Shiba Inu Still Under Pressure and at Risk of Continuing Decline

On Tuesday (12/2), SHIB fell about 1.67%, extending the reversal after failing to break the $0.00000700 supply zone. Under these conditions, the most likely direction of movement leads to a correction towards the S1 pivot point at $0.00000528, which means a potential decline of about 20%.

Like Dogecoin, technical indicators on the daily chart show SHIB’s bullish momentum weakening. The RSI is at 45 and falling past the centerline, while the positive histogram on the MACD is shrinking, signaling reduced buying pressure.

Read also: Bitcoin Price Drops to $67,000 Today: BTC Long-Term Holders Remain Confident

For the uptrend to re-establish, Shiba Inu needs to break and hold above the 50-day EMA at $0.00000723. If this level is successfully passed, a strengthening opportunity could open up towards the R1 pivot point at $0.0000921.

Pepe at Risk of Continuing Decline Toward Lowest Levels

On Sunday, PEPE fell more than 8% and broke below its 50-day EMA at $0.00000462. As of Tuesday (17/2), the frog-themed meme coin is still continuing its correction with a weakening of about 3%, while selling pressure is aiming at the support level of US$0.00000363, which is the lowest point of December 18.

Like other meme coins, the bullish pressure on Pepe is starting to weaken. The RSI is at 49 and moving down past the center line, signaling diminishing buying interest. Meanwhile, MACD and the signal line are still in the negative area, with the positive histogram continuing to shrink, indicating the upward momentum is losing steam.

In order to start a sustained recovery, Pepe needs to break the $0.0000521 resistance level, which previously capped the upside in late January. If successful, the price has the potential to continue strengthening towards the R1 pivot point at $0.0000633.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Meme Coins Price Prediction: Bears push Dogecoin, Shiba Inu, Pepe to the ropes. Accessed on February 18, 2026

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.